- United States

- /

- Chemicals

- /

- NYSE:FUL

Do Diverging Analyst Views Signal a New Phase for H.B. Fuller's (FUL) Shareholder Strategy?

Reviewed by Sasha Jovanovic

- In recent days, UBS initiated coverage of H.B. Fuller with a Neutral rating, highlighting anticipated growth challenges, while Seaport Global Securities upgraded the company’s outlook due to expected margin expansion through pricing and operational improvements.

- This mix of analyst opinions has brought renewed attention to H.B. Fuller’s shareholder policies, including steady dividends and ongoing share buybacks.

- With UBS’s focus on growth headwinds and Seaport Global’s margin optimism, we’ll explore what these updates could mean for H.B. Fuller’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

H.B. Fuller Investment Narrative Recap

Owning H.B. Fuller means believing in the company's ability to expand margins and deliver on operational improvements, despite modest revenue growth expectations against a backdrop of sector challenges. The recent analyst updates, while renewing debate over the pace of growth and margin expansion, do not materially change the primary short-term catalyst: delivering cost savings and margin benefits from pricing actions. The biggest risk remains weak market demand and cost pressures, particularly in global industrial and construction segments.

Among recent announcements, the reaffirmation of H.B. Fuller's regular quarterly cash dividend stands out, reinforcing the company's ongoing commitment to shareholder returns. This is particularly relevant as both margin expansion and cash flows are under scrutiny amid evolving growth expectations, making the reliability of dividends a potential stabilizing factor for current and prospective investors.

Yet, in contrast to the margin optimism, investors should be aware of H.B. Fuller's exposure to raw material cost inflation, which could...

Read the full narrative on H.B. Fuller (it's free!)

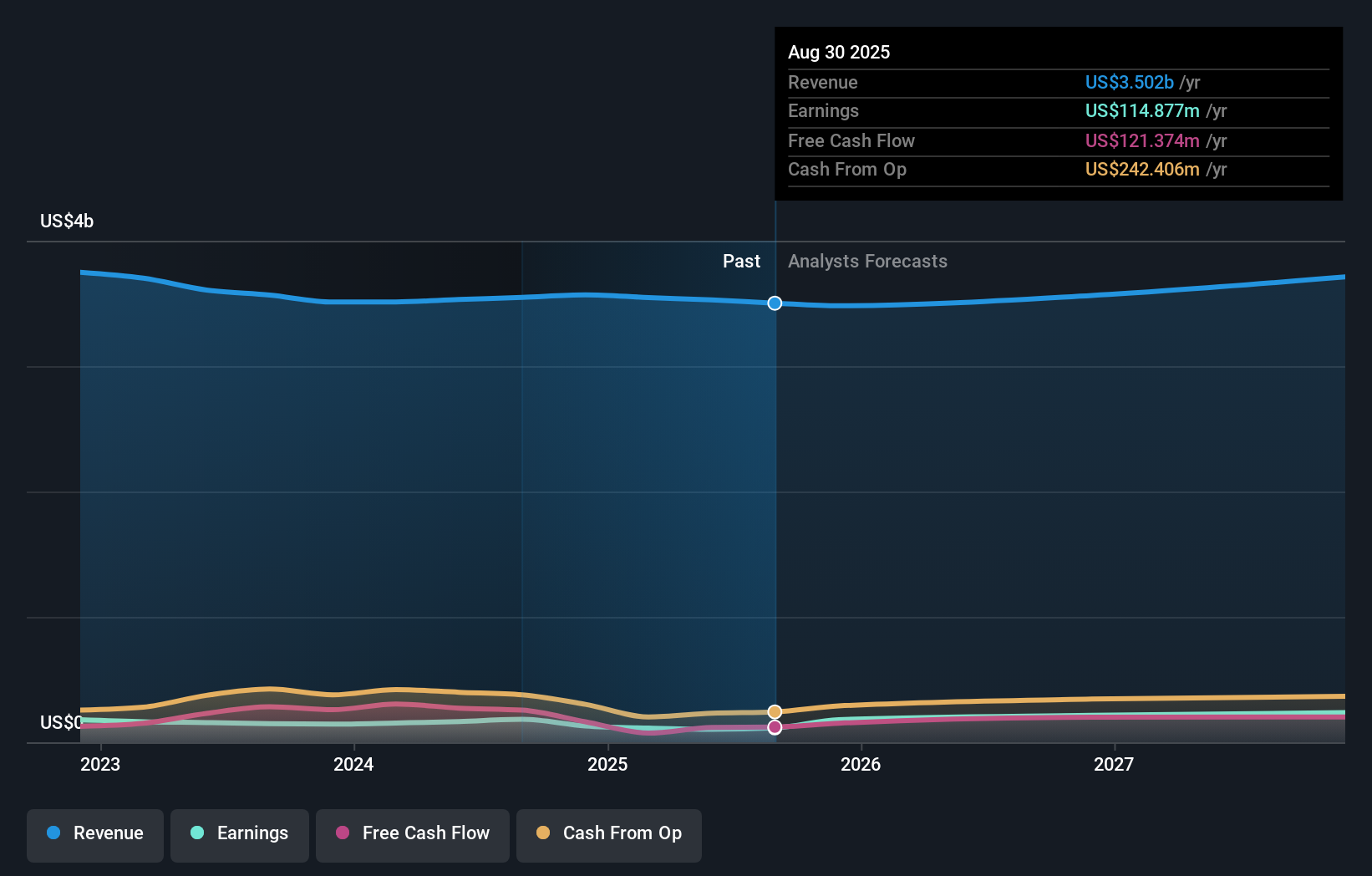

H.B. Fuller's outlook projects $3.8 billion in revenue and $300.5 million in earnings by 2028. This assumes a 2.4% annual revenue growth rate and an increase in earnings of about $197 million from the current $103.1 million.

Uncover how H.B. Fuller's forecasts yield a $68.83 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community supplied two unique fair value estimates for H.B. Fuller, ranging from US$63.39 to US$68.83. Margin expansion hopes highlighted by recent analyst upgrades could shape future views, but cost pressures and growth constraints may challenge those assumptions.

Explore 2 other fair value estimates on H.B. Fuller - why the stock might be worth as much as 20% more than the current price!

Build Your Own H.B. Fuller Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H.B. Fuller research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free H.B. Fuller research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H.B. Fuller's overall financial health at a glance.

No Opportunity In H.B. Fuller?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H.B. Fuller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUL

H.B. Fuller

H.B. Fuller Company, together with its subsidiaries, formulates, manufactures, and markets adhesives, sealants, coatings, polymers, tapes, encapsulants, additives, and other specialty chemical products.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives