- United States

- /

- Chemicals

- /

- NYSE:DD

DuPont de Nemours (NYSE:DD) Will Pay A Larger Dividend Than Last Year At $0.38

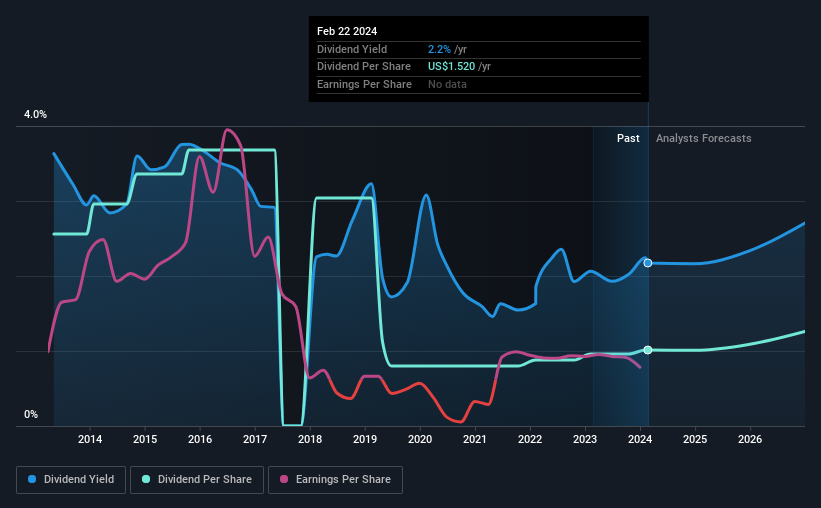

The board of DuPont de Nemours, Inc. (NYSE:DD) has announced that it will be paying its dividend of $0.38 on the 15th of March, an increased payment from last year's comparable dividend. This takes the annual payment to 2.2% of the current stock price, which is about average for the industry.

See our latest analysis for DuPont de Nemours

DuPont de Nemours' Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 28%, which is in a comfortable range for us.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from $3.84 total annually to $1.52. The dividend has shrunk at around 8.9% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Could Be Constrained

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. It's encouraging to see that DuPont de Nemours has been growing its earnings per share at 31% a year over the past five years. Although earnings per share is up nicely DuPont de Nemours is paying out 131% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

DuPont de Nemours' Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for DuPont de Nemours you should be aware of, and 1 of them can't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026