- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Loma Negra (NYSE:LOMA) Valuation in Focus After Third Quarter Revenue Decline and Debt Refinance Moves

Reviewed by Simply Wall St

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) recently posted a drop in both net sales revenues and cement volumes for the third quarter. Recovery momentum slowed and pricing remained soft amid Argentina’s shifting political landscape.

See our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima.

While the latest quarter brought softer sales for Loma Negra, its share price has staged a swift comeback, jumping over 40% in the past month even as its year-to-date return remains down 14%. That said, the cement maker’s long-term track record is more compelling, with a 5.3% total shareholder return over the past year and an impressive 198% total return over five years. This signals resilience beyond recent volatility.

If the recent price surge has you looking for broader market momentum, consider expanding your search and discover fast growing stocks with high insider ownership

With shares rebounding sharply despite ongoing operational headwinds, the key question is whether Loma Negra’s current price offers true value or if the market has already factored in all expected future gains.

Most Popular Narrative: 27% Undervalued

The market price is sitting well below the narrative’s fair value estimate, with upside potential implied if its growth story plays out. All eyes are on those forward-looking assumptions and catalysts fueling optimism for the stock.

Emerging momentum in bulk cement dispatches linked to industrial, commercial, and large-scale housing developments, combined with early-stage increases in public works across key provinces, positions Loma Negra to gain from accelerated urbanization and infrastructure modernization. This will support revenue expansion and reduce cyclicality.

Curious what underpins this bold price target? The narrative hinges on aggressive forecasts for rising profits, richer margins, and a bullish revenue trajectory. Find out which surprising financial moves and market shifts are factored in, plus just how optimistic those long-term projections get.

Result: Fair Value of $14.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressures and Argentina’s unpredictable economic policies could easily alter the outlook and challenge assumptions that support today’s upbeat narrative.

Another View: Market Ratios Raise a Red Flag

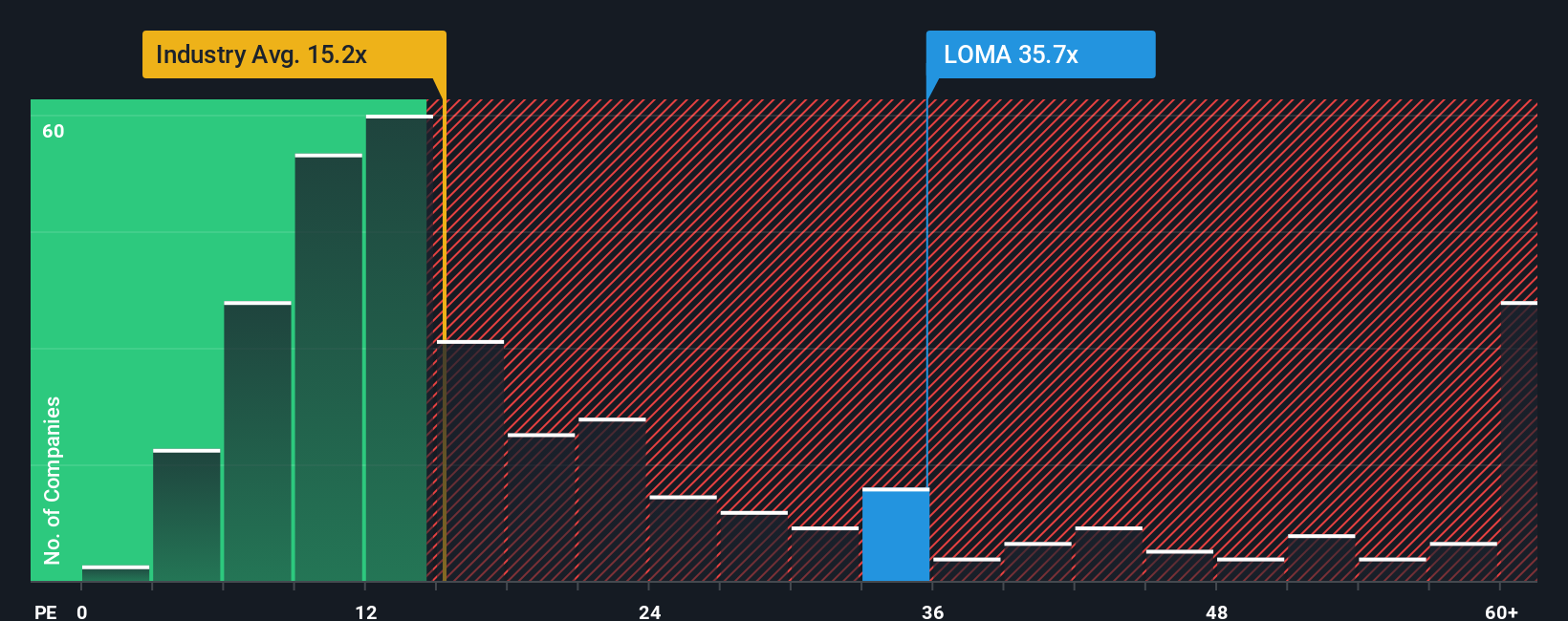

Looking through the lens of market ratios, Loma Negra’s shares look expensive. Its price-to-earnings ratio is 34.5x, notably higher than both its peers’ average (20.7x) and the global Basic Materials industry (15.1x). Even the fair ratio, at 19.5x, is far below the current level. This wide gap could expose investors to greater valuation risk if growth expectations do not materialize. How will the market react if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loma Negra Compañía Industrial Argentina Sociedad Anónima Narrative

If you see the story differently or want to dig into the numbers yourself, it is simple to craft your own outlook and share your take in just a few minutes, Do it your way

A great starting point for your Loma Negra Compañía Industrial Argentina Sociedad Anónima research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock fresh opportunities and level up your portfolio. Missing these unique markets could leave top performers out of reach. Take charge and target trends before the crowd.

- Fuel your search for tomorrow’s breakthrough innovations by evaluating these 25 AI penny stocks that tap into real-world growth from artificial intelligence advancements.

- Secure potential passive income streams when you hunt for these 16 dividend stocks with yields > 3% offering attractive yields above 3% and proven payout records.

- Position yourself ahead of the next technology shift by checking these 28 quantum computing stocks at the forefront of quantum computing progress and industry-changing applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives