- United States

- /

- Chemicals

- /

- NYSE:DD

Assessing DuPont’s Valuation Amid Leadership Changes and a 51% Share Price Drop

Reviewed by Bailey Pemberton

- Curious about whether DuPont de Nemours offers fair value in today’s ever-changing market? You’re in the right place to dig deeper into what the numbers say about this well-known materials giant.

- The stock has seen some dramatic movement lately, with a sharp drop of over 51% in the last month but a solid gain of nearly 15% over the past year. This highlights both risks and longer-term gains for investors.

- Recent news stories have centered around leadership changes and ongoing portfolio shifts, sparking both optimism and fresh questions about DuPont’s future strategy. This context is important for making sense of the recent share price swings and what might come next.

- Right now, DuPont de Nemours scores just 1 out of 6 on our key valuation checks, which suggests there is more to explore if you want the full picture. We will break down these valuation methods, and provide a closer look at a smarter way to gauge value near the end of this article.

DuPont de Nemours scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: DuPont de Nemours Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a foundational tool for investors. It aims to estimate a company's value by forecasting its future cash flows and then discounting those projections back to present-day dollars. This approach helps provide a sense of what a business is truly worth if you owned every dollar it generates in the future, today.

For DuPont de Nemours, the latest reported Free Cash Flow (FCF) stands at $1.31 Billion. Analysts provide FCF forecasts for the next several years, which are then extended out over a 10-year period by Simply Wall St to estimate longer-term trends. According to these projections, DuPont’s FCF is expected to be $1.03 Billion by 2028. Subsequent years are extrapolated using decreasing growth assumptions based on recent performance and industry trends.

After discounting these future cash flows to their present value, the DCF approach calculates an intrinsic fair value for DuPont de Nemours stock of $33.15 per share. This is approximately 19.5% below the company’s current share price. The DCF valuation method currently sees the stock as overvalued under the present cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DuPont de Nemours may be overvalued by 19.5%. Discover 849 undervalued stocks or create your own screener to find better value opportunities.

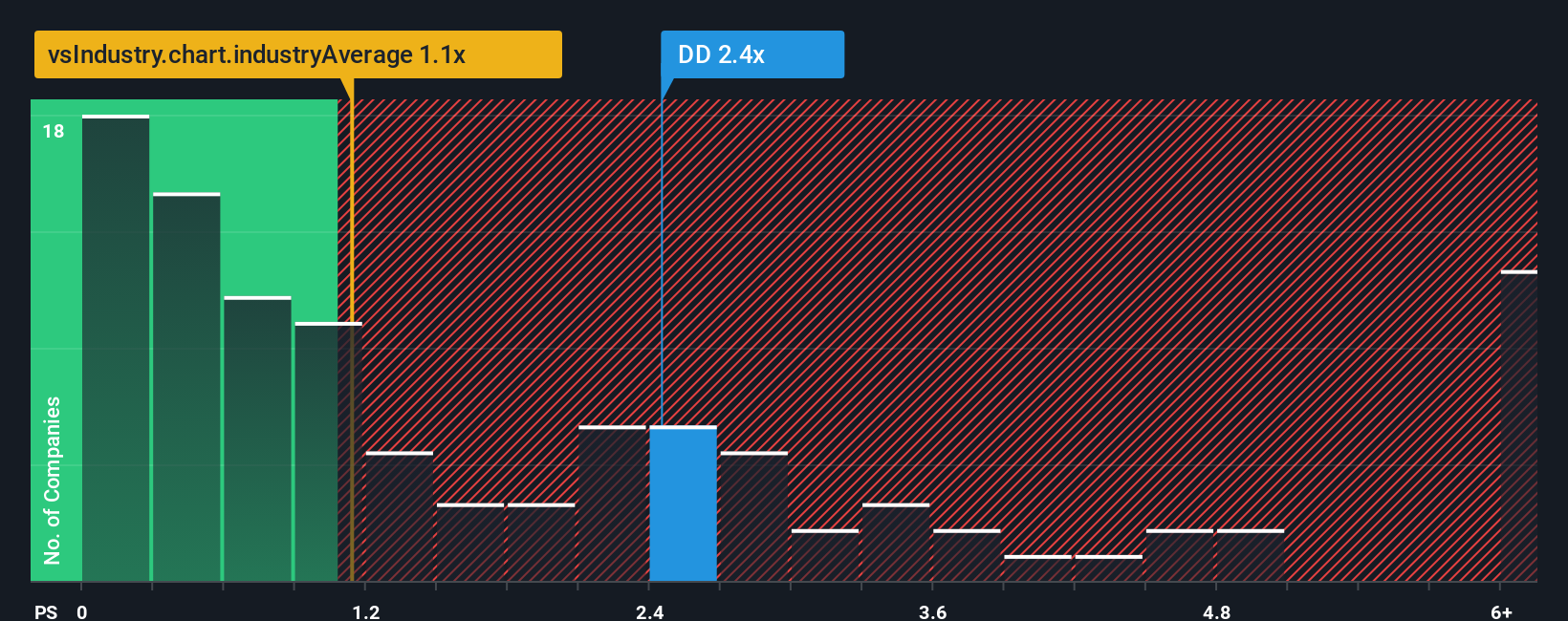

Approach 2: DuPont de Nemours Price vs Sales

For profitable companies, the Price-to-Sales (P/S) ratio is a widely used valuation tool. It offers a clear sense of how much investors are willing to pay for each dollar of a company's sales, which is especially useful in industries where earnings may be more volatile or affected by recent events. The P/S ratio can be influenced by expectations for future growth as well as perceived risks; generally, higher future growth or lower risk justifies a higher "normal" multiple.

