- United States

- /

- Chemicals

- /

- NYSE:KWR

A Fresh Look at Quaker Chemical (KWR) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Quaker Chemical (KWR) shares slipped nearly 2.4% in the last session. The performance comes as investors keep an eye on the company’s ongoing transformation efforts, as well as how market conditions could impact its specialty chemical business moving forward.

See our latest analysis for Quaker Chemical.

Quaker Chemical’s 1-day share price return of -2.35% continues what has been a challenging stretch, with momentum fading and a 1-year total shareholder return of -23.87%. Recent price action reflects a mix of strategic transitions and shifting investor sentiment, rather than any sudden downturn in fundamentals.

If corporate transformation stories like this have you wondering what else is out there, it might be time to discover fast growing stocks with high insider ownership

With shares still trading at a substantial discount to both analyst targets and intrinsic value measures, the big question is whether the recent decline leaves Quaker Chemical undervalued, or if the current price already reflects its future prospects.

Most Popular Narrative: 23.1% Undervalued

At $124.65, Quaker Chemical's share price stands well below the narrative's fair value estimate of $162. This significant gap sets up a compelling narrative about the company’s future profit turnaround and strong margin expansion potential.

The ongoing roll-out of FLUID INTELLIGENCE (breakthrough sensor technology, digitalization, and automation of services) creates stickier customer relationships and recurring revenue streams. This also differentiates Quaker in an environment increasingly focused on sustainability and efficiency, supporting more predictable cash flows and potentially higher net margins.

Want to see what powers this bullish narrative? Expect some big leaps in profit margins, ambitious sales growth, and a bold earnings multiple. Curious which needle-moving assumptions justify a fair value premium this size? The secrets behind the forecast are just a click away.

Result: Fair Value of $162 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in key regions and higher debt levels could still limit Quaker Chemical's ability to deliver on these optimistic forecasts.

Find out about the key risks to this Quaker Chemical narrative.

Another View: Peer and Industry Comparisons

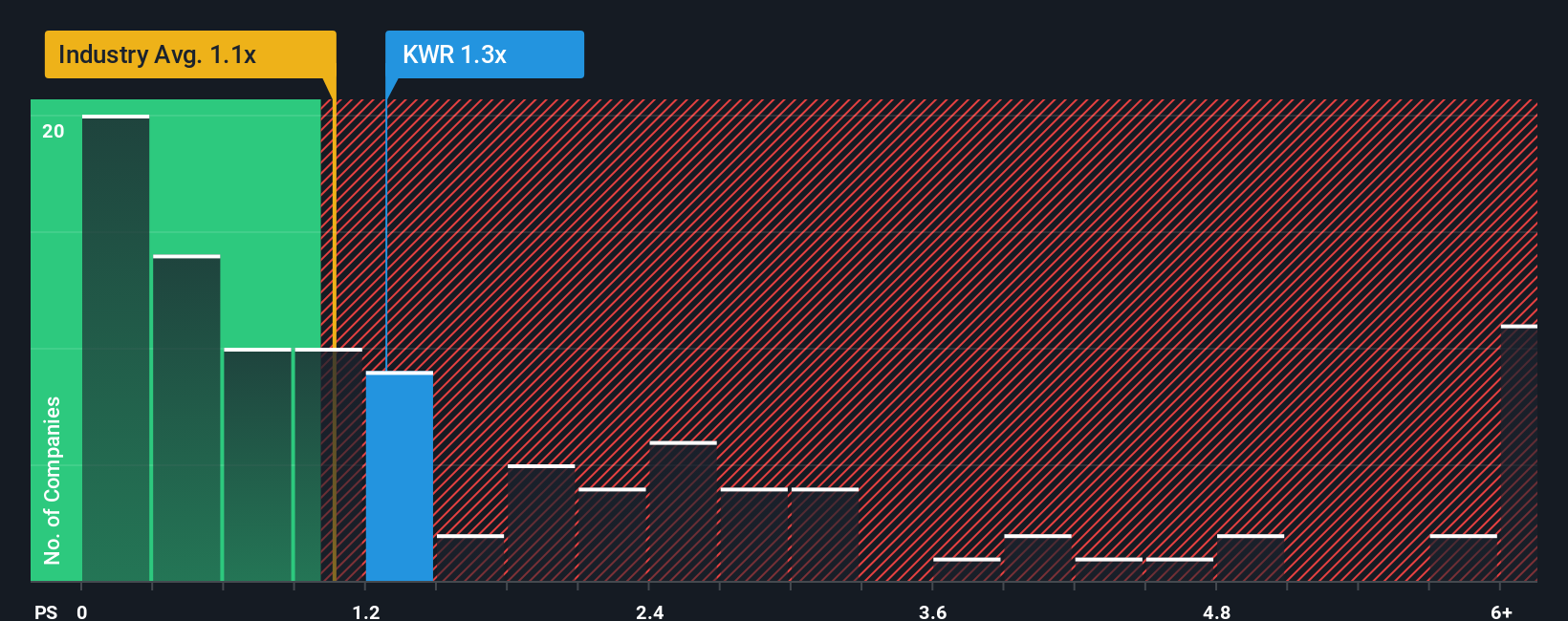

While the narrative valuation points to underappreciated upside, a quick reality check against the company’s sales ratio tells a different story. Quaker Chemical is trading at a higher price-to-sales ratio (1.2x) than both its industry average (1.1x) and its close peers (1.0x), even though the fair ratio is estimated at 1.4x. That discrepancy suggests the market already builds in some optimism and leaves less obvious margin for safety, especially if future growth falls short. Could this premium signal hidden risks, or is it a sign of real outperformance to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quaker Chemical Narrative

Not convinced by the current storyline or want to crunch the numbers yourself? You can shape your own view in just a few minutes. Do it your way

A great starting point for your Quaker Chemical research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity rarely knocks twice. Don’t miss your chance to uncover stocks positioned for growth, value, and innovation with a powerful head start.

- Uncover new potential by scanning these 3613 penny stocks with strong financials poised for impressive moves and resilient financials. Access hidden gems that remain off most investors’ radar.

- Capitalize on the next wave of artificial intelligence breakthroughs by starting with these 25 AI penny stocks to spot companies advancing the forefront of tomorrow’s technology.

- Lock in value with these 925 undervalued stocks based on cash flows which are trading below their intrinsic worth. This approach may increase your chances for future gains before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives