- United States

- /

- Chemicals

- /

- NYSE:DD

What DuPont de Nemours (DD)'s New China Lubricants Plant Means for Shareholders

Reviewed by Sasha Jovanovic

- DuPont recently held a groundbreaking ceremony for its new MOLYKOTE specialty lubricants manufacturing plant in Zhangjiagang, Jiangsu Province in East China, supporting capacity expansion and regional customer responsiveness, with operations projected to begin by early 2027.

- This investment aims to cement DuPont’s position in the advanced lubricants market, particularly in sectors like transportation and electronics, while enhancing collaboration and innovation within a key growth region.

- We’ll explore how DuPont’s new specialty lubricants plant in China could strengthen its investment case and reshape growth expectations.

Find companies with promising cash flow potential yet trading below their fair value.

DuPont de Nemours Investment Narrative Recap

The core investment story for DuPont centers on its shift toward high-growth specialty areas like electronics, water, and healthcare, balanced by the ongoing challenges of legal liabilities and navigating portfolio changes post-Qnity separation. The recent announcement of a new specialty lubricants plant in China underpins DuPont's efforts to boost local production and innovation but does not materially change the near-term catalysts or the overarching risk, namely, potential volatility from business realignment and unresolved legal issues.

Among recent company actions, DuPont’s tender offer to repurchase nearly US$740 million in senior notes stands out. This move, together with the settlement of future debt obligations, represents a step toward simplifying capital structure after the ElectronicsCo separation, supporting financial flexibility, a factor that could influence how short-term risks and catalysts play out for shareholders.

On the other hand, investors need to closely monitor how ongoing legal liabilities, especially PFAS-related cases, could...

Read the full narrative on DuPont de Nemours (it's free!)

DuPont de Nemours' outlook targets $14.0 billion in revenue and $1.7 billion in earnings by 2028. This is based on analysts forecasting 3.7% annual revenue growth and a significant increase in earnings, up by $1.63 billion from the current $71.0 million.

Uncover how DuPont de Nemours' forecasts yield a $53.25 fair value, a 38% upside to its current price.

Exploring Other Perspectives

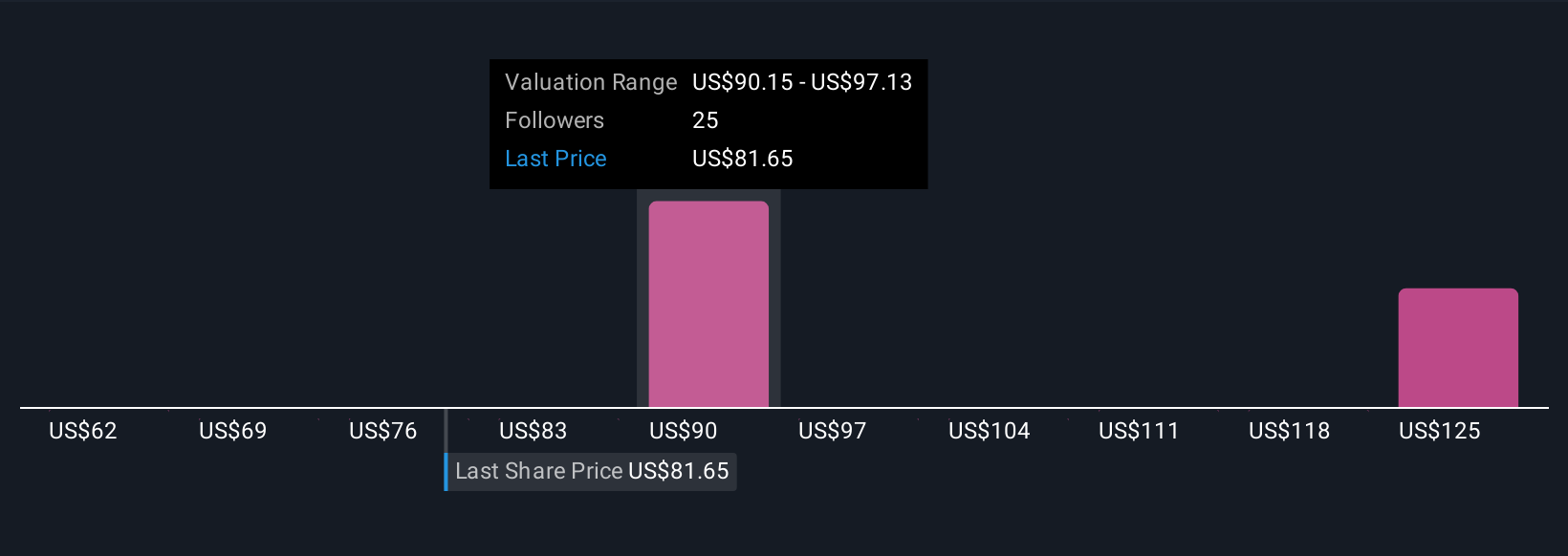

Simply Wall St Community members provided five fair value targets for DuPont shares, spanning US$41.24 up to US$62.26. While opinions are split, the spotlight remains on unresolved legal risks that could impact returns into the future; consider how varying perspectives shape your own conclusions.

Explore 5 other fair value estimates on DuPont de Nemours - why the stock might be worth just $41.24!

Build Your Own DuPont de Nemours Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DuPont de Nemours research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free DuPont de Nemours research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DuPont de Nemours' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives