- United States

- /

- Chemicals

- /

- NYSE:NEU

NewMarket (NEU): Assessing Valuation Following Dividend Hike and Soft Q3 Earnings

Reviewed by Simply Wall St

NewMarket (NEU) just announced a boost to its quarterly dividend, increasing it to $3.00 per share. This represents a 9% jump. At the same time, third-quarter earnings showed both sales and net income dipped compared to last year.

See our latest analysis for NewMarket.

NewMarket’s latest dividend hike comes on the heels of a solid run for shareholders. Despite softer earnings and a recent C-suite change, momentum hasn’t faded. Year-to-date, the share price is up more than 52%, and the one-year total shareholder return clocks in at 41.99%. Looking further back, patient investors have seen a remarkable 170.8% total return over three years, suggesting robust long-term value creation even through executive transitions and quarterly bumps.

If you’re interested in broadening your search beyond NewMarket, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares at multi-year highs and new dividend momentum, it is worth asking whether NewMarket is an overlooked bargain or if investors have already priced in all the company’s future growth potential.

Price-to-Earnings of 16.4x: Is it justified?

NewMarket is currently trading at a price-to-earnings (P/E) ratio of 16.4x, notably lower than both its peer group average of 18.6x and the wider US Chemicals industry average of 23x. This positions the stock as relatively undervalued based on earnings compared to its sector.

The P/E ratio reflects how much investors are willing to pay today for each dollar of company earnings. In the chemicals sector, this metric is a key indicator for weighing profitability against the market’s valuation expectations. In NewMarket’s case, this discount could suggest investor caution, or it may signal overlooked potential for future profit growth.

Compared to other US chemical companies, NewMarket’s valuation looks appealing. The market is assigning a lower earnings multiple to NewMarket than to its peers, which could represent an opportunity for investors if the company’s performance continues on track. If valuation moves toward industry averages, there could be room for multiple expansion.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.4x (UNDERVALUED)

However, any slowdown in earnings or unexpected market shifts could quickly challenge the case for NewMarket’s current valuation and bullish momentum.

Find out about the key risks to this NewMarket narrative.

Another View: Discounted Cash Flow Perspective

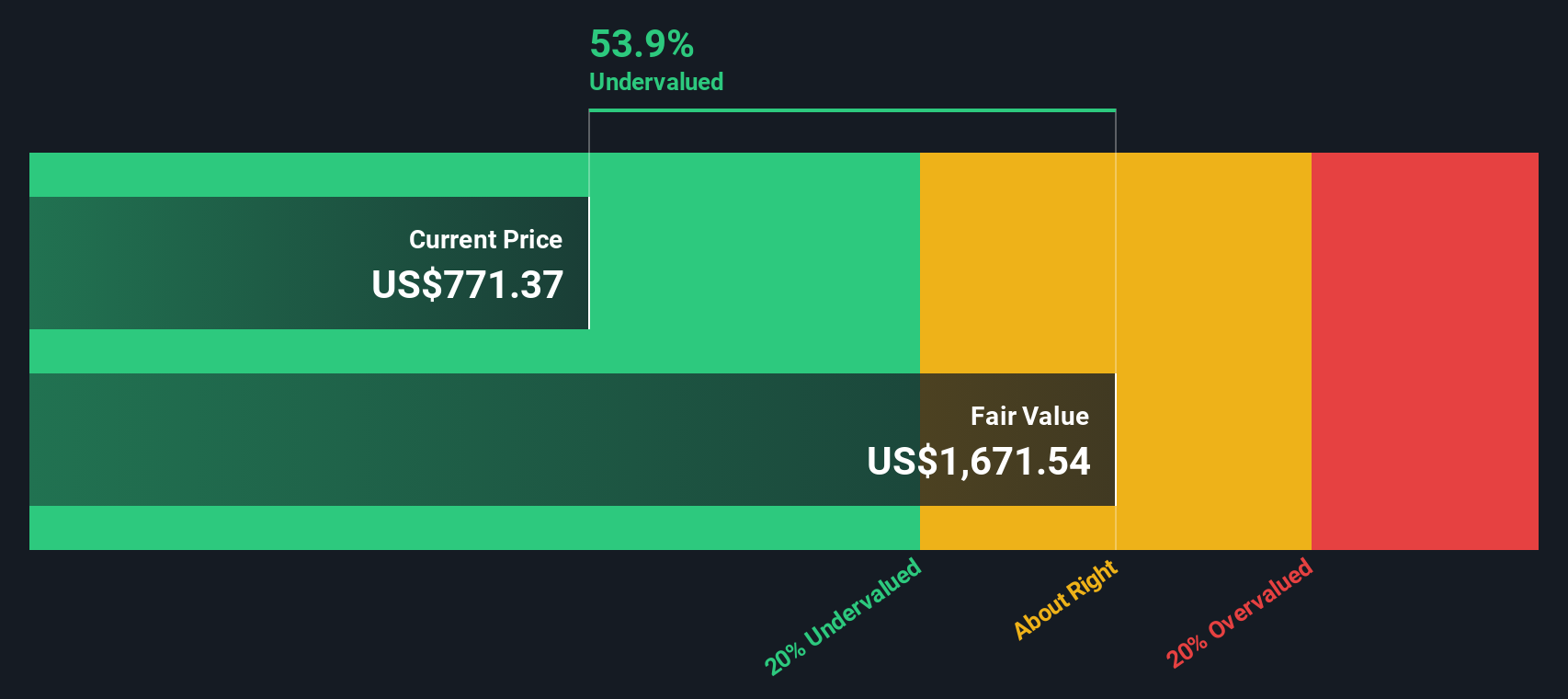

While NewMarket appears attractively valued when compared with its industry peers on earnings, our DCF model provides a notably different perspective. According to this method, the shares trade 53.4% below fair value, which indicates even deeper undervaluation. Could this suggest the market is overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewMarket for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewMarket Narrative

If you want to look at the numbers from a different angle or believe your analysis can reveal more, you can shape your own perspective on NewMarket in just a few minutes. Do it your way.

A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t leave potential gains on the table. Find your next standout investment in markets others overlook by taking advantage of powerful screening tools. Your next big win could be a click away.

- Catch sectors on the rise and see which companies are unlocking the promise of artificial intelligence. Check out these 25 AI penny stocks setting trends in automation and smart data.

- Zero in on tomorrow’s leaders trading below fair value by reviewing these 868 undervalued stocks based on cash flows that could offer serious upside before the crowd notices.

- Grow your passive income the smart way and tap into yield opportunities with these 16 dividend stocks with yields > 3% returning over 3% in a single glance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMarket might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEU

NewMarket

Through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives