- United States

- /

- Packaging

- /

- NYSE:SEE

How Investors May Respond To Sealed Air (SEE) Surging Profitability Amid Flat Sales in Q3

Reviewed by Sasha Jovanovic

- Sealed Air Corporation recently reported third-quarter 2025 earnings, highlighting a substantial increase in net income to US$255.1 million and diluted earnings per share to US$1.73, compared to the same period last year, with sales remaining largely unchanged at US$1.35 billion.

- This performance suggests operational efficiencies are compensating for flat revenue, as the company also reaffirmed its full-year earnings guidance despite continued volume pressures in several segments.

- We’ll explore how Sealed Air’s improved profitability, paired with steady sales, may affect the company's investment case moving forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Sealed Air Investment Narrative Recap

To be a Sealed Air shareholder today, you need confidence that productivity gains and automation can drive earnings growth even as sales volumes face headwinds, particularly in the Food and Protective segments. The latest quarterly results, which paired higher profits with flat sales, do not materially change the short-term focus on whether volume declines linked to protein market cycles and customer behavior can be offset by ongoing cost controls, remaining the primary catalyst and risk for the business now.

Among recent company announcements, the reaffirmation of full-year 2025 earnings guidance is most relevant, signaling management’s belief in the underlying resilience of operational improvements despite volume pressures. This is especially meaningful in the context of persistent challenges for higher-margin food packaging and ongoing overreliance on cost takeout as volume recovery remains elusive.

Yet, in contrast to these profitable quarters, investors should be aware that persistent volume weakness in key segments remains a...

Read the full narrative on Sealed Air (it's free!)

Sealed Air's outlook forecasts $5.7 billion in revenue and $534.4 million in earnings by 2028. This implies a 2.4% annual revenue growth rate and an earnings increase of $235 million from the current earnings of $299.4 million.

Uncover how Sealed Air's forecasts yield a $41.31 fair value, a 22% upside to its current price.

Exploring Other Perspectives

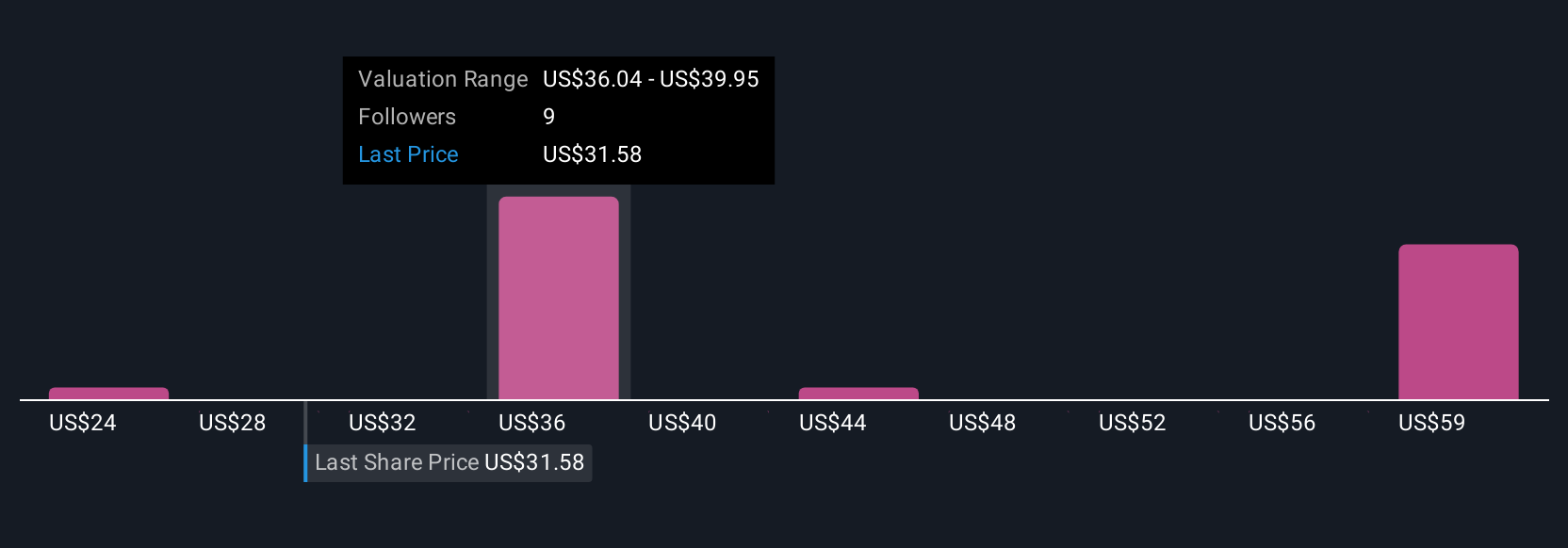

Four Simply Wall St Community valuations put Sealed Air’s fair value anywhere from US$24.33 to US$70.79 per share. With current profitability driven more by cost controls than underlying volume recovery, consider how long this approach can sustain growth as you review different views from the Community.

Explore 4 other fair value estimates on Sealed Air - why the stock might be worth over 2x more than the current price!

Build Your Own Sealed Air Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sealed Air research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sealed Air research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sealed Air's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives