- United States

- /

- Chemicals

- /

- NYSE:EMN

Eastman Chemical (EMN) Margin Decline Reinforces Concerns About Financial Health and Dividend Sustainability

Reviewed by Simply Wall St

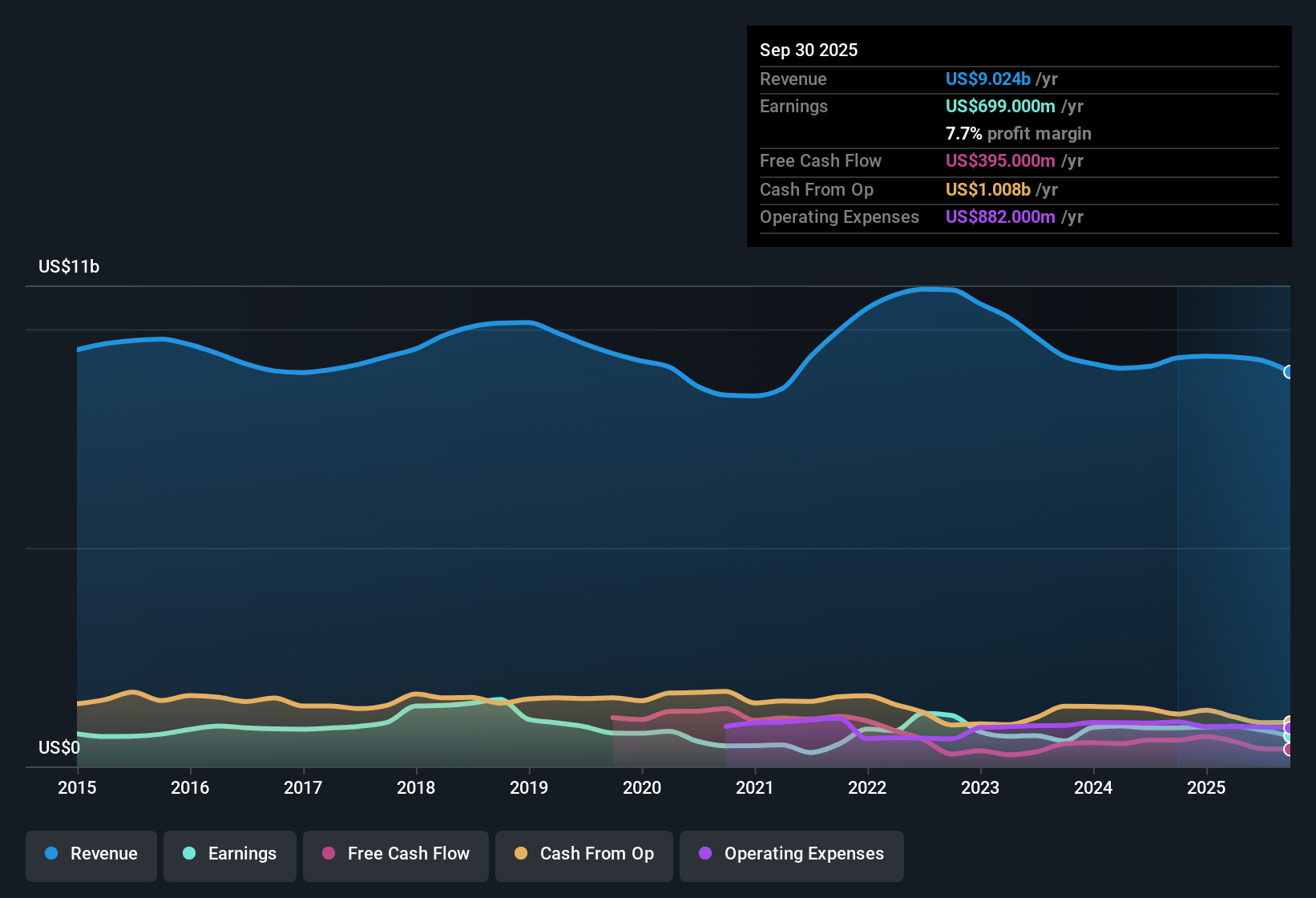

Eastman Chemical (EMN) reported a net profit margin of 7.7%, down from last year’s 9.5%, with a five-year annualized earnings growth rate of 9.2%. Shares are trading at $60.74, well below the estimated fair value of $152.01 by discounted cash flow analysis. Expectations are for earnings to grow by 10.88% per year, which is slower than both the broader US market's 16% pace and the threshold for significant growth. Investors see good value here due to low price-to-earnings ratios and high quality earnings, but the latest period’s slipping margins and flagged risks around dividends and financial health mean the outlook remains a nuanced one.

See our full analysis for Eastman Chemical.We will now see how these latest numbers stack up against the dominant market narratives. Some expectations could be confirmed, while others might be put to the test.

See what the community is saying about Eastman Chemical

Margin Recovery Hinges on Cost Cuts

- Analysts project EMN's profit margins will rise from 9.0% to 9.5% over the next three years, despite the recent drop from 9.5% to 7.7%.

- According to the analysts' consensus view, ongoing initiatives such as $75M to $100M in cost reduction and asset optimization are expected to support improved margins and higher return on invested capital as end-market demand recovers.

- Consensus highlights that stable long-term contracts in specialty materials could ease volatility and make future margin gains more predictable.

- However, the consensus acknowledges ongoing trade tensions and consumer demand weakness place additional uncertainty on the margin recovery path.

Cost Advantage Drives Relative Value

- With a trailing price-to-earnings ratio of 9.9x, EMN trades at a steep discount to both the chemicals industry average of 24.7x and its peer group at 17.5x, making it one of the cheapest stocks in its sector.

- Analysts' consensus view states that this valuation gap heavily supports the bullish case. EMN could see multiple expansion if profitability stabilizes and sustainability initiatives lead to premium pricing.

- Stable high-quality earnings and below-industry multiples have already caught value investors' attention.

- At the same time, analysts caution that recovery stories depend on delivering on margin and growth expectations, not just deep value multiples.

Dividend and Financial Flexibility in Focus

- Recent results highlight flagged risks around dividend sustainability and financial flexibility, especially after capital-intensive investments and ongoing cost-cutting demands.

- Consensus narrative flags these concerns as a tension point. Elevated recent investments and rising rates could limit EMN's ability to maintain attractive dividends while funding continued innovation.

- Bears argue that higher interest costs and deferred growth investments may constrain future cash flows.

- On the other hand, EMN's push for innovation and strong customer partnerships are expected to support long-term earnings power if execution remains disciplined.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Eastman Chemical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the figures? Share your perspective and shape your own Eastman Chemical story in just a few minutes. Do it your way

A great starting point for your Eastman Chemical research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Although Eastman Chemical offers value, its slipping margins and mounting concerns over dividend sustainability and financial flexibility highlight vulnerabilities in its financial health.

If you're seeking businesses with stronger balance sheets and less financial strain, check out solid balance sheet and fundamentals stocks screener (1978 results) to find companies built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives