- United States

- /

- Chemicals

- /

- NYSE:CTVA

Corteva (CTVA): Assessing Valuation Following Strong Q3 Sales Growth and Raised 2025 Guidance

Reviewed by Simply Wall St

Corteva (CTVA) drew investor attention this week after announcing third-quarter 2025 results showing higher net sales. Continued momentum in both Seed and Crop Protection segments led management to raise guidance for the year. This added to market optimism.

See our latest analysis for Corteva.

Corteva’s string of upbeat earnings, dividend affirmations, and new product launches has kept the company in the spotlight and fueled a 12.1% year-to-date share price return. While the 1-year total shareholder return stands at 8.8%, longer-term investors have seen outstanding gains of nearly 90% over five years. This underscores solid performance as momentum builds on strong fundamentals.

If Corteva’s recent momentum caught your attention, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With strong momentum and a raised outlook, could Corteva’s stock still hold untapped value for investors, or has the future growth story already been factored into the current price?

Most Popular Narrative: 18.9% Undervalued

When comparing the narrative's fair value estimate to the most recent closing price, Corteva looks attractively priced. The fair value is set well above current market levels, offering a potential upside according to this widely followed viewpoint.

Robust ongoing demand for high-yield and resilient seeds, driven by increasing global food consumption and the need for productivity under variable climate conditions, is supporting volume and pricing gains in both developed and emerging markets. This underpins sustained revenue growth. Advancements in Corteva's innovation pipeline, including premium trait launches (Vorceed, PowerCore), expansion of biological products, and gene editing, enable premium pricing, secure market share, and improve product mix, translating into higher gross margins and earnings growth.

Curious how such an ambitious fair value comes together? The driving force is a future outlook marked by bold growth assumptions, margin expansion goals, and a premium profit multiple that is typically reserved for industry giants. Want to see the main lever that analysts think will push shares even higher? Dive into the full narrative for all the numbers that could shape the next major move.

Result: Fair Value of $77.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price declines in crop protection and currency volatility, particularly in key emerging markets, could challenge the growth projected in this outlook.

Find out about the key risks to this Corteva narrative.

Another View: What Do the Earnings Ratios Say?

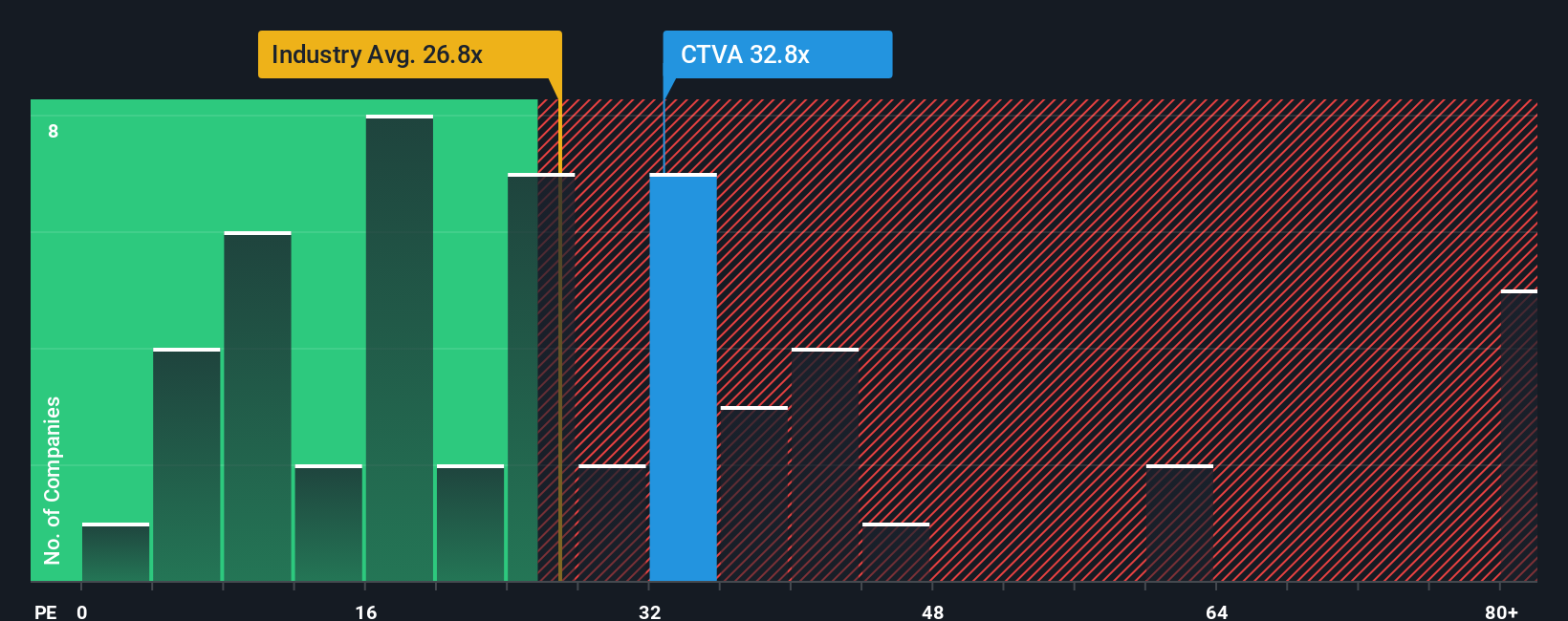

Taking a look through the lens of price-to-earnings, Corteva’s current ratio stands at 25.5, closely in line with the US Chemicals industry average of 26. This suggests the market values Corteva on par with its sector. However, compared to its peer group average of 14.5 and a fair ratio of 24.5, Corteva appears a bit pricier, indicating a possible valuation risk if expectations are not fully met. Does this mean the market is too optimistic, or is there still hidden value here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If you see things differently or want to dig deeper into Corteva’s story yourself, you can build your own perspective in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Corteva.

Looking for More Investment Ideas?

Take the lead in your investment journey by using the Simply Wall Street Screener to uncover unique opportunities before others do. These strategies could be the edge your portfolio needs.

- Uncover explosive growth prospects by checking out these 25 AI penny stocks which are set to shape tomorrow’s industries with artificial intelligence at their core.

- Target reliable income streams and boost your returns with these 17 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Ride the momentum in digital finance and tap into fresh potential by exploring these 82 cryptocurrency and blockchain stocks making waves in blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives