- United States

- /

- Chemicals

- /

- NYSE:RPM

RPM International (RPM): Evaluating Current Valuation and Long-Term Potential

Reviewed by Simply Wall St

RPM International (RPM) shares have seen modest moves in recent sessions. This activity has drawn attention as investors weigh the company’s latest performance metrics and overall sector sentiment. RPM’s results often offer clues about trends in manufacturing and specialty coatings.

See our latest analysis for RPM International.

RPM International’s share price has faced some pressure this year, reflecting a wider cooling in manufacturing stocks. After a strong multiyear run, its 1-year total shareholder return slipped to -20.26 percent. However, the company still boasts a respectable 30.37 percent five-year total return. While momentum has faded recently, there is still underlying strength in the long-term trend, suggesting investors are reassessing risk and growth potential as sector sentiment shifts.

If you’re curious what else is catching investors’ attention in this market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and decent fundamentals underpinning the business, the big question is whether RPM International is undervalued right now or if the market is already pricing in all future growth.

Most Popular Narrative: 20% Undervalued

With shares closing at $107.45, the narrative consensus suggests RPM International's current price leaves considerable upside to fair value, driven by targeted growth themes and margin expansion strategies. This sets up a compelling framework for what could power RPM's next chapter.

The successful execution of the MAP 2025 efficiency program (with incremental $70 million in savings targeted for FY26), ongoing plant consolidations, and a streamlined 3-segment structure are set to deliver further margin improvement and operational leverage. These initiatives are expected to benefit earnings and free cash flow.

What makes this number so ambitious? The calculation hinges on forecasted earnings growth, a strategic shift in how RPM runs its business, and volatility in future profit margins. Can RPM’s transformation really deliver the results needed for such an upgrade? Find out which surprises shape the math behind this potential valuation surge.

Result: Fair Value of $134.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer weakness and high input costs could put pressure on RPM’s profit margins and challenge the bullish valuation outlook in the future.

Find out about the key risks to this RPM International narrative.

Another View: How Does RPM Stack Up Against Peers?

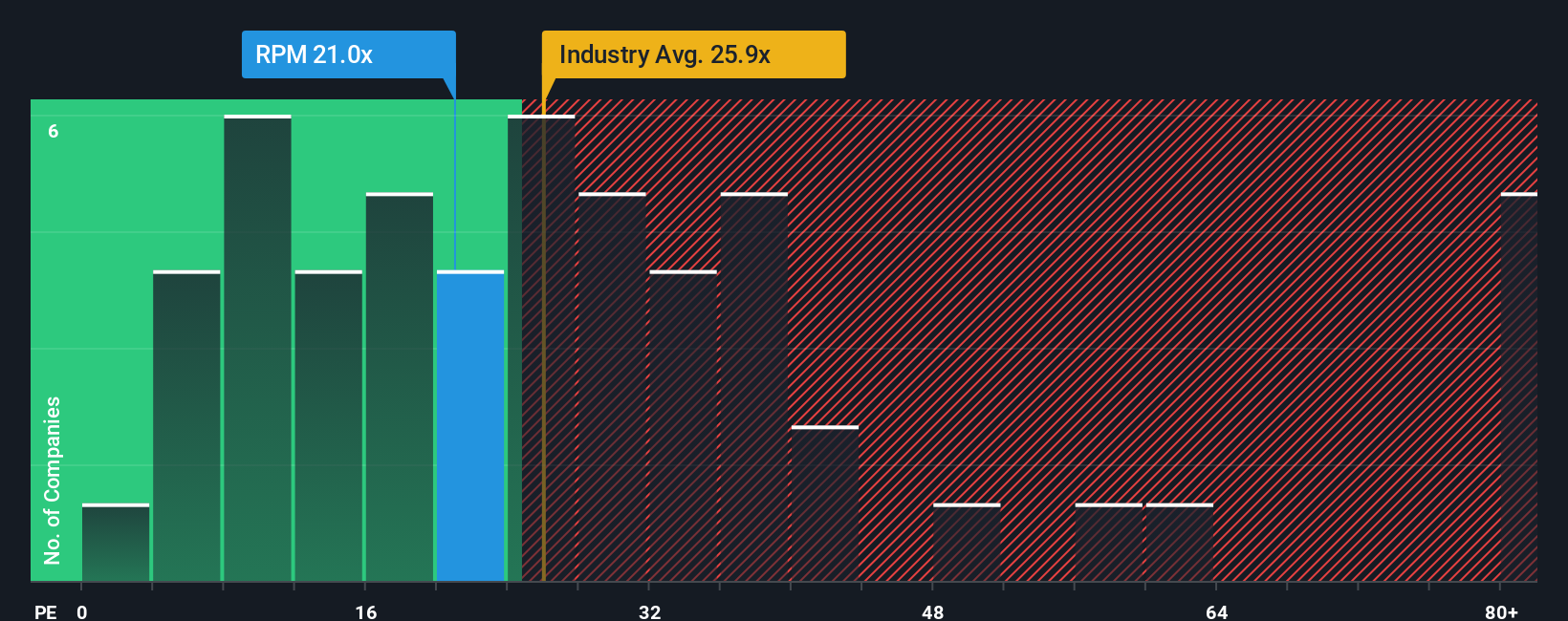

Looking beyond fair value estimates, RPM’s price-to-earnings ratio tells a different story. At 20.1x, it is slightly above the peer average of 19.8x and also higher than its fair ratio of 19.9x. This subtle premium suggests some valuation risk if market sentiment reverses. Could investor optimism be running ahead of real progress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RPM International Narrative

If you have a new perspective or would rather work through the details yourself, you can quickly build your personalized outlook in just a few minutes. Do it your way

A great starting point for your RPM International research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don't limit your strategy to just one company when there are so many compelling investment possibilities waiting. Let Simply Wall Street guide you to high-potential stocks tailored to your goals.

- Tap into higher income potential and steady returns by reviewing these 16 dividend stocks with yields > 3% with attractive yields above 3%.

- Ride the wave of innovation and rapid growth by checking out companies harnessing artificial intelligence through these 25 AI penny stocks.

- Unlock opportunities in undervalued businesses by finding these 882 undervalued stocks based on cash flows poised for growth based on robust cash flow data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RPM

RPM International

Provides specialty chemicals for the construction, industrial, specialty, and consumer markets.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives