- United States

- /

- Life Sciences

- /

- NYSE:DNA

Revenues Tell The Story For Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) As Its Stock Soars 33%

Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 88% share price drop in the last twelve months.

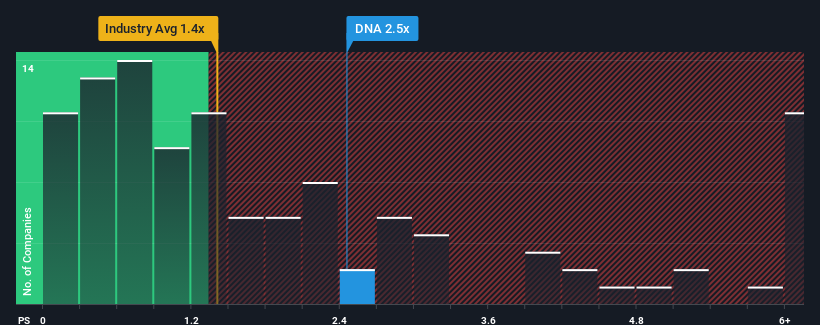

Following the firm bounce in price, given close to half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Ginkgo Bioworks Holdings as a stock to potentially avoid with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Ginkgo Bioworks Holdings

How Has Ginkgo Bioworks Holdings Performed Recently?

Recent times haven't been great for Ginkgo Bioworks Holdings as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ginkgo Bioworks Holdings.How Is Ginkgo Bioworks Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Ginkgo Bioworks Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 7.1% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 3.5% growth forecast for the broader industry.

With this information, we can see why Ginkgo Bioworks Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Ginkgo Bioworks Holdings' P/S

Ginkgo Bioworks Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Ginkgo Bioworks Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Ginkgo Bioworks Holdings (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNA

Ginkgo Bioworks Holdings

Develops a platform for cell programming in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives