- United States

- /

- Life Sciences

- /

- NYSE:DNA

Ginkgo Bioworks Holdings, Inc.'s (NYSE:DNA) Share Price Is Still Matching Investor Opinion Despite 30% Slump

Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

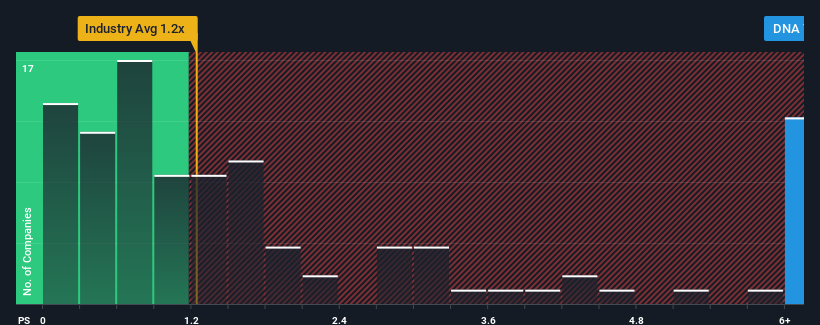

Although its price has dipped substantially, you could still be forgiven for thinking Ginkgo Bioworks Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.9x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Ginkgo Bioworks Holdings

How Has Ginkgo Bioworks Holdings Performed Recently?

Recent times haven't been great for Ginkgo Bioworks Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ginkgo Bioworks Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Ginkgo Bioworks Holdings would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to climb by 25% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this information, we can see why Ginkgo Bioworks Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ginkgo Bioworks Holdings' P/S Mean For Investors?

Even after such a strong price drop, Ginkgo Bioworks Holdings' P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Ginkgo Bioworks Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ginkgo Bioworks Holdings you should know about.

If you're unsure about the strength of Ginkgo Bioworks Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNA

Ginkgo Bioworks Holdings

Develops a platform for cell programming in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives