- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab’s (ECL) Scientific Clean Debut in Home Depot Canada Could Be a Game Changer

Reviewed by Sasha Jovanovic

- In the past week, Ecolab Inc. announced the expansion of its exclusive partnership with The Home Depot Canada, bringing its Scientific Clean product line to over 180 Canadian retail stores and online, introducing nine specialized solutions for commercial, industrial, and residential cleaning needs.

- This marks Ecolab's first entry of the Scientific Clean line into the Canadian retail market, potentially increasing its brand presence and access to a broader range of customers.

- We'll now examine how entering the Canadian retail market through Home Depot may shift Ecolab's investment outlook and growth potential.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ecolab Investment Narrative Recap

Owning shares in Ecolab means believing in its ability to grow through expanding market share, pricing power, and innovation in cleaning and life sciences. The Home Depot Canada partnership expands Ecolab's retail presence, but is unlikely to immediately impact the most important short-term catalyst, One Ecolab’s focus on market share and operating margin improvement, or change the core risk of softer demand in heavy industrial markets.

Among recent developments, the expansion into Home Depot Canada stands out, as it increases access to a broader range of customers. This complements the company’s One Ecolab growth initiative, which remains central to its revenue and margin progress. Yet, investors should watch for signs that demand in industrial markets could weigh on results…

Read the full narrative on Ecolab (it's free!)

Ecolab's narrative projects $18.4 billion revenue and $2.8 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $0.7 billion earnings increase from $2.1 billion.

Uncover how Ecolab's forecasts yield a $290.15 fair value, a 13% upside to its current price.

Exploring Other Perspectives

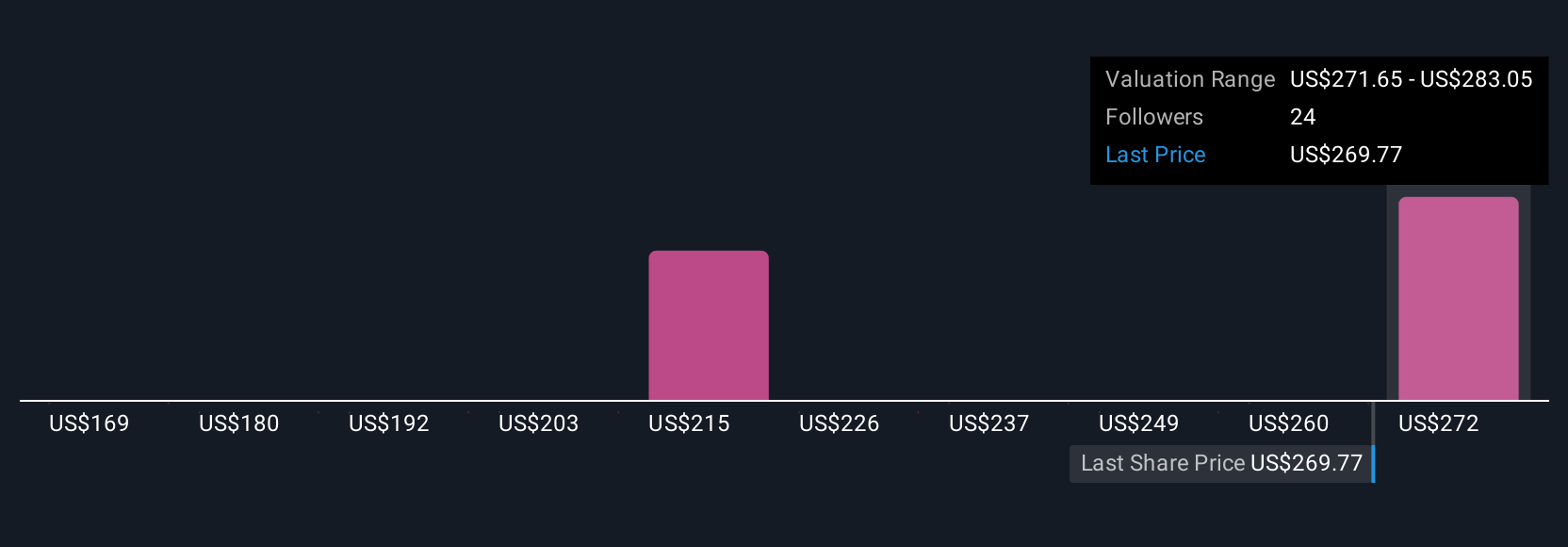

Simply Wall St Community members have set fair values for Ecolab between US$239.48 and US$290.15 across four estimates. While many see positive catalysts like the One Ecolab initiative, you may want to review these varied perspectives before forming your own view on the company’s prospects.

Explore 4 other fair value estimates on Ecolab - why the stock might be worth 6% less than the current price!

Build Your Own Ecolab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ecolab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ecolab's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives