Stock Analysis

- United States

- /

- Metals and Mining

- /

- NYSE:AU

Risks To Shareholder Returns Are Elevated At These Prices For AngloGold Ashanti plc (NYSE:AU)

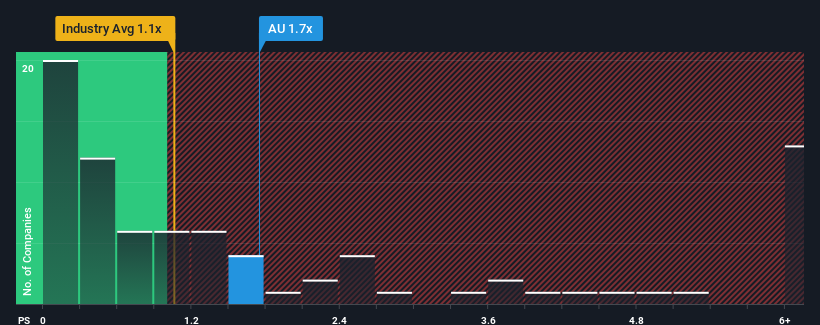

When you see that almost half of the companies in the Metals and Mining industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, AngloGold Ashanti plc (NYSE:AU) looks to be giving off some sell signals with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for AngloGold Ashanti

What Does AngloGold Ashanti's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, AngloGold Ashanti has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AngloGold Ashanti will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like AngloGold Ashanti's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.4% gain to the company's revenues. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 5.6% as estimated by the seven analysts watching the company. With the industry predicted to deliver 6.9% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AngloGold Ashanti's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From AngloGold Ashanti's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting AngloGold Ashanti's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AngloGold Ashanti that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether AngloGold Ashanti is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AU

AngloGold Ashanti

AngloGold Ashanti plc operates as a gold mining company in Africa, Australia, and the Americas.

Fair value with moderate growth potential.