Currently, DuPont de Nemours trades at a P/S ratio of 1.32x. For context, this is just above the Chemicals industry average of 1.23x but well below the average of its closest peers at 2.32x. These benchmarks provide rough guidance on how the market typically values similar companies, but they do not tell the full story.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for DuPont is 1.11x, calculated using a range of factors including the company’s future growth outlook, profit margins, specific risks, its market cap, and its place within the industry. Unlike basic peer or industry comparisons, the Fair Ratio aims to offer a more nuanced and relevant benchmark for valuation.

Comparing the Fair Ratio (1.11x) to DuPont’s actual P/S (1.32x), the difference is about 0.21. This suggests the shares are trading modestly above the tailored fair value level implied by the company's own fundamentals and risks.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DuPont de Nemours Narrative

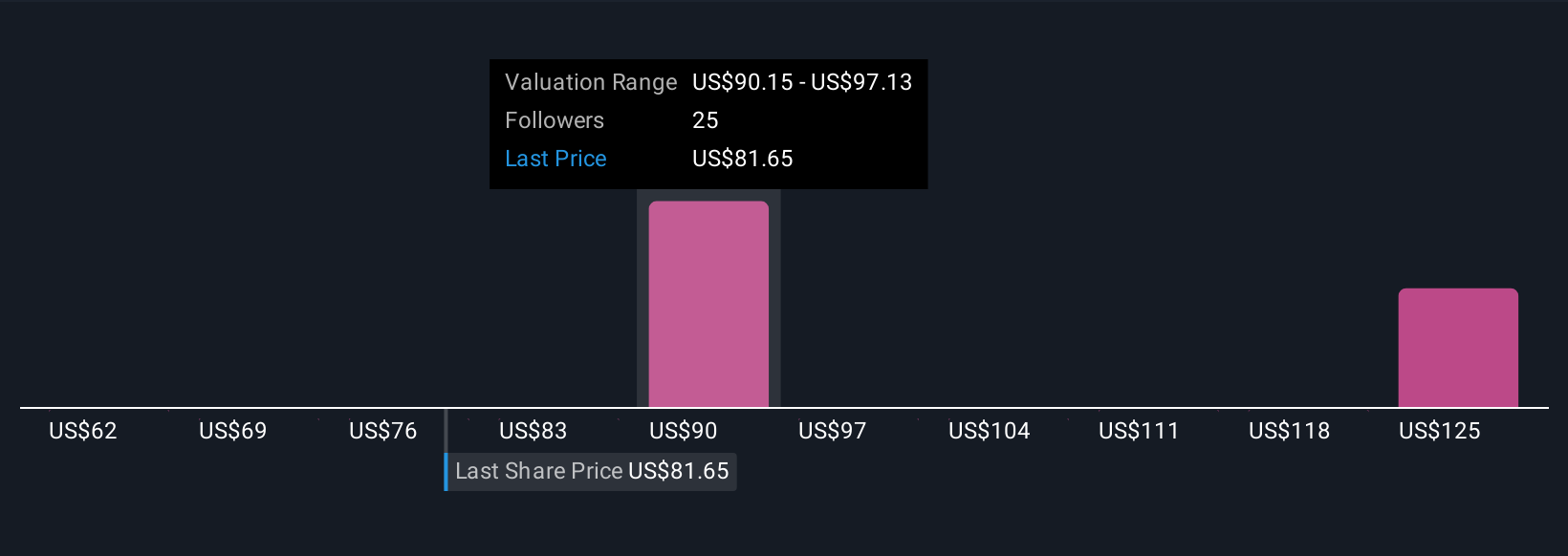

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your view of a company, including its story, prospects, and risks, to a tangible financial forecast and fair value calculation. Instead of relying solely on standard metrics, Narratives let you build your own perspective around DuPont de Nemours’ future, such as what you expect for revenue, earnings, and profit margins.

On Simply Wall St’s Community page (where millions of investors share their insights), Narratives are an accessible tool that help you bring numbers and stories together, making it simpler to decide whether today’s price is attractive or not. Narratives dynamically update as new information comes in, keeping your viewpoint relevant when news or results change. Importantly, they provide a clear link between your estimate of fair value and the current market price, letting you see at a glance if DuPont is worth buying, holding, or selling.

For example, some investors are optimistic, using the most bullish analyst targets and believing DuPont could be worth $113 per share if electronics and water solutions outperform. Others are more cautious and set their fair value closer to $47 per share due to persistent legal and operational risks. With Narratives, you can quickly see how your viewpoint compares and adjust your decisions with confidence.

Do you think there's more to the story for DuPont de Nemours? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives