- United States

- /

- Packaging

- /

- NYSE:ATR

What AptarGroup (ATR)'s $599.5 Million Debt Offering Means for Shareholders

Reviewed by Sasha Jovanovic

- On November 17, 2025, AptarGroup completed a major US$599.5 million fixed-income offering of 4.750% senior unsubordinated unsecured notes maturing in 2031, priced just below par and featuring callability provisions.

- This sizable debt issuance highlights AptarGroup's efforts to bolster its capital base, providing increased financial flexibility for potential investments or operational initiatives.

- We'll explore how this major capital raise may influence AptarGroup's investment narrative, particularly considering its effect on financial leverage and future growth capacity.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AptarGroup Investment Narrative Recap

For shareholders in AptarGroup, belief in the value of its advanced drug delivery and sustainable packaging platforms remains key, especially as global healthcare and eco-friendly packaging trends continue to shape long-term opportunity. The recent US$599.5 million unsecured notes offering enhances financial flexibility, but in the near term, it does not substantially alter the main catalyst, the growth of proprietary drug delivery systems, or the top risk, namely ongoing litigation costs and pressure on margins from both legal and operational challenges.

Of recent announcements, AptarGroup’s extended collaboration with Nasus Pharma on intranasal epinephrine development aligns closely with the company’s core growth catalysts in pharmaceutical and drug delivery innovation. However, while the company is investing in technology partnerships and pursuing bolt-on acquisitions, investors will still be weighing the impact of uncertain demand in segments like naloxone/Narcan and consumer healthcare, as well as the effect of elevated ongoing legal costs.

In contrast, investors should be aware of how rising litigation expenses might impact AptarGroup’s earnings trajectory...

Read the full narrative on AptarGroup (it's free!)

AptarGroup's narrative projects $4.3 billion revenue and $450.9 million earnings by 2028. This requires 6.1% yearly revenue growth and a $59.4 million earnings increase from $391.5 million today.

Uncover how AptarGroup's forecasts yield a $161.43 fair value, a 31% upside to its current price.

Exploring Other Perspectives

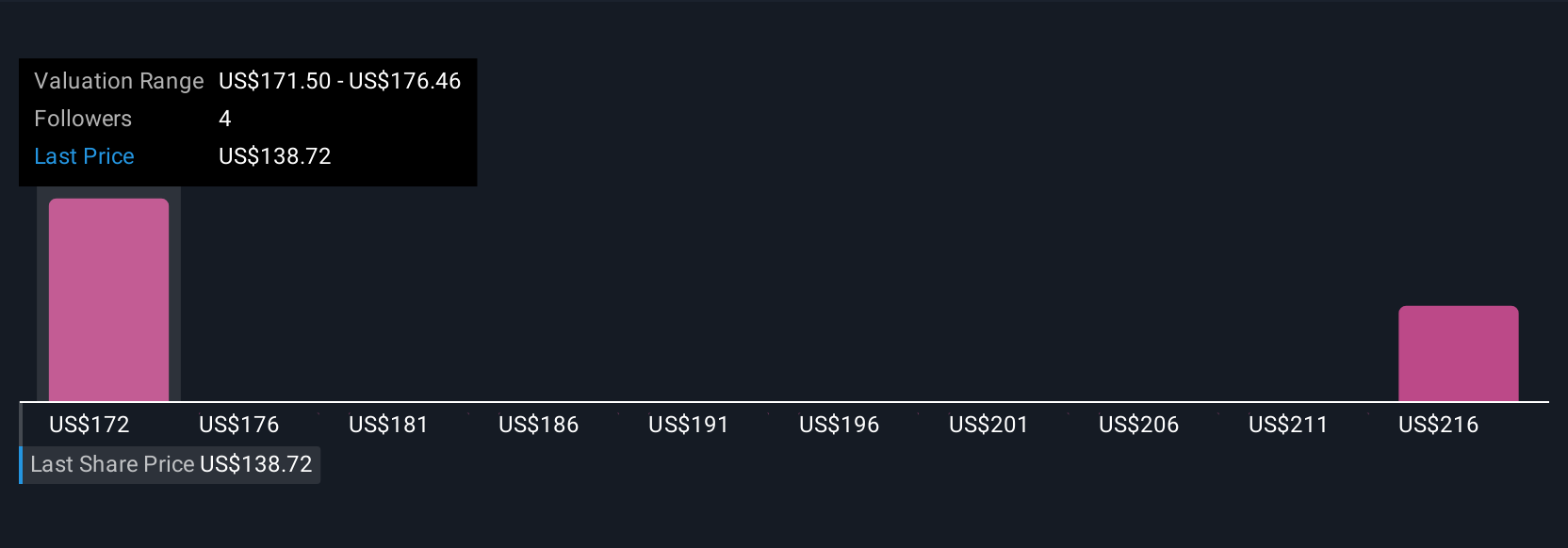

Four individual fair value estimates from the Simply Wall St Community sit between US$153.00 and US$164.55 per share. While community opinions vary, ongoing legal expenses remain an important factor for anyone weighing how AptarGroup’s margin profile could change in the coming quarters, consider multiple viewpoints before forming your own outlook.

Explore 4 other fair value estimates on AptarGroup - why the stock might be worth as much as 33% more than the current price!

Build Your Own AptarGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AptarGroup research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AptarGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AptarGroup's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success