- United States

- /

- Packaging

- /

- NYSE:SEE

Is Sealed Air’s Recent Price Dip Hiding a Value Opportunity?

Reviewed by Bailey Pemberton

- Ever wondered if Sealed Air’s current price is a golden opportunity or just treading water? You’re not alone. Let’s dig in and see if there’s hidden value waiting to be found.

- Sealed Air’s share price has dipped recently, falling 3.8% in the past week and 5.8% over the last month. It is still holding onto a slim 0.7% gain year-to-date.

- News that Sealed Air continues to invest in its automation and sustainability strategy has caught the attention of both bulls and skeptics. Industry chatter has generally focused on whether these investments can pay off against mounting competitive pressures, providing useful context for the recent price movement.

- When we run Sealed Air through our checklist, it comes out with a valuation score of 5 out of 6. This suggests undervaluation on most fronts. We will break down the different approaches analysts use to reach this number, but stick around for an even smarter way to look at value before the article wraps up.

Approach 1: Sealed Air Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting future cash flows and discounting them back to today’s dollars. With Sealed Air, analysts project the company’s Free Cash Flow (FCF), currently at $364.2 million, to steadily increase over the next decade, based on business fundamentals and growth assumptions.

According to these projections, Sealed Air’s FCF is expected to reach $507.9 million by 2027. Further estimates, extrapolated by Simply Wall St, suggest that by 2035, FCF could grow to about $672.3 million. These calculations encompass both near-term analyst estimates and longer-term growth assumptions.

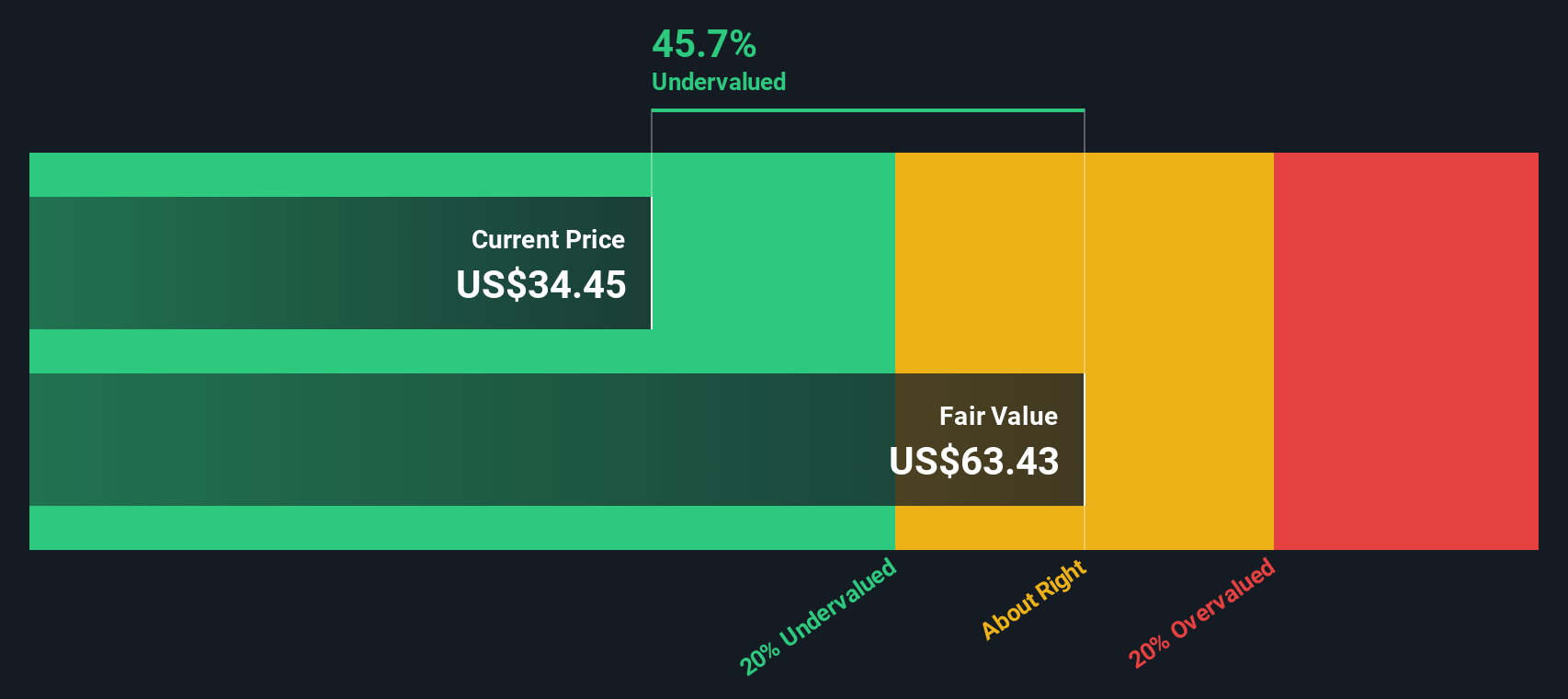

Using this two-stage DCF approach, the fair value for Sealed Air stock comes out to $70.92 per share, while the model indicates that shares are trading at a 52.7% discount to this intrinsic value.

In plain terms, this DCF analysis suggests Sealed Air is deeply undervalued and may offer significant upside if its projected cash flows come to pass.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sealed Air is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Sealed Air Price vs Earnings

The price-to-earnings (PE) ratio is a commonly used valuation tool for profitable companies like Sealed Air because it links the current share price to the company’s bottom-line profits. Investors often rely on the PE ratio to quickly assess whether a stock is priced generously or cheaply compared to its earnings. However, what qualifies as a “fair” PE depends on factors such as how quickly the business is expected to grow, the stability of its earnings, and the risks associated with the company and its industry.

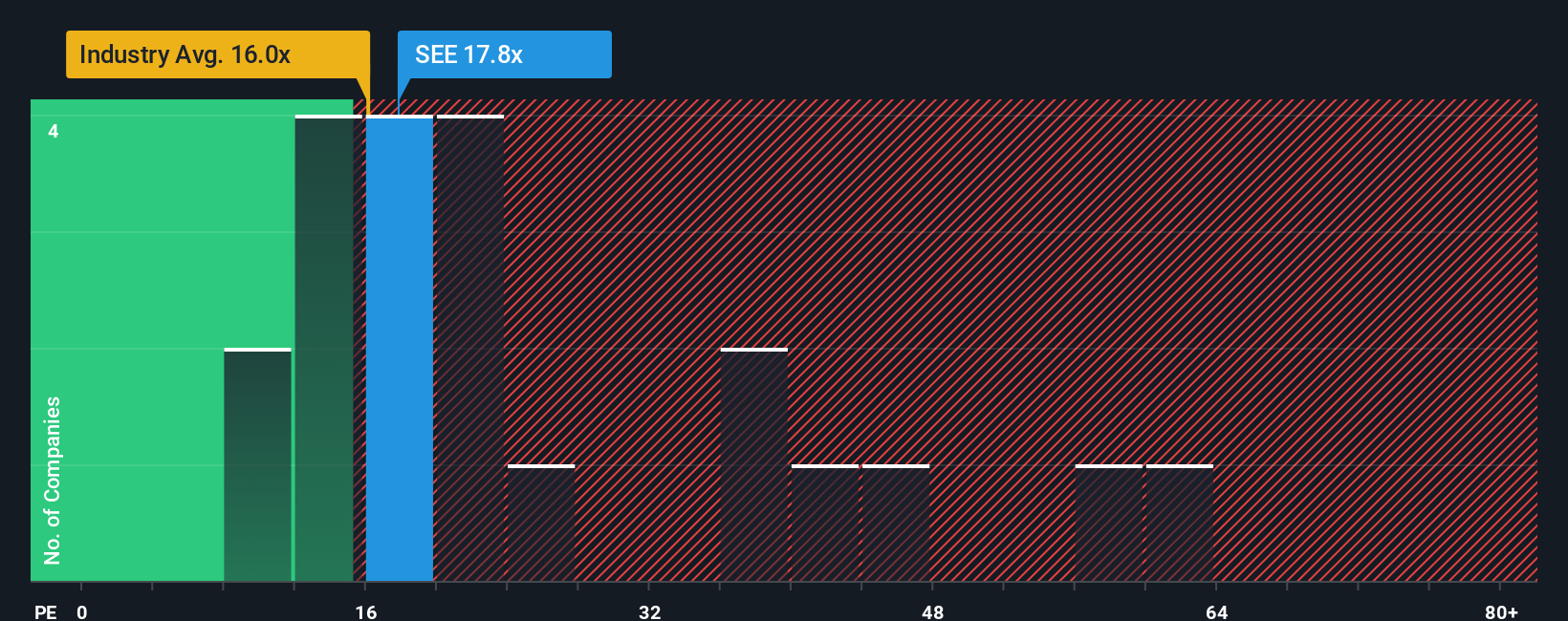

Currently, Sealed Air trades at a PE ratio of 16.5x. For context, the Packaging industry average is 16.0x, while peer companies in the sector trade higher at an average of 21.4x. At first glance, this puts Sealed Air just above its sector’s median but below direct peers.

This is where the “Fair Ratio” comes in. Simply Wall St calculates this figure (21.9x for Sealed Air) using not only industry trends but also company-specific factors such as market cap, growth outlook, margins, and risk profile. This approach provides a more holistic and refined benchmark compared to basic averages, reflecting the underlying drivers that affect what investors may be willing to pay for each dollar of earnings.

In Sealed Air’s case, its current PE ratio of 16.5x is well below the Fair Ratio of 21.9x. This suggests the stock is trading at a significant discount based on its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sealed Air Narrative

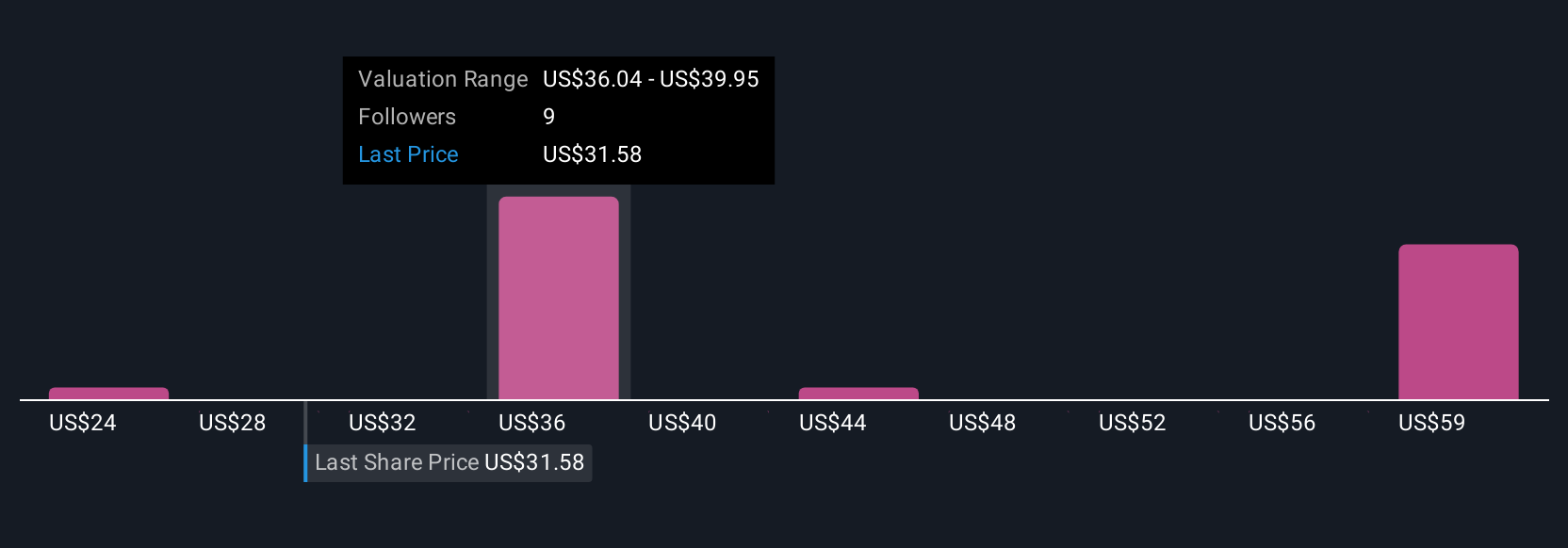

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, yet powerful story you create about a company. Think of it as your own unique perspective that connects what you believe about Sealed Air’s future (like expected revenue growth, profit margins, or industry trends) directly to financial forecasts and a calculated fair value.

This approach allows you to bridge the gap between numbers and meaning, grounding your analysis in a clear set of assumptions and expected outcomes. Narratives are easy to build right within the Simply Wall St Community page, where millions of investors share and update their views in response to the latest news, earnings reports, or industry changes.

By comparing your Narrative’s Fair Value to the actual share price, you get a fast, personalized guide to whether it might be time to buy, hold, or sell. In addition, Narratives automatically adjust when market-moving events are reported. For example, one Narrative for Sealed Air might highlight sustainable packaging and global expansion as drivers of long-term growth, projecting a fair value as high as $50 per share. Another might focus more on risks like pricing pressure and overreliance on internal efficiencies, leading to a much lower value closer to $31 per share.

Do you think there's more to the story for Sealed Air? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives