- United States

- /

- Metals and Mining

- /

- NYSE:DRD

DRDGOLD (NYSE:DRD) Valuation Spotlight: Assessing Fair Value as Gold Production Targets and Dividends Drive Interest

Reviewed by Simply Wall St

DRDGOLD (NYSE:DRD) has caught investor attention as it pursues a goal of producing 200,000 ounces of gold annually from tailings by 2029. The company maintains an impressive 18-year dividend streak and follows a debt-free expansion strategy.

See our latest analysis for DRDGOLD.

DRDGOLD’s share price momentum has been remarkable this year, climbing almost 190% year-to-date and surging 71% over the past 90 days. The company’s operational goals and commitment to consistent dividends are taking center stage. Executive changes have made headlines, but most investors seem more focused on the strong performance in retreatment operations and the long-term outlook. A 139% total shareholder return over the last twelve months underscores the optimism.

If this kind of momentum sparks your curiosity, you might want to discover fast growing stocks with high insider ownership.

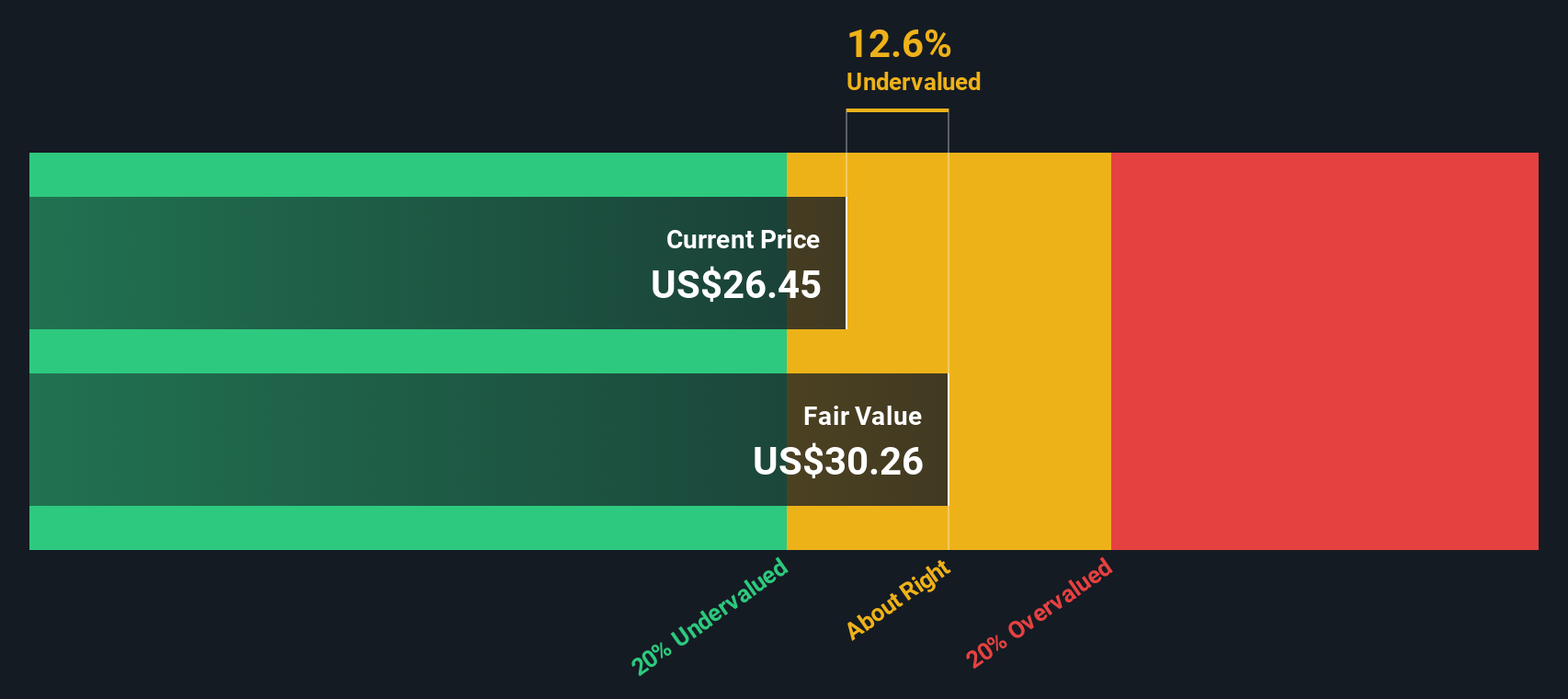

With such rapid gains and ambitious targets, is DRDGOLD truly trading at a discount, or has the recent rally already priced in its future growth story? This leaves investors to wonder if there is still a buying opportunity.

Price-to-Earnings of 17.4x: Is it justified?

DRDGOLD’s latest closing price of $26.14 represents a price-to-earnings ratio of 17.4x, making it look attractively valued relative to both peers and its industry.

The price-to-earnings (P/E) ratio shows how much investors are paying for each dollar of the company’s earnings. For a gold producer like DRDGOLD, this is a common yardstick to compare profitability and growth expectations within the mining sector.

With a P/E ratio of 17.4x, DRDGOLD is trading noticeably below the Metals and Mining industry average of 21.6x and the peer average of 20.3x. This means the market is assigning a lower price tag to DRDGOLD relative to its current profit, possibly underestimating the company’s robust recent earnings growth and strong operational performance. If sentiment shifts, valuations could move closer to the industry norm.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.4x (UNDERVALUED)

However, any slowdown in gold prices or operational setbacks could quickly reverse recent share gains and challenge the undervaluation thesis surrounding DRDGOLD.

Find out about the key risks to this DRDGOLD narrative.

Another View: Discounted Cash Flow Perspective

While DRDGOLD appears undervalued using its current price-to-earnings figure, our DCF model presents an even more optimistic picture. At $26.14, the stock trades around 45.6% below our fair value estimate of $48.06 based on future cash flows. Is this discount a lasting opportunity or a mirage?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DRDGOLD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DRDGOLD Narrative

If you'd rather dig deeper on your own and interpret the numbers independently, you can shape a narrative in just a few minutes. Do it your way.

A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The market is moving fast and the right opportunities won’t wait. Use the Simply Wall Street Screener now to identify outstanding stocks beyond the usual headlines.

- Uncover strong, consistent income potential when you check out these 16 dividend stocks with yields > 3% with yields above 3% and proven fundamentals.

- Position yourself at the forefront of innovation by targeting these 24 AI penny stocks, which are powering advancements in artificial intelligence across industries.

- Capitalize on overlooked value by seeking these 870 undervalued stocks based on cash flows with compelling cash flow profiles before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives