- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

A Fresh Look at Louisiana-Pacific’s (LPX) Valuation After Earnings, Guidance Update and CEO Transition

Reviewed by Simply Wall St

Louisiana-Pacific (LPX) is drawing investor attention after releasing quarterly earnings that reflect both pressure and pockets of strength. The company reported a decline in overall sales and profits, citing soft OSB pricing.

See our latest analysis for Louisiana-Pacific.

Shares of Louisiana-Pacific have lost steam this year, with the latest share price at $78.50 after a year-to-date share price return of -24.42%. Investor sentiment took another hit following a tough third quarter and softer guidance for the year ahead. At the same time, leadership changes and product innovation signal efforts to steady the ship. Despite a sharp slide recently, it is worth noting the company’s five-year total shareholder return of 168.10% highlights longer-term value creation. Momentum clearly faded over the past 12 months, as the one-year total shareholder return sits at -28.91%.

If you’re watching shifts in the building materials sector, consider broadening your search and discover fast growing stocks with high insider ownership.

This mixed performance has investors debating its true value and raising the question: has the recent downturn made Louisiana-Pacific a compelling buy, or is the market already factoring in the company's growth prospects?

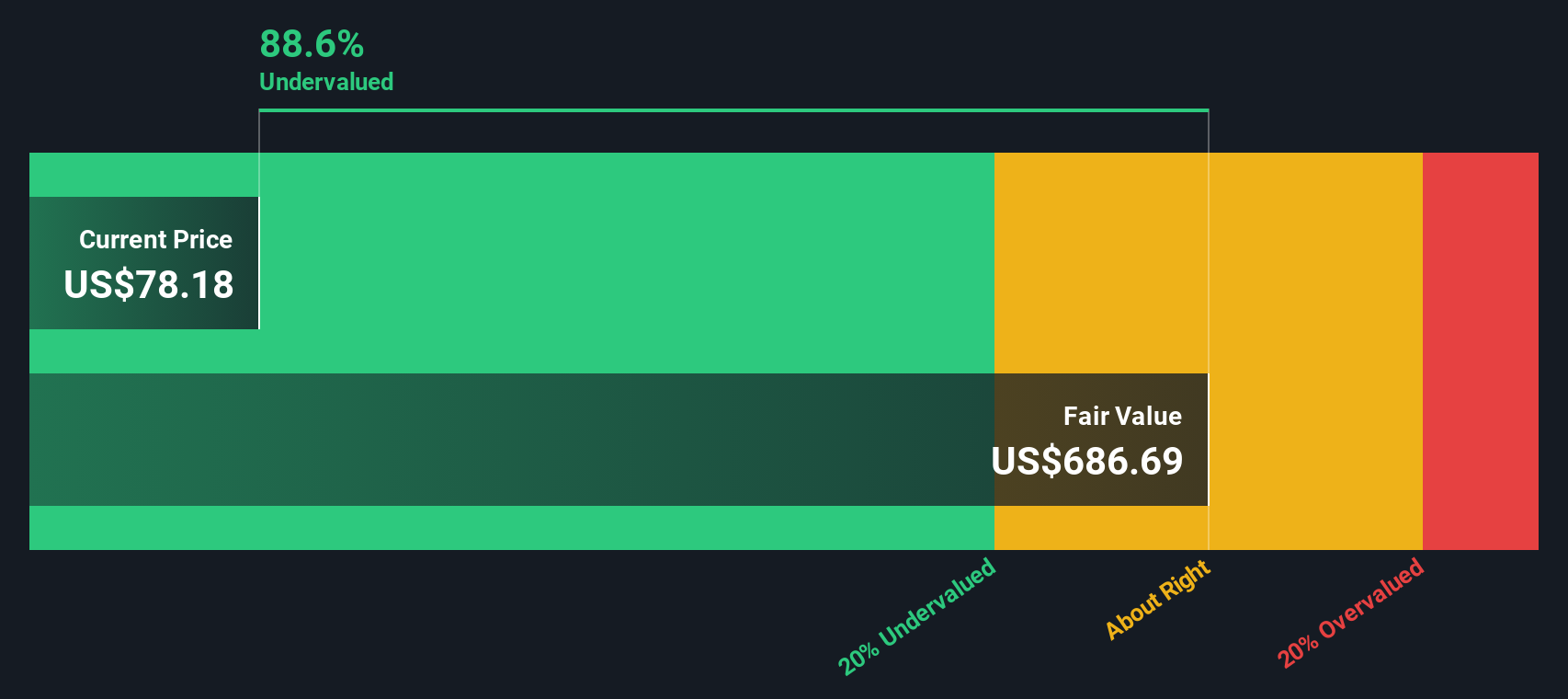

Most Popular Narrative: 25.9% Undervalued

According to the most widely followed narrative, Louisiana-Pacific’s fair value stands notably above its recent $78.50 close, suggesting substantial potential upside if company forecasts hold. Recent market momentum may be lacking, but narrative-driven expectations point to renewed interest as assumptions shift.

Continued product innovation (for example, new textures, prefinished offerings, three-dimensional corners) and penetration into under-served segments like manufactured housing and offsite/modular construction expands the company's total addressable market and should enable further market share gains. This could provide a long runway for top-line and earnings growth.

Curious what assumptions fuel this bold upside? There’s a profit and margin story lurking beneath, shaped by ambitious growth targets and future earnings power. The real surprise? One underlying metric could drive years of outperformance, but only if it plays out. Find out how these projections combine to deliver the standout fair value.

Result: Fair Value of $105.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing starts or a steep drop in OSB prices could quickly undermine even the most optimistic long-term growth outlook for Louisiana-Pacific.

Find out about the key risks to this Louisiana-Pacific narrative.

Another View: Peering Through the SWS DCF Model

Looking at Louisiana-Pacific through our DCF model, things appear less optimistic. The SWS DCF model estimates a fair value of just $23.76 per share, which is far below today's market price. This significant gap suggests downside risk if the company's long-term cash flows fall short. Which view will prove more accurate as the cycle plays out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Louisiana-Pacific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Louisiana-Pacific Narrative

If the numbers and outlook here don’t quite match your own perspective, dig into the details and see what story you build yourself in just a few minutes. Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity. Make your research count by checking these handpicked themes. Your next winning stock could be a click away.

- Boost your portfolio with strong yields and steady returns by scanning these 16 dividend stocks with yields > 3% that consistently pay over 3%.

- Ride the AI mega-trend by targeting innovation-focused companies in these 25 AI penny stocks reshaping industries around the globe.

- Tap into tomorrow’s blue chips early by reviewing these 3588 penny stocks with strong financials with financial muscle and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives