- United States

- /

- Basic Materials

- /

- NYSE:KNF

Knife River (KNF): Profit Margin Decline Tests Bullish Growth Narrative as Valuation Premium Widens

Reviewed by Simply Wall St

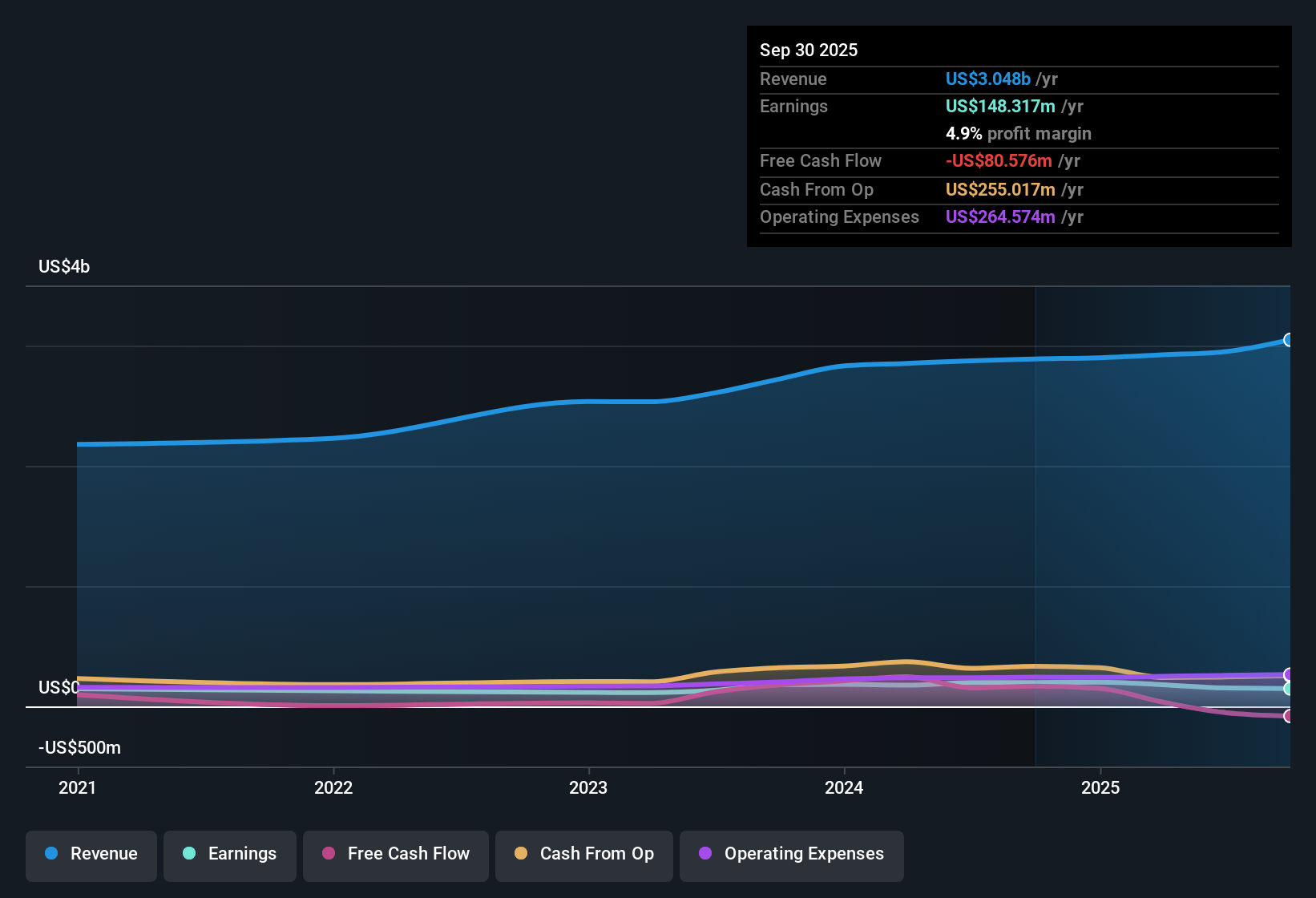

Knife River (KNF) is forecasting earnings growth of 18.7% per year, well ahead of the broader US market’s expected 16% annual increase, while revenue is set to grow at 5.9% per year, trailing behind the US average of 10.5%. Despite five-year annualized earnings growth of 7.2% and high-quality earnings, the most recent profit margin slipped to 4.9% from last year’s 6.9%. Shares are currently trading at $66.22, which is above the estimated fair value of $59.10.

See our full analysis for Knife River.Next, we’ll see how these headline numbers compare to the most widely followed narratives about Knife River, highlighting where the data puts the stories to the test.

See what the community is saying about Knife River

Public Project Backlog Fuels Growth Hopes

- Knife River has a record $1.3 billion order backlog, underscoring multiyear visibility from federally backed infrastructure spending. More than 60% of IIJA funds have yet to be used, which could help sustain revenue well into 2026 and beyond.

- Analysts' consensus view notes this major backlog and dedicated public DOT funding:

- Forecasts hinge on the company converting the backlog via project execution, estimating revenue will grow at 7.4% per year over the next three years.

- However, with 90% of backlog tied to public infrastructure, any political or funding hurdle could slow contract wins or squeeze margins, challenging the consensus narrative.

- To see how the latest results test analysts’ expectations for Knife River’s future, check the full consensus narrative for deeper insights. 📊 Read the full Knife River Consensus Narrative.

Margin Recovery Centered on Cost Controls

- Profit margins currently sit at 4.9%, lower than the 6.9% margin recorded last year. Analysts forecast a recovery to 7.2% within three years as operational improvements take hold.

- Consensus narrative highlights management’s push for dynamic pricing, higher-margin aggregates, and operational excellence programs:

- If the company delivers on digitization, vertical integration, and cost reduction, consensus expects margin expansion to outpace recent pressures from weather disruptions and cost increases.

- Yet, ongoing region-specific challenges, especially in Oregon and weather-affected markets, remain a threat to margin progress. Failure to navigate them could derail the brighter outlook.

Premium Valuation Puts Pressure on Execution

- Knife River trades at a P/E of 25.3x, above the industry average of 15.2x and the peer average of 22.9x. The current share price of $66.22 also exceeds its DCF fair value of $59.10.

- Analysts’ consensus narrative flags that for the stock to warrant the current premium, management needs to deliver sustained earnings acceleration. Otherwise, investors risk buying in above both fair value and sector multiples:

- Consensus expects earnings to reach $264.4 million by 2028, supporting a higher valuation if execution aligns with forecasts.

- If anticipated margin and revenue gains stall, the stock’s valuation gap could widen, exposing investors to downside versus the $59.10 DCF fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Knife River on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something different in the figures? Take a couple of minutes to shape your unique perspective into a new narrative and share your view. Do it your way

A great starting point for your Knife River research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Knife River’s premium valuation and reliance on public projects could expose investors to downside if growth or margin expansion falls short of expectations.

If you want stronger value and less price risk, check out these 844 undervalued stocks based on cash flows where companies trading below fair value may offer better upside potential with less uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knife River might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNF

Knife River

Provides aggregates-led construction materials and contracting services in the United States.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives