- United States

- /

- Metals and Mining

- /

- NYSE:MP

Assessing MP Materials (MP) Valuation Following Quarterly Earnings and Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for MP Materials.

It's been a rollercoaster year for MP Materials, as the share price has surged over 291% year-to-date, reflecting renewed optimism after a challenging stretch. The 1-year total shareholder return of 214% highlights strong long-term rewards for investors. Momentum may be returning, especially as today’s upbeat results have reignited interest despite recent volatility.

If today’s rally sparks your curiosity, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after such strong gains and upbeat earnings, is there still hidden value in MP Materials, or is the market already factoring in the company’s future growth? Could this be a true buying opportunity, or is optimism priced in?

Most Popular Narrative: 20.5% Undervalued

With MP Materials' fair value calculated at $80.77, well above its last close of $64.18, the prevailing analyst narrative sees substantial upside driven by growth catalysts and strategic execution.

MP Materials recently secured long-term, government-backed offtake agreements, including a minimum price floor and guaranteed EBITDA for magnet output from the Department of Defense. Additionally, a $500M+ multi-year supply contract with Apple ensures predictable and resilient revenue streams insulated from price volatility, directly enhancing future revenue and earnings visibility.

Curious how these blockbuster contracts shape a rare valuation? This narrative hinges on outsized growth projections and ambitious profit margins. Uncover the exact numbers and bold forecasts fueling this bullish fair value in the complete breakdown.

Result: Fair Value of $80.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen delays in facility expansions or a major policy reversal impacting key contracts could quickly disrupt MP Materials' current profit and growth outlook.

Find out about the key risks to this MP Materials narrative.

Another View: What Do Sales Multiples Suggest?

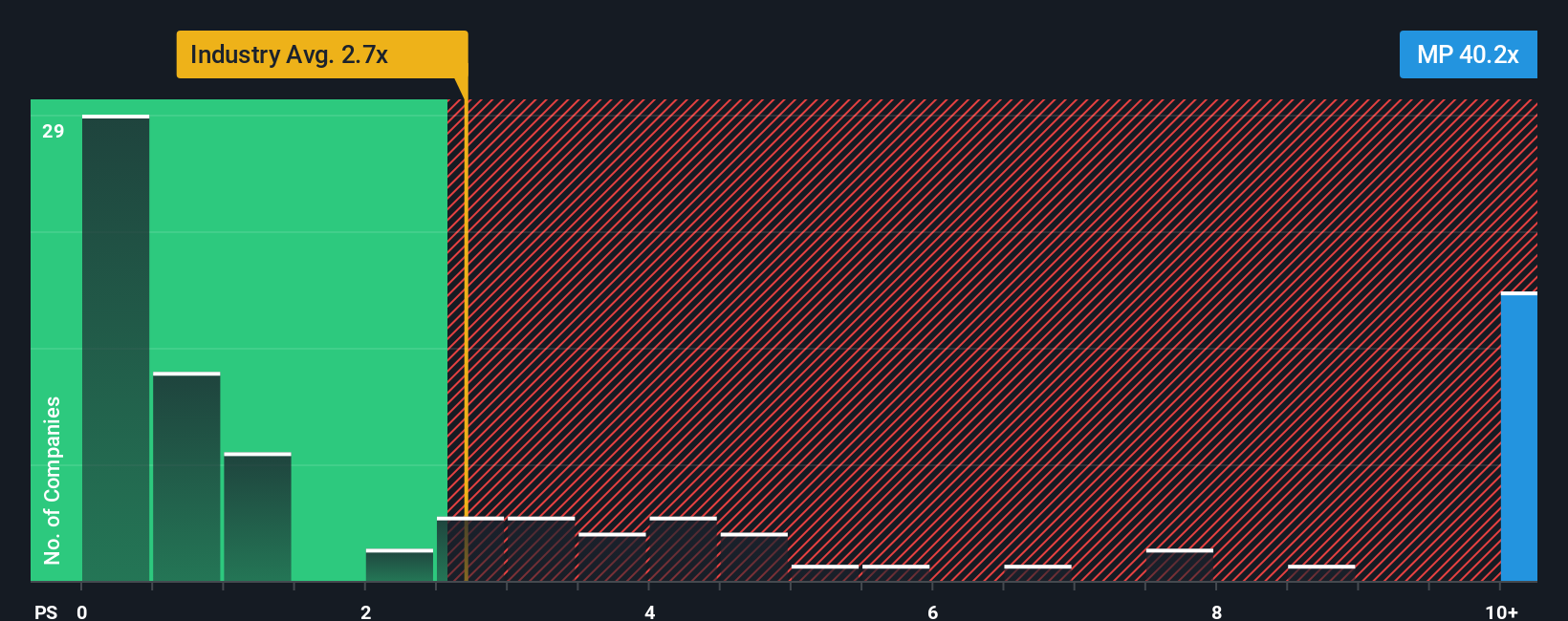

While analysts' fair value estimates suggest MP Materials could be undervalued, the current sales ratio tells a different story. The company trades at a price-to-sales ratio of 48.9x, far above both the industry average of 2.8x and its fair ratio of 2.5x. This substantial gap may signal caution for investors. Does the market see something extraordinary here, or is it just running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own narrative for MP Materials in just a few minutes: Do it your way

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Invest smarter by browsing unique stock ideas hand-picked for major trends, high yield, and emerging tech winners.

- Capture rising yields and steady income by checking out these 16 dividend stocks with yields > 3% offering yields above 3% from established dividend payers.

- Catalyze your next big move by tapping into these 24 AI penny stocks at the forefront of artificial intelligence innovation and disruption.

- Join the frontier of digital finance and future-proof your portfolio with these 82 cryptocurrency and blockchain stocks making waves in the cryptocurrency and blockchain arena.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives