- United States

- /

- Chemicals

- /

- NYSE:KWR

Quaker Chemical (KWR): Ongoing Losses and Weak Revenue Growth Challenge Bullish Valuation Narrative

Reviewed by Simply Wall St

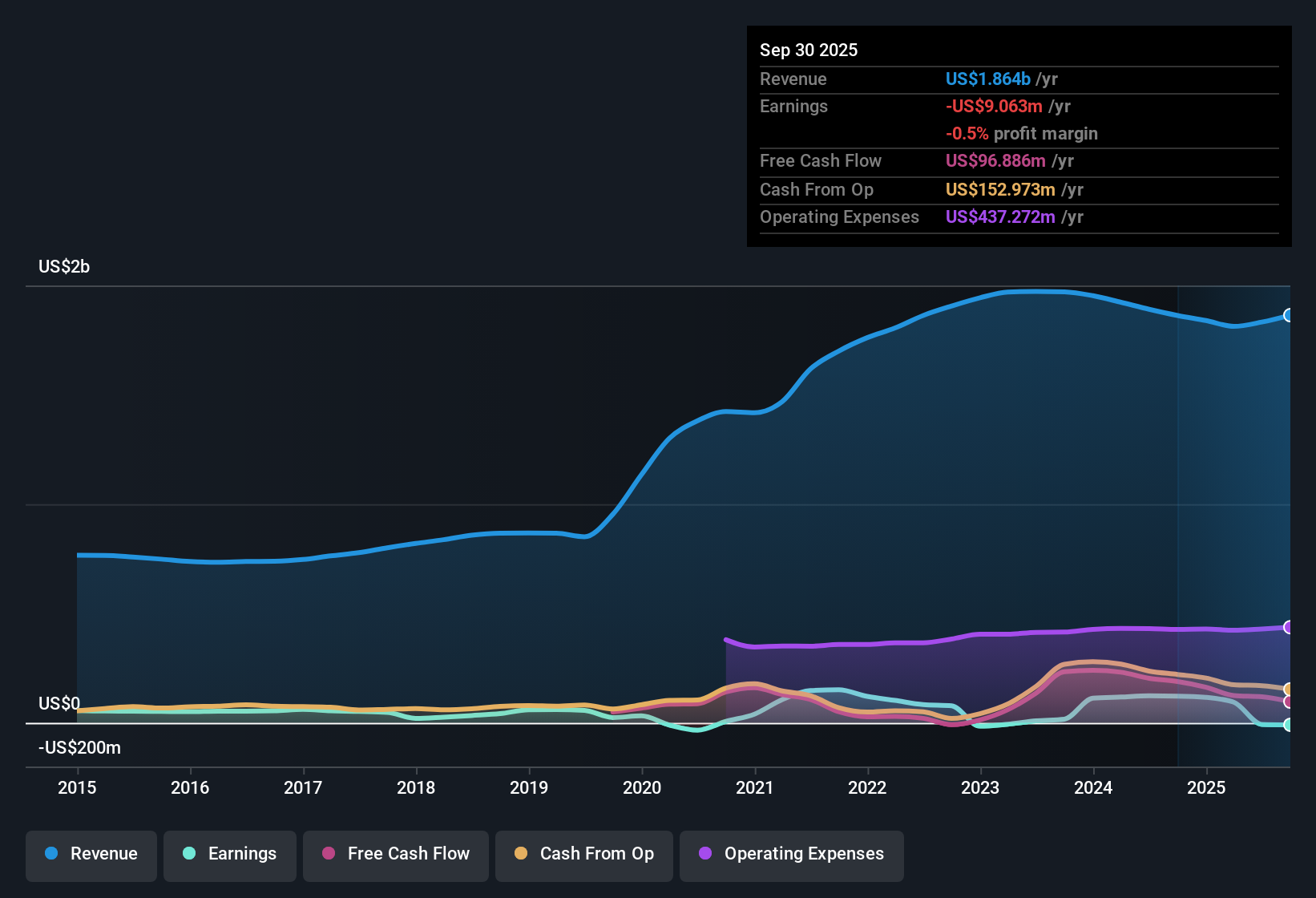

Quaker Chemical (KWR) remains unprofitable, with losses having increased at an average rate of 1.1% per year over the past five years. Revenue is forecast to grow 4% annually, which is below the broader US market's expected 10.3% growth rate and indicates ongoing commercial challenges. Investors are left weighing persistent unprofitability, slowing growth expectations, and a relatively high price-to-sales ratio against the potential upside suggested by the current discount to fair value.

See our full analysis for Quaker Chemical.Next, we will compare these headline figures with the prevailing narratives to assess where market perceptions align with reality and where new questions may arise.

See what the community is saying about Quaker Chemical

Profit Margin Set to Swing from -0.4% to 25.9%

- Analysts expect Quaker Chemical’s profit margins will jump from -0.4% today to 25.9% by 2028, which would be a dramatic turnaround compared to its recent string of losses.

- Analysts' consensus view emphasizes the margin improvement as a key support for future earnings, highlighting:

- Ongoing cost-saving initiatives, worth a targeted $40 million annually, are set to underpin stronger long-term profitability even while end-markets stay flat.

- Double-digit volume growth in advanced and specialty solutions showcases the company’s strategy to shift towards higher-value products and recurring revenues. This could pave the way for smoother, more predictable cash flows as margins climb.

- Consensus narrative points out that if Quaker delivers this margin improvement, it could justify analyst projections for earnings to swing from a loss of $7.1 million today to $531.8 million by 2028.

- Consensus narrative also flags that this trajectory relies heavily on the success of streamlined operations and ongoing demand growth in the automation and greener industry segments.

Net Leverage Climbs to 2.6x EBITDA

- After recent acquisitions, Quaker Chemical’s net leverage reached 2.6x trailing EBITDA, reflecting higher debt and adding financial risk to the equation.

- Consensus narrative highlights that:

- Elevated leverage and increased interest expenses may restrain future investment and share repurchases. This tightens financial flexibility at a time when macroeconomic and regional challenges are already weighing on performance.

- A restructuring program is in place to lower costs, but this comes with elevated short-term spending. The path to healthier margins and more available cash could therefore be bumpy and drawn-out.

DCF Fair Value Shows Wide Gap at $255.48

- Quaker Chemical’s current share price of $138.89 is well below the DCF fair value of $255.48, creating a significant theoretical upside even after factoring in its above-peer price-to-sales multiple of 1.3x versus the industry average of 1.1x.

- Consensus narrative highlights a tension:

- The apparent discount to fair value provides a cushion. However, analysts' consensus price target sits closer at $157.60, signaling cautious optimism that depends on positive earnings momentum materializing.

- Investors will need conviction not just on a discounted valuation, but also on whether revenue and margin gains can actually be delivered in a tough competitive and cost environment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Quaker Chemical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on what the data reveals? It only takes a few minutes to craft your own story and share your perspective. Do it your way

A great starting point for your Quaker Chemical research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Quaker Chemical’s turnaround relies on cost cuts and margin recovery. However, high debt, rising interest expenses, and limited financial flexibility threaten its outlook.

If you want investments with sturdier finances and less risk from leverage, check the options with solid balance sheet and fundamentals stocks screener (1984 results) that are built to weather financial headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives