- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Valuation Insights Following Record Q3 Results and Upbeat 2024 Guidance

Reviewed by Simply Wall St

Martin Marietta Materials (NYSE:MLM) grabbed attention after reporting record third-quarter results. Growth in revenues and profitability was led by the aggregates segment. Management raised its full-year guidance, pointing to momentum in key markets.

See our latest analysis for Martin Marietta Materials.

Following the upbeat earnings, Martin Marietta’s share price has shown solid momentum this year, gaining nearly 20% year-to-date and reflecting growing optimism around infrastructure spending and the company’s execution. However, total shareholder return over the past year was just below flat, which is a reminder that both capital gains and dividends together tell the full story of investor experience. Momentum remains compelling for those looking toward long-term growth, especially given strong three- and five-year total shareholder returns.

If you’re curious about what other companies are managing impressive growth with strong insider backing, this could be a great moment to discover fast growing stocks with high insider ownership

But after such robust financials and a double-digit stock run-up, is Martin Marietta still trading at an attractive valuation? Or are markets already factoring in its future growth potential and leaving little room for upside?

Most Popular Narrative: 8% Undervalued

The widely followed narrative puts Martin Marietta Materials’ fair value at $664 per share, about 8% above the recent close. This suggests that, despite strong momentum, the market may still be underestimating the company’s forward drivers.

Ongoing adoption of advanced cost management, digital tools, and operational efficiency measures, evidenced by record improvements in gross and EBITDA margins, are likely to deliver sustained net margin expansion and higher profitability, even through cyclical slowdowns.

Want to know what is powering this forecast? The narrative factors in a future margin leap and a valuation multiple that could surprise even optimistic investors. Which financial lever carries the most weight in the fair value equation? Dive in to uncover what the narrative is betting on next.

Result: Fair Value of $664 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, particularly if construction demand recovery is delayed or if infrastructure funding falters; either scenario could quickly challenge the bullish outlook.

Find out about the key risks to this Martin Marietta Materials narrative.

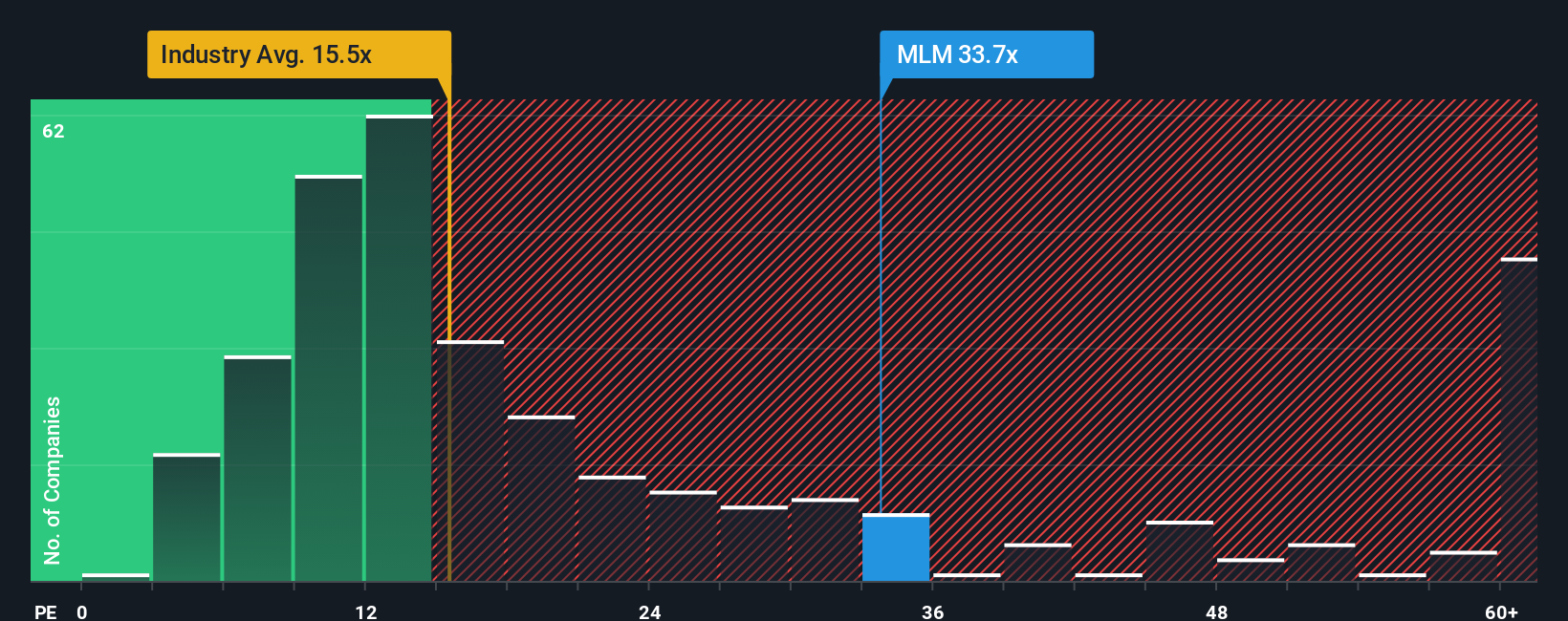

Another View: Valuation Through Market Multiples

While fair value estimates hint at upside potential, a look at the company's price-to-earnings ratio delivers a different perspective. Martin Marietta is trading at 31.1x earnings, which is significantly higher than both the peer average of 24.9x and the Basic Materials industry average of 15.1x. The fair ratio, calculated to be 22.9x, suggests that if the market were to re-rate the company closer to this level, downside risk could emerge for the current share price. Does the premium pricing signal confidence in future growth, or is it a red flag for investors betting on further upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you want to dig deeper, challenge the assumptions, or follow your own perspective, you can craft a personalized view in under three minutes, and Do it your way

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Unlock even greater opportunities by using the Simply Wall Street Screener to target stocks that match your goals. Don’t settle for the familiar. Seize fresh potential with every search.

- Start building wealth with reliable income and check out these 20 dividend stocks with yields > 3% offering yields above 3% for steady cash flows.

- Ride the surge in technological innovation by browsing these 25 AI penny stocks that are reshaping industries with artificial intelligence breakthroughs.

- Capitalize on mispriced value by scanning these 838 undervalued stocks based on cash flows to uncover stocks trading below their cash flow potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives