- United States

- /

- Metals and Mining

- /

- NYSE:AU

AngloGold Ashanti (NYSE:AU): Analyst Upgrades and Surging Sentiment Spark Fresh Look at Valuation

Reviewed by Simply Wall St

Recent attention has centered on AngloGold Ashanti (NYSE:AU) following a wave of analyst upgrades and earnings estimate revisions. This renewed optimism among brokers is sparking fresh conversations about the stock's momentum and outlook.

See our latest analysis for AngloGold Ashanti.

AngloGold Ashanti’s share price has surged, closing at $74.1 after a 6.8% jump in just one day and a notable 10.5% gain over the past week. The company’s total shareholder return over the past year is an eye-catching 206.9%, reflecting momentum that has increased amid fresh optimism and strong earnings growth signals. Both short-term buyers and long-term holders are seeing renewed confidence in the gold miner’s outlook, with recent events supporting one of the sector’s standout rallies.

If AngloGold Ashanti’s remarkable run sparked your curiosity, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analysts raising estimates and the stock near recent highs, the question becomes whether AngloGold Ashanti is still undervalued or if investors have already priced in all the expected growth. Is there real upside left?

Most Popular Narrative: 16.1% Undervalued

AngloGold Ashanti's most widely followed valuation narrative puts fair value at $88.29, compared to the last close price of $74.10. This positions the stock below the latest consensus and creates the foundation for a valuation argument based on improved profitability and accelerating revenue in the years ahead.

Portfolio optimization, disciplined cost control, and efficiency initiatives are supporting higher margins and production stability, positioning the company for sustained growth.

What is driving that premium valuation? The answer centers on strong margin gains and a major efficiency turnaround forecast for the next few years. Want to know the forecasted leap in profit that has analysts optimistic? Unlock the full narrative to see what is behind this outlook.

Result: Fair Value of $88.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation driving higher costs or unexpected production setbacks could quickly erode profitability and challenge AngloGold Ashanti’s promising outlook.

Find out about the key risks to this AngloGold Ashanti narrative.

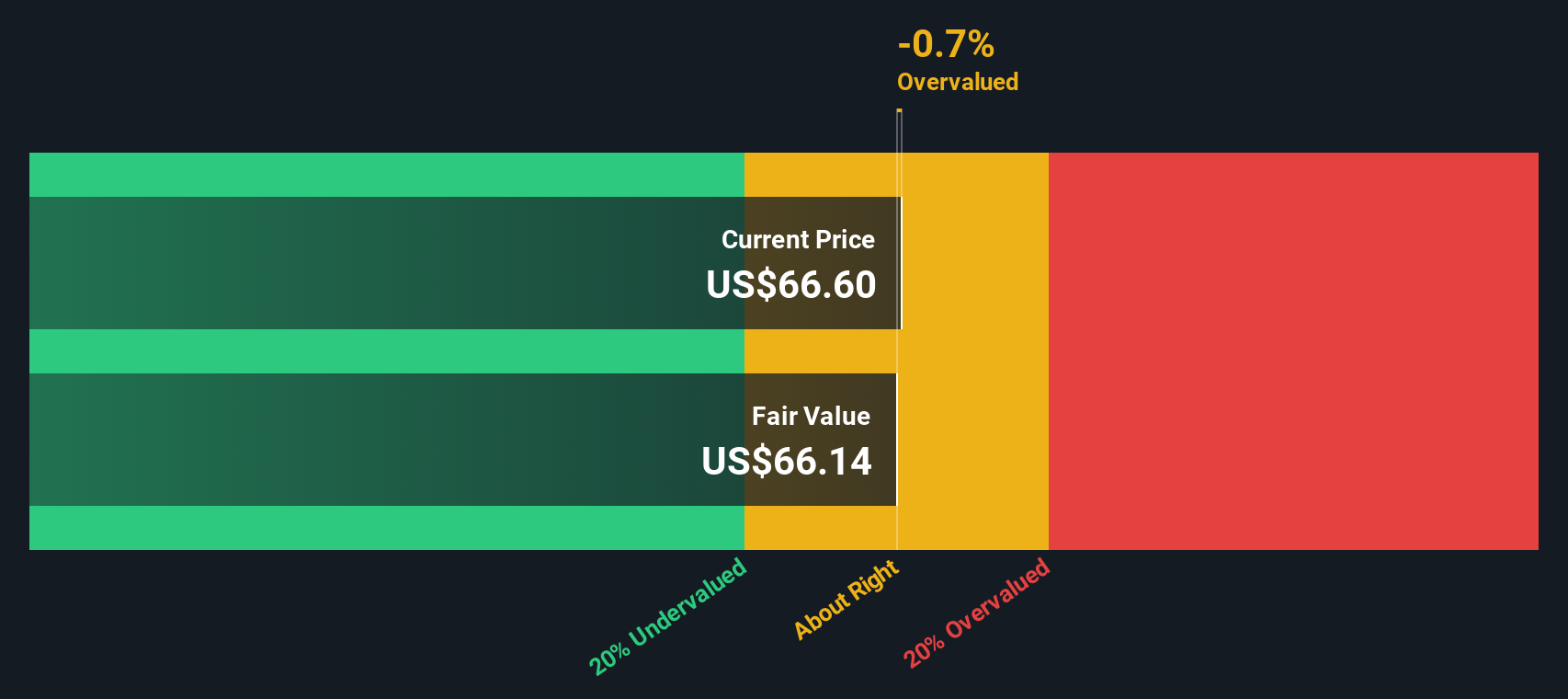

Another View: SWS DCF Model Challenges the Narrative

Taking a different approach, our DCF model puts AngloGold Ashanti's fair value at $69.10. This is slightly below the current share price of $74.10, which suggests that, based purely on future cash flows, the stock may be trading a bit above its underlying value. Could this be a warning sign for momentum investors, or does the market see opportunity missed by models?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AngloGold Ashanti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AngloGold Ashanti Narrative

If you have a different take on AngloGold Ashanti or want to dive into the numbers yourself, it’s easy to build your own story in just a few minutes. Do it your way

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond just one stock. Don't let the next big opportunity pass you by. Expand your watchlist and discover what else is shaking up the markets right now.

- Spot opportunities for growth by evaluating these 865 undervalued stocks based on cash flows that could be trading below their intrinsic value and primed for a rally.

- Boost your income potential with these 16 dividend stocks with yields > 3% offering attractive yields above 3% and solid fundamentals.

- Capitalize on innovation by targeting these 25 AI penny stocks at the forefront of artificial intelligence advancements disrupting entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives