- United States

- /

- Life Sciences

- /

- NYSE:DNA

With Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) It Looks Like You'll Get What You Pay For

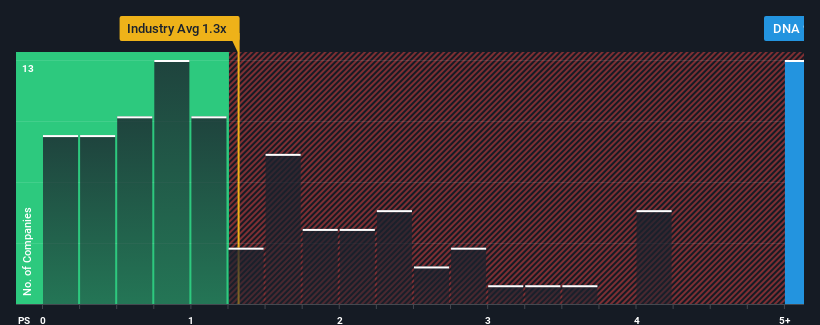

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) looks to be giving off strong sell signals with its 9.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ginkgo Bioworks Holdings

What Does Ginkgo Bioworks Holdings' P/S Mean For Shareholders?

Ginkgo Bioworks Holdings has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ginkgo Bioworks Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ginkgo Bioworks Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Ginkgo Bioworks Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 21% per annum over the next three years. That's shaping up to be materially higher than the 8.4% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Ginkgo Bioworks Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Ginkgo Bioworks Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ginkgo Bioworks Holdings that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNA

Ginkgo Bioworks Holdings

Develops a platform for cell programming in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives