- United States

- /

- Packaging

- /

- NYSE:SLGN

Is Silgan Holdings a Bargain After 24% Price Drop in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Silgan Holdings is genuinely undervalued, or if it just appears that way on the surface? Here is a breakdown of why now could be an interesting time to investigate the stock’s true worth.

- Despite recent volatility, with the share price down 13.7% over the past week and off 24.4% year-to-date, Silgan has delivered an 18.8% total return over the past five years. This may indicate underlying resilience.

- Recently, sector-wide momentum and evolving global packaging trends have influenced the stock. Investors have been processing new industry announcements about sustainability initiatives and changing consumer demand, contributing to increased volatility and renewed interest in stocks like Silgan.

- Looking at the numbers, Silgan Holdings scores a 6 out of 6 on our valuation checklist, suggesting strong fundamental value. We will look beyond traditional metrics in the following sections and explore an even smarter way to consider a stock’s true value.

Find out why Silgan Holdings's -26.2% return over the last year is lagging behind its peers.

Approach 1: Silgan Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach provides a holistic view of what the company is fundamentally worth. For Silgan Holdings, this method uses cash flow projections based on both analyst estimates and longer-term extrapolations.

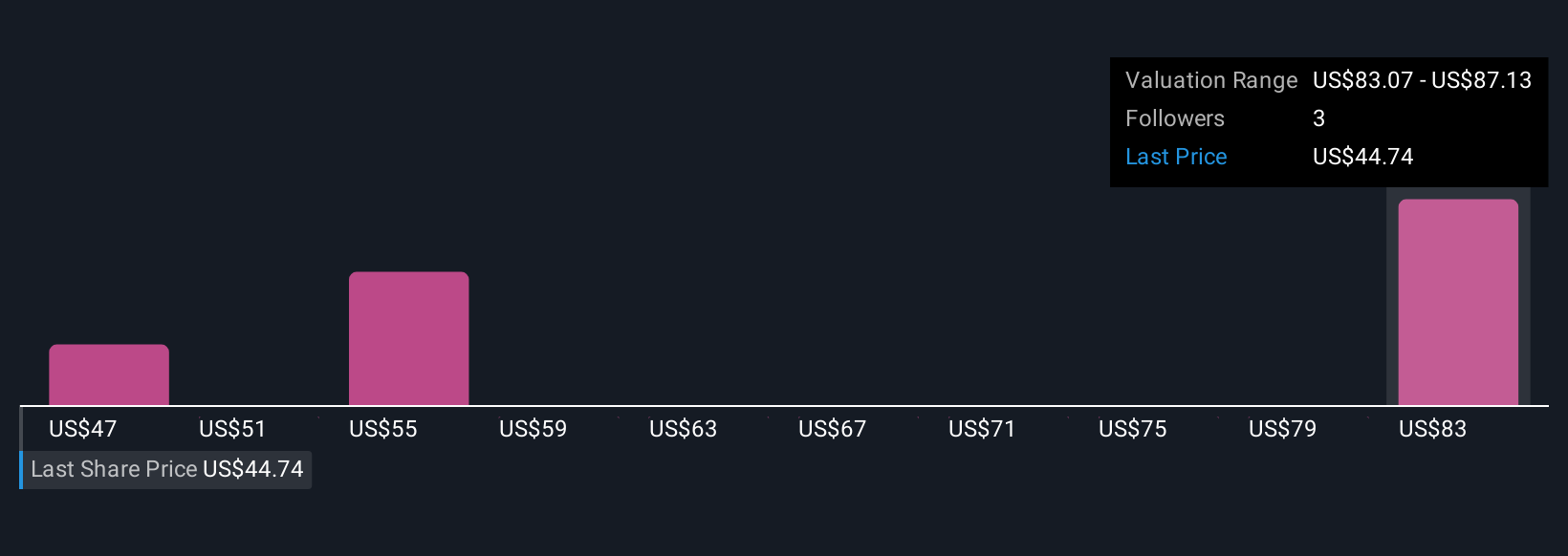

Currently, Silgan Holdings generates Free Cash Flow of approximately $98 million. Analysts project significant growth over the next few years, with Free Cash Flow expected to reach $427 million by 2026 and continue increasing to nearly $640 million by 2035. Cash flows beyond the next five years are extrapolated, so while informative, they rely more on assumptions than hard analyst data. All cash flows are measured in US dollars.

Based on these projections, the DCF analysis calculates an intrinsic fair value of $85.08 per share. Compared to the market price, the data suggests Silgan Holdings is trading at a 54.6% discount to its calculated value, which indicates the stock may be undervalued according to cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Silgan Holdings is undervalued by 54.6%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

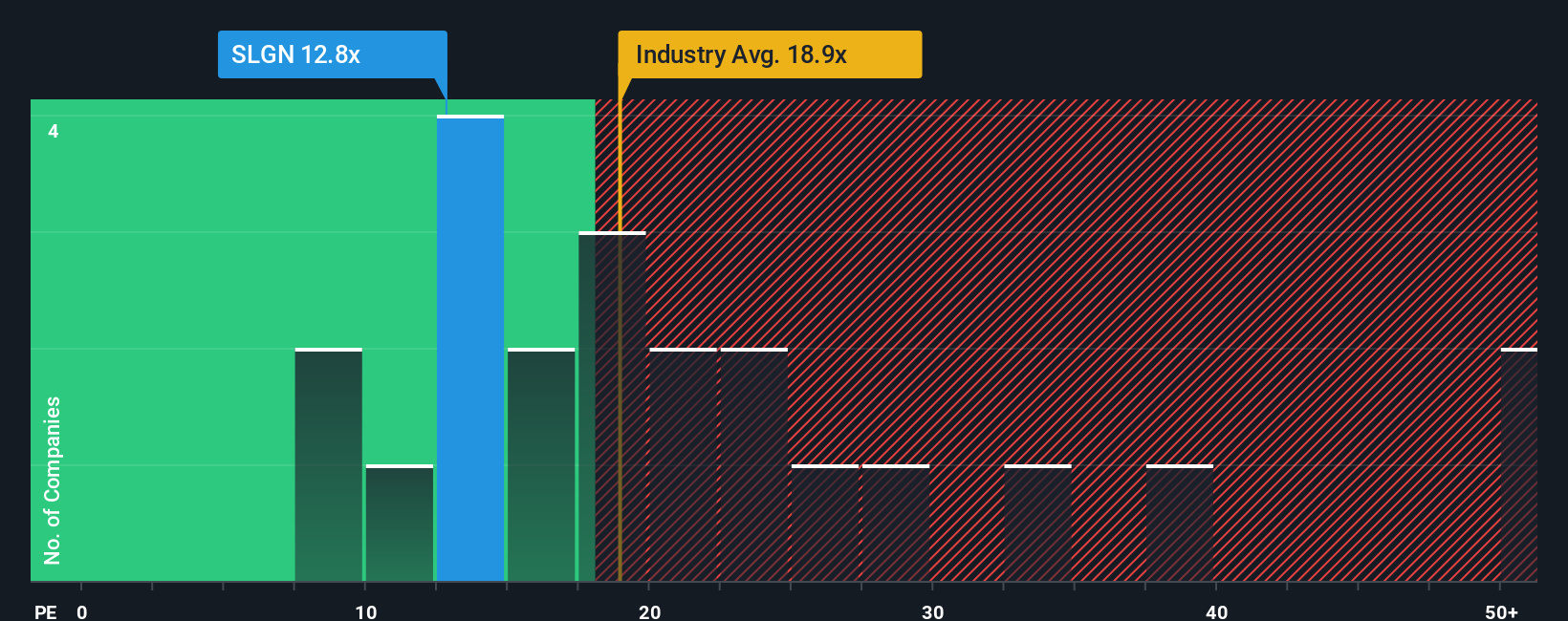

Approach 2: Silgan Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Silgan Holdings because it allows investors to compare a company’s current share price to its per-share earnings. A lower PE can suggest a stock is undervalued relative to its earnings, while a higher one might indicate high growth expectations or elevated risks.

Growth prospects and risk play a central role in what counts as a “normal” or “fair” PE ratio. Typically, faster-growing companies or those with lower risk warrant higher PEs, while slower-growing or riskier businesses trade at lower multiples. Therefore, simply looking at the raw PE without context can be misleading.

Silgan Holdings is currently trading at a PE ratio of 13.1x. This sits noticeably below both the packaging industry average of 16.0x and the broader peer average of 19.9x. However, Simply Wall St’s proprietary "Fair Ratio" for Silgan, which blends insights from the company’s specific growth outlook, profit margins, market cap, risks, and industry, is 18.0x. Unlike standard benchmarks, the Fair Ratio provides a more informed, company-specific target for valuation as it reflects underlying fundamentals beyond just basic comparisons.

Comparing Silgan’s current PE of 13.1x with its Fair Ratio of 18.0x, the stock appears undervalued based on what investors might reasonably pay given its characteristics and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Silgan Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple story that connects your perspective about Silgan Holdings, such as its industry drivers, risks, and market opportunities, to future financial forecasts and a resulting fair value for the shares.

Narratives let investors move beyond just the numbers by tying together the company's business story with quantitative assumptions about future revenue, earnings, and profit margins. On Simply Wall St's platform, used by millions, anyone can create, share, and update their own Narratives right on the Community page. This makes them an easy and accessible decision-making tool.

Because Narratives always link back to a fair value estimate, they help you make confident decisions about when to buy or sell. Simply compare your Narrative's fair value to Silgan's latest share price. Narratives are also updated automatically whenever important news or earnings are announced, so your investment decisions stay relevant.

For example, one investor might believe Silgan’s push into premium dispensing products will accelerate earnings growth and sees fair value above $67 per share. Another may be concerned about customer concentration risks and reliance on legacy packaging, estimating fair value closer to $47. Narratives capture these different viewpoints and make them actionable.

Do you think there's more to the story for Silgan Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLGN

Silgan Holdings

Manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives