- United States

- /

- Packaging

- /

- NYSE:SLGN

Is Silgan's (SLGN) $500 Million Buyback and Leadership Shakeup Shifting Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Silgan Holdings Inc. recently unveiled several executive leadership changes, including the appointment of Shawn C. Fabry as Chief Financial Officer and new roles for other senior leaders, while also announcing a US$500 million share repurchase program set to run through December 2029.

- This combination of fresh leadership and a large buyback initiative highlights the company's ongoing efforts to enhance shareholder value and possibly signal confidence in its long-term direction.

- We’ll explore how the new US$500 million share repurchase authorization could affect Silgan Holdings’ future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Silgan Holdings Investment Narrative Recap

To be a Silgan Holdings shareholder, you have to believe that the company can grow in established and emerging packaging markets while navigating shifts in consumer demand and input costs. The latest executive leadership changes and the US$500 million buyback are unlikely to change the near-term outlook, where expanding into attractive end-markets remains the core catalyst and concentrated customer risk is the biggest near-term concern.

The announcement of Shawn Fabry as Chief Financial Officer stands out, reflecting Silgan's emphasis on deep company experience in its financial leadership. This move, against a backdrop of customer concentration and margin pressures, puts renewed focus on execution as the company looks to deliver on growth opportunities and capital returns for shareholders.

Yet, in contrast, investors should not overlook how ongoing customer concentration poses potential risks if another large account...

Read the full narrative on Silgan Holdings (it's free!)

Silgan Holdings' outlook anticipates $6.8 billion in revenue and $448.6 million in earnings by 2028. This projection assumes a 3.1% annual revenue growth rate and a $146.6 million increase in earnings from the current $302.0 million.

Uncover how Silgan Holdings' forecasts yield a $50.40 fair value, a 33% upside to its current price.

Exploring Other Perspectives

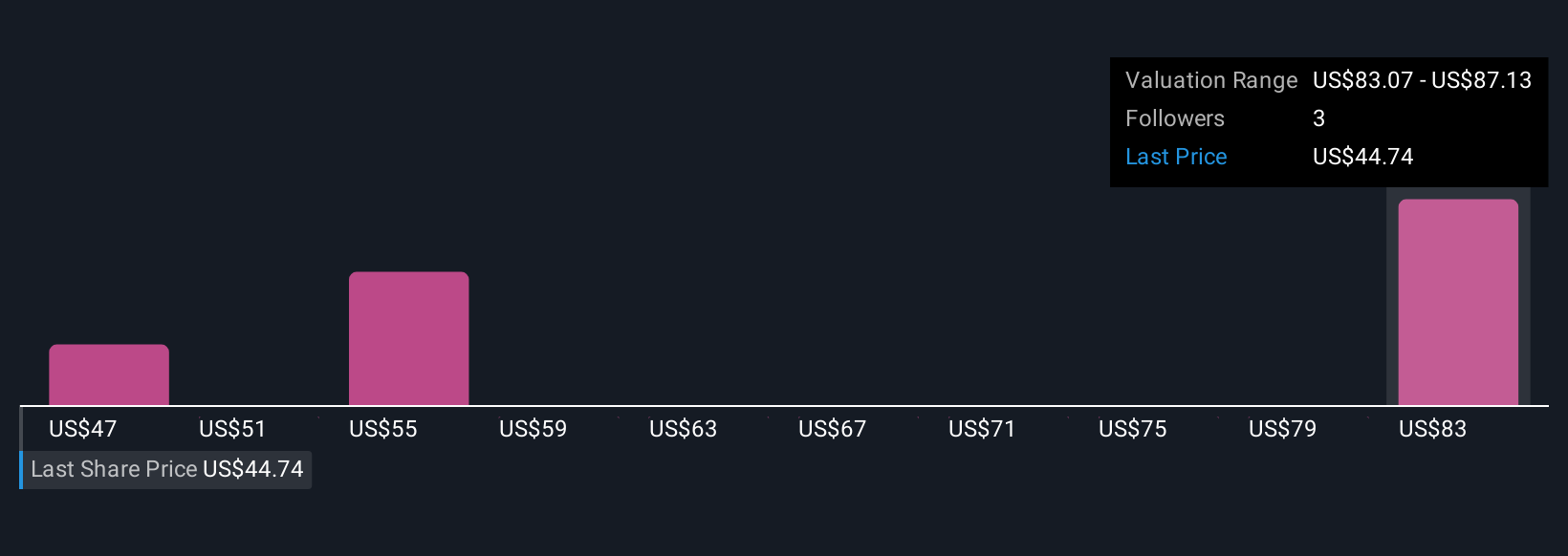

Simply Wall St Community members offered three fair value estimates for Silgan Holdings, ranging from US$46.51 to US$85.05 per share. While opinions span a wide value band, these perspectives exist alongside ongoing risks tied to customer concentration, reminding you that expectations for future performance can differ significantly.

Explore 3 other fair value estimates on Silgan Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Silgan Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silgan Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Silgan Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silgan Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLGN

Silgan Holdings

Manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives