- United States

- /

- Chemicals

- /

- NYSE:KWR

A Look at Quaker Chemical’s (KWR) Valuation After Surprising Q3 Earnings Beat and Global Growth Push

Reviewed by Simply Wall St

Quaker Chemical (NYSE:KWR) just delivered third-quarter results that topped expectations, with both revenue and adjusted earnings per share beating consensus. The company’s global performance, especially in the Asia/Pacific region, contributed to this growth.

See our latest analysis for Quaker Chemical.

After this stronger than expected quarter, Quaker Chemical’s share price surged over 10% in a single day, giving investors a much-needed boost. However, this has not been enough to reverse the longer-term trend, with the one-year total shareholder return still down more than 12%. Momentum seems to be building in the wake of recent buybacks and improving fundamentals, but the stock remains well below its past highs.

If Quaker’s rebound and buyback news have you rethinking what’s out there, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still well below their historical highs but analysts projecting notable upside, investors now face a key question: is Quaker Chemical undervalued after its recent rally, or is the market already factoring in the next phase of growth?

Most Popular Narrative: 10.6% Undervalued

With the latest consensus narrative setting Quaker Chemical’s fair value at $155.40, the shares trade well below this target after the recent rally. This amplifies debate about what drives this potential upside from current levels.

Quaker is seeing double-digit volume growth in its advanced and specialty solutions product line, tied to rising demand for high-performance, sustainable chemistries that support manufacturing automation, energy storage/battery production, and greener industrial processes. This boosts both revenue growth and supports higher margins as product mix shifts favorably.

Why do powerful tailwinds in automation and greener technologies make this valuation so compelling? The narrative’s secret lies in ambitious improvements in future profitability and razor-sharp growth forecasts. Uncover the bold financial logic fueling the analyst optimism and find out what surprising assumptions drive that fair value.

Result: Fair Value of $155.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical and macroeconomic disruptions in EMEA or rising raw material costs could quickly derail earnings momentum. This would challenge the optimistic outlook.

Find out about the key risks to this Quaker Chemical narrative.

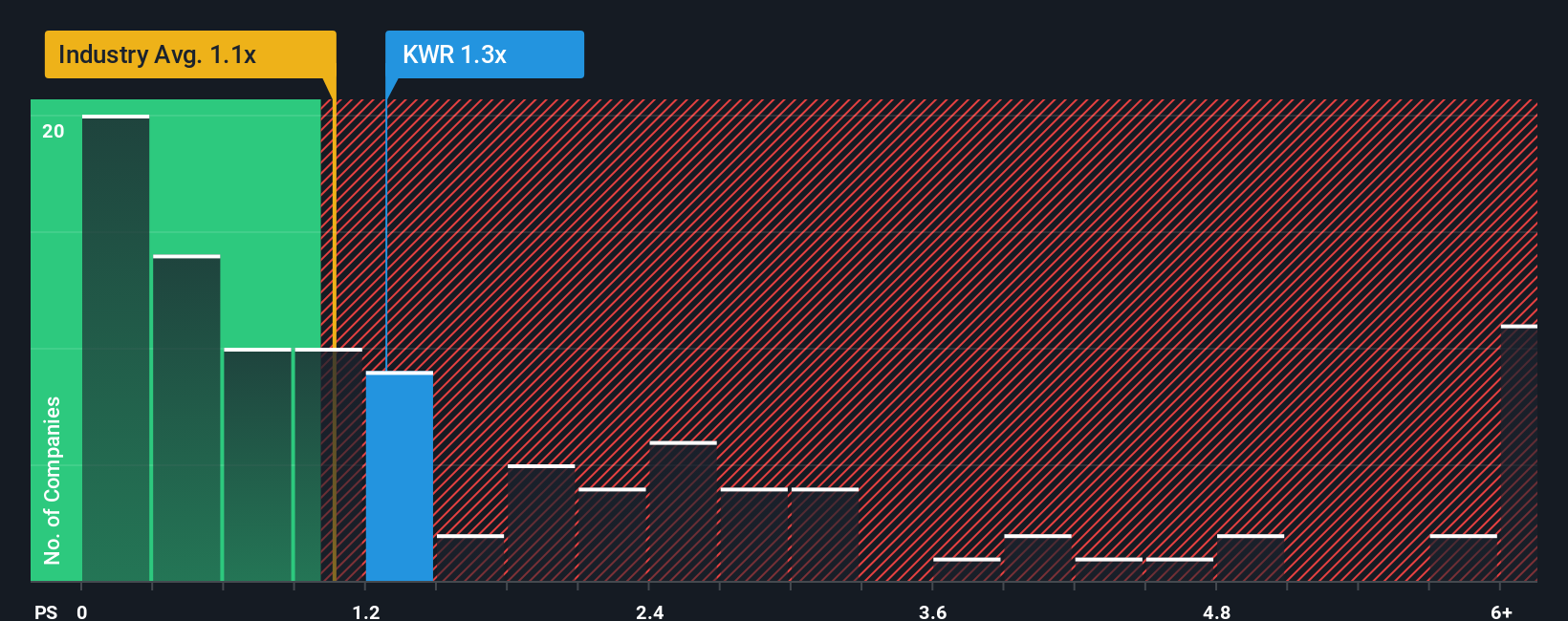

Another View: Market Ratios Tell a Different Story

Looking beyond analyst fair values, Quaker Chemical trades at a price-to-sales ratio above both the US Chemicals industry average and its direct peers. While our fair ratio suggests some value may exist, the market’s current stance points to greater valuation risk. Could sentiment be holding back a true rebound?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quaker Chemical Narrative

If you see things differently or want to dive into the numbers on your own terms, it’s easy to build your personal narrative in just a few minutes with Do it your way.

A great starting point for your Quaker Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities in the market rarely wait. Take the next step and spot exciting stocks that match your strategy by using expert-curated screeners below.

- Capture major upside in digital finance by reviewing these 81 cryptocurrency and blockchain stocks, which delivers innovation in blockchain and secure payments.

- Tap into strong, steady returns with these 22 dividend stocks with yields > 3%, which offers robust yields above 3% for income-focused investors.

- Unlock undervalued gems built on cash flow strength through these 840 undervalued stocks based on cash flows and get ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives