- United States

- /

- Paper and Forestry Products

- /

- NYSE:GLT

How Much is P. H. Glatfelter Company's (NYSE:GLT) CEO Getting Paid?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Dante Parrini became the CEO of P. H. Glatfelter Company (NYSE:GLT) in 2011. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for P. H. Glatfelter

How Does Dante Parrini's Compensation Compare With Similar Sized Companies?

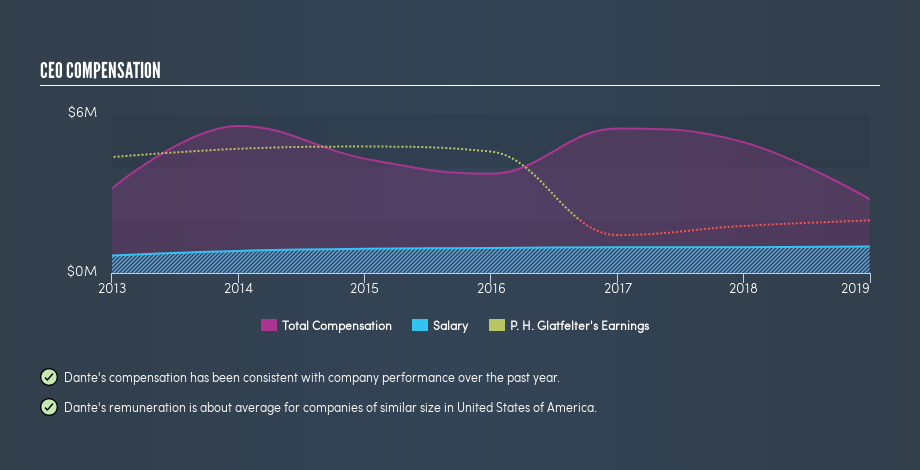

According to our data, P. H. Glatfelter Company has a market capitalization of US$668m, and pays its CEO total annual compensation worth US$2.8m. (This number is for the twelve months until December 2018). That's actually a decrease on the year before. While we always look at total compensation first, we note that the salary component is less, at US$996k. We looked at a group of companies with market capitalizations from US$400m to US$1.6b, and the median CEO total compensation was US$2.3m.

So Dante Parrini is paid around the average of the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

The graphic below shows how CEO compensation at P. H. Glatfelter has changed from year to year.

Is P. H. Glatfelter Company Growing?

P. H. Glatfelter Company has reduced its earnings per share by an average of 101% a year, over the last three years (measured with a line of best fit). Its revenue is up 8.2% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. The modest increase in revenue in the last year isn't enough to make me overlook the disappointing change in earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has P. H. Glatfelter Company Been A Good Investment?

With a three year total loss of 29%, P. H. Glatfelter Company would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Remuneration for Dante Parrini is close enough to the median pay for a CEO of a similar sized company .

After looking at EPS and total shareholder returns, it's certainly hard to argue the company has performed well, since both metrics are down. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves. Shareholders may want to check for free if P. H. Glatfelter insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this freelist of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:GLT

Glatfelter

Engages in the manufacture and sale of engineered materials worldwide.

Mediocre balance sheet very low.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success