- United States

- /

- Chemicals

- /

- NYSE:SHW

A Look at Sherwin-Williams's Valuation Following Q3 Beat, Suvinil Acquisition, and Positive Outlook

Reviewed by Simply Wall St

Sherwin-Williams (NYSE:SHW) shares got a lift after the company delivered third-quarter earnings that beat expectations, as a result of strength in its Paint Stores Group. Management also reaffirmed earnings guidance and shared a constructive sales outlook for next quarter.

See our latest analysis for Sherwin-Williams.

After rallying on robust third-quarter results and news of the Suvinil acquisition, Sherwin-Williams shares recently climbed as high as 5% before easing, reflecting renewed investor confidence. While momentum over the past month has been modest, the three-year total shareholder return still stands at an impressive 64%. This highlights the company’s strong long-term track record, even as this year’s total return has slipped by nearly 3%.

If Sherwin-Williams’ latest moves have you thinking about new opportunities, consider broadening your search and discover fast growing stocks with high insider ownership.

But after this earnings beat and a boost from recent acquisitions, is Sherwin-Williams trading at an attractive price, or has the market already factored in these growth prospects? Is there still a buying opportunity here, or is future upside already accounted for?

Most Popular Narrative: 8.8% Undervalued

The most followed narrative suggests Sherwin-Williams’ fair value is $378.43, about 8.8% higher than its last closing price of $344.94. With the narrative fair value sitting above the current market price, investors are weighing up positive catalysts against a backdrop of cautious sentiment.

Heightened investment in targeted customer-facing growth initiatives during a period of competitor retrenchment, layoffs, and price disruptions in the industry is likely to accelerate share gains with professional contractors and commercial projects. This could support long-term topline growth substantially above industry averages.

Curious how Sherwin-Williams could outgrow its peers when the sector faces headwinds and rivals are pulling back? The narrative hinges on aggressive growth initiatives, ambitious earnings projections, and a powerful rebound thesis. Want to decode the assumptions driving this calculated optimism? The details behind the forecast may surprise you.

Result: Fair Value of $378.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weak demand in key end markets or ongoing margin pressure could quickly challenge the optimistic case that underpins Sherwin-Williams’ current valuation.

Find out about the key risks to this Sherwin-Williams narrative.

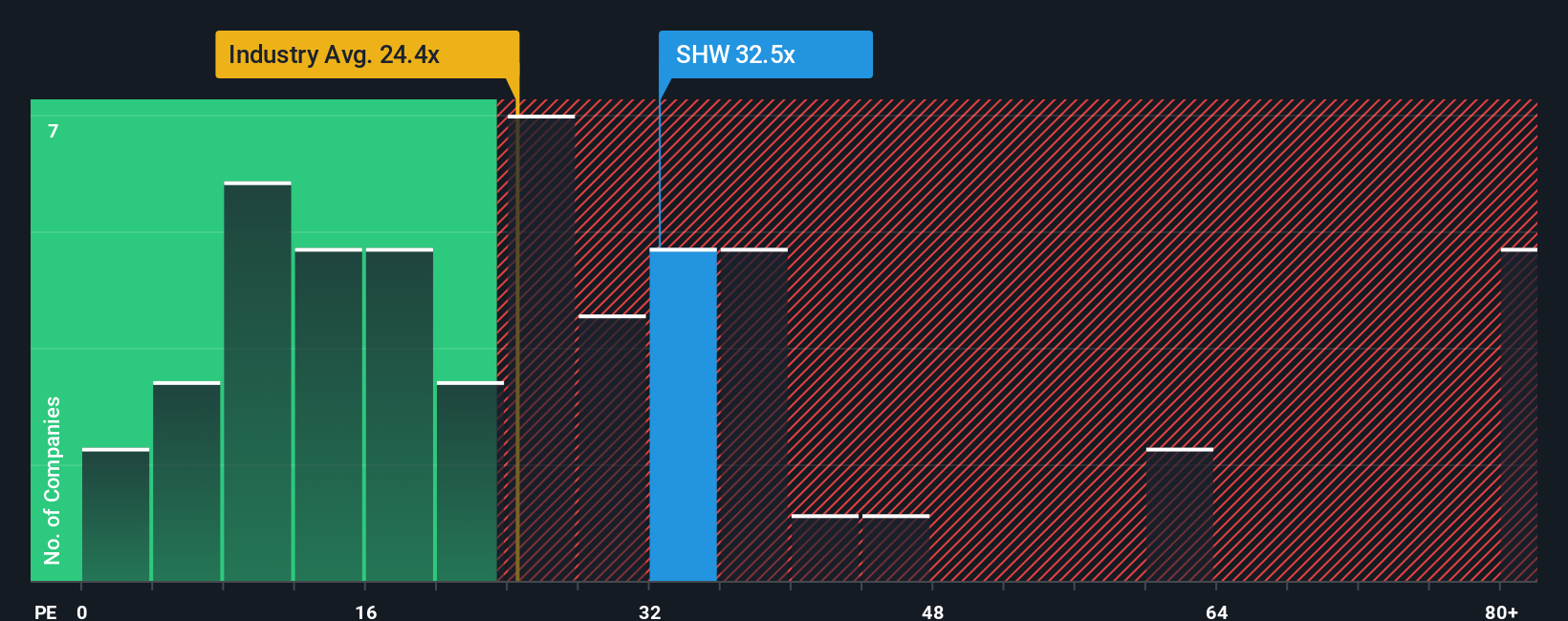

Another View: Multiples Tell a Different Story

Looking at valuation through the lens of price-to-earnings, Sherwin-Williams trades at 33.1x earnings, which is well above both the US Chemicals industry average of 25.3x and the peer average of 22.4x. The fair ratio, based on market patterns, sits even lower at 24.5x. This premium raises questions about potential downside if market sentiment cools, despite strong forecasts and long-term growth efforts. Could the company's momentum justify staying expensive, or is the market ignoring valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If you see things differently or want the full picture, dive into the data and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next big market move with fresh stock opportunities you might have missed. Let the right screeners help you seize tomorrow’s winners before the crowd does.

- Grow your income stream by tapping into these 22 dividend stocks with yields > 3% with attractive yields and reliable long-term performance.

- Find high potential as you explore these 26 AI penny stocks at the forefront of artificial intelligence innovation and disruptive tech solutions.

- Capitalize on undervaluation with these 833 undervalued stocks based on cash flows chosen for strong fundamentals and room for price appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives