Stock Analysis

- United States

- /

- Packaging

- /

- NYSE:GEF

Greif Insiders Sold US$1.6m Of Shares Suggesting Hesitancy

Many Greif, Inc. (NYSE:GEF) insiders ditched their stock over the past year, which may be of interest to the company's shareholders. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Greif

The Last 12 Months Of Insider Transactions At Greif

The Executive VP & CFO, Lawrence Hilsheimer, made the biggest insider sale in the last 12 months. That single transaction was for US$885k worth of shares at a price of US$60.61 each. So it's clear an insider wanted to take some cash off the table, even below the current price of US$63.86. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was only 13% of Lawrence Hilsheimer's holding.

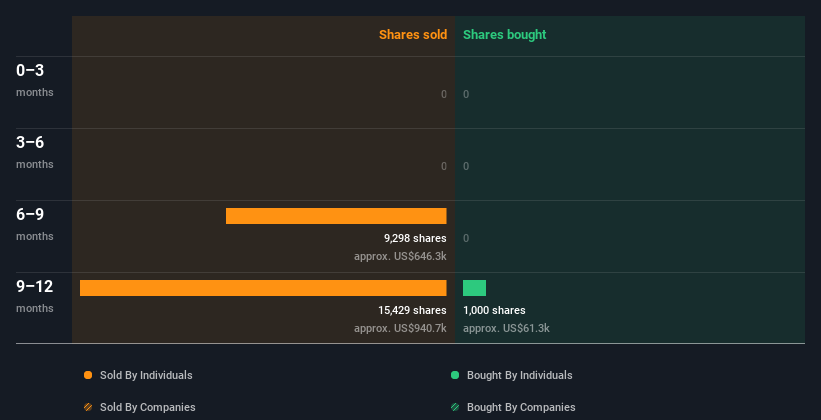

All up, insiders sold more shares in Greif than they bought, over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Greif better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Greif insiders own 38% of the company, currently worth about US$1.1b based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Greif Insider Transactions Indicate?

The fact that there have been no Greif insider transactions recently certainly doesn't bother us. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Greif insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Greif. For example, Greif has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're helping make it simple.

Find out whether Greif is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GEF

Greif

Greif, Inc. engages in the production and sale of industrial packaging products and services worldwide.

Very undervalued established dividend payer.