- United States

- /

- Packaging

- /

- NYSE:ATR

Should AptarGroup’s (ATR) Expanded Nasus Collaboration Reshape Expectations for Its Pharma Solutions Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Nasus Pharma Ltd. announced an expanded collaboration with AptarGroup and Aptar France, executing multiple agreements to advance the development and commercialization of an intranasal epinephrine product, with Aptar providing specialized drug delivery support and exclusive device supply upon regulatory approval.

- This collaboration highlights AptarGroup's growing role as a key partner for innovative pharmaceutical delivery solutions, leveraging its manufacturing and digital health expertise to enable new therapeutic offerings.

- We'll explore how AptarGroup's enhanced pharmaceutical partnerships may influence its investment narrative and long-term healthcare market positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

AptarGroup Investment Narrative Recap

For shareholders in AptarGroup, the big picture centers on continued growth in proprietary drug delivery systems and sustainable packaging, both supporting revenue expansion and pricing power. The recent Nasus Pharma collaboration underlines AptarGroup’s leadership in pharmaceutical delivery, yet does not materially shift the most important short-term catalyst, momentum in core injectables and device sales, nor does it directly mitigate the largest risk, which remains unpