- United States

- /

- Chemicals

- /

- NYSE:SHW

What Do Recent Price Declines Mean for Sherwin-Williams Stock in 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with your Sherwin-Williams shares right now, you are definitely not alone. With a storied past and a reputation as a bellwether in paints and coatings, Sherwin-Williams consistently draws attention from investors looking for steady growth. But lately, the share price has been more interesting than you might expect. Over the past year, the stock dropped 14.1%, and in the past 30 days alone it’s slipped 5.6%. Even so, if we zoom out a bit, the longer-term story looks far rosier, with a 63.5% gain over three years and a 51.7% rise over five years.

Much of the recent volatility in SHW stock seems to be tied to shifting market sentiment across the wider materials sector, with investors moving money in response to interest rate chatter and global supply chain updates. While not every news headline has had a direct impact, the bigger picture shows both risk and potential. It is a fascinating setup: near-term jitters, yet a proven history of compounding returns for patient shareholders.

Of course, past performance is only part of the story. If you are wondering whether the current price offers real value, there are some sobering numbers to consider. Sherwin-Williams currently gets a valuation score of 0 out of 6, meaning by standard metrics, the company does not appear undervalued in any of the major checks analysts use. Don’t worry though, we are about to explore those valuation approaches in detail, and there may be a smarter way to understand what SHW is truly worth.

Sherwin-Williams scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sherwin-Williams Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company's shares should be worth today by projecting its future cash flows and then discounting those projections back to their present value. This approach is often used for businesses with predictable cash generation, like Sherwin-Williams.

Currently, Sherwin-Williams generates just over $2.1 billion in Free Cash Flow (FCF) per year. Analysts forecast that by 2028, annual FCF could reach $3.3 billion. Beyond 2028, projections are extrapolated for another few years, suggesting continued steady increases, but estimates beyond 5 years always come with added uncertainty.

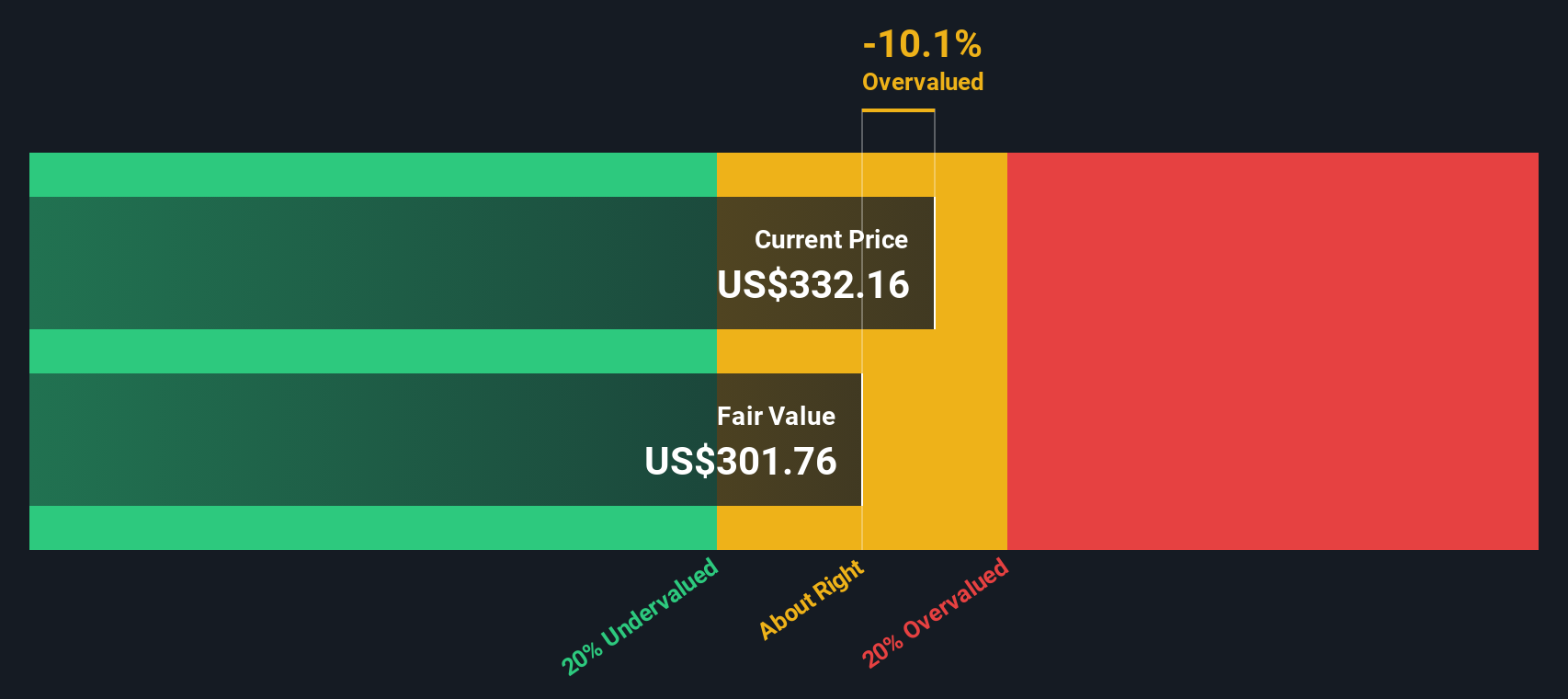

After running these forecasts through the DCF model, the estimated intrinsic value for Sherwin-Williams stock comes in at $259.60 per share. Compared to the current market price, this analysis suggests Sherwin-Williams is trading at a 27.4% premium. In other words, it appears overvalued according to today's cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sherwin-Williams may be overvalued by 27.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sherwin-Williams Price vs Earnings

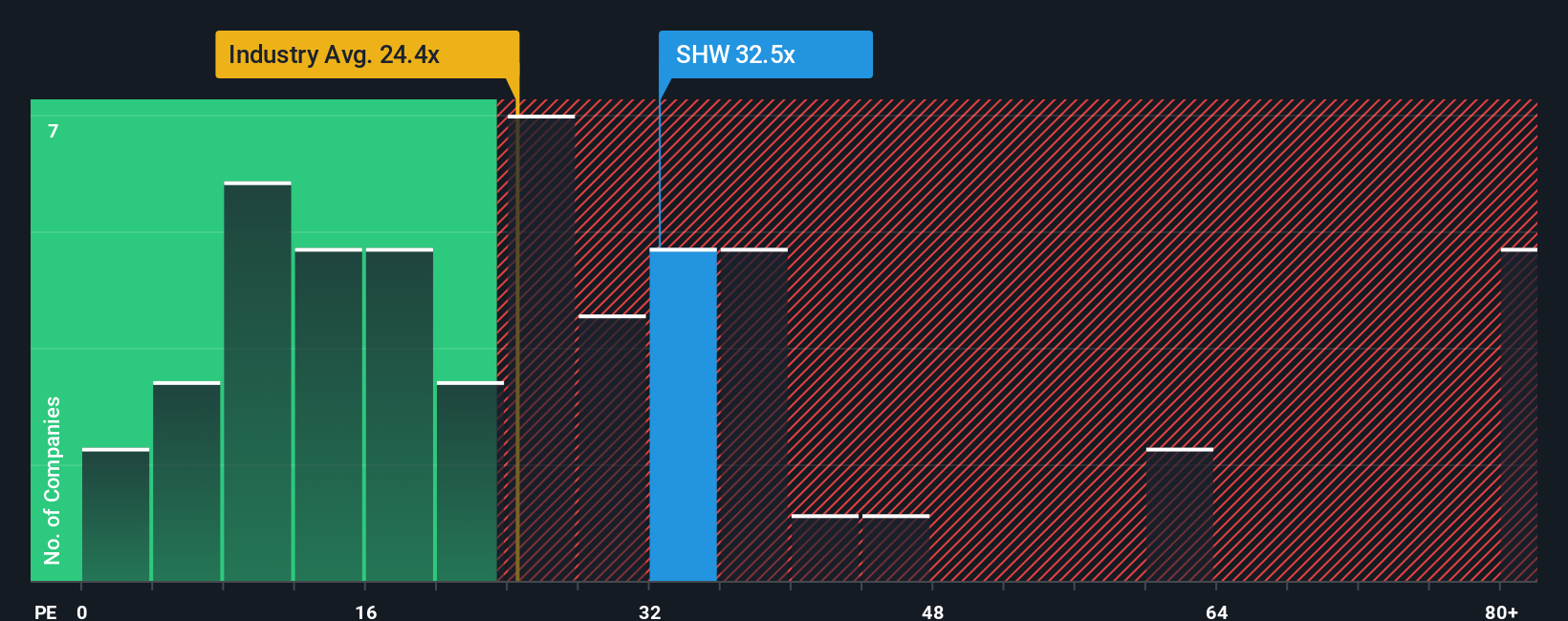

For established, profitable companies like Sherwin-Williams, the Price-to-Earnings (PE) ratio is one of the most popular ways to assess valuation. This metric tells investors how much they are paying for each dollar of earnings, which makes sense for steady businesses with a solid profit record. A higher PE can signal either strong future growth expectations or, alternatively, a stock that is getting ahead of itself. Meanwhile, a lower PE may suggest undervaluation or lower growth prospects. Factors such as industry trends, profit margins, and risk profiles all influence what PE you might consider “normal” or fair for a given company.

Right now, Sherwin-Williams trades on a PE ratio of 32.3x. That is significantly above both the industry average of 25.9x and its closest peers at 22.7x. At first glance, this premium might raise eyebrows, but context matters. That is why Simply Wall St uses a “Fair Ratio”, which is a custom PE level calculated for Sherwin-Williams based on its specific growth prospects, risk factors, profitability, and size. For Sherwin-Williams, the Fair Ratio stands at 24.3x, giving a more tailored benchmark.

Unlike traditional comparisons to industry averages or competitor PEs, the Fair Ratio gives a more complete picture because it factors in exactly how the company compares across fundamental metrics, not just to a broad group. It is especially helpful for separating stocks that deserve a premium because of unique strengths from those that carry it simply due to market hype.

Given that Sherwin-Williams’ current PE of 32.3x is meaningfully higher than its Fair Ratio of 24.3x, the shares do look overvalued based on this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sherwin-Williams Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company. It's how you connect your unique perspective on Sherwin-Williams’s business future with financial forecasts and your own estimate of fair value. Narratives on Simply Wall St make investing more dynamic and personal by letting users define their own assumptions about future revenue, earnings, and profit margins, all tied together into a fair value and actionable strategy.

Instead of relying solely on traditional ratios or “one-size-fits-all” analyst targets, Narratives allow you to directly compare your fair value estimate against the current price to help you decide when to buy, hold, or sell. These Narratives update automatically when new information comes out, so your investment decisions always reflect the latest news or earnings.

For example, some investors see Sherwin-Williams as poised for double-digit annual growth from urbanization and eco-friendly coatings, justifying a bullish price target of $420. Others expect more moderate expansion and risk, leading to a fair value closer to $258. Your decisions can reflect your own conviction, not just the average opinion.

Accessible on the Simply Wall St Community page, Narratives help millions of investors make smarter, story-driven decisions, and you can start building yours in minutes.

Do you think there's more to the story for Sherwin-Williams? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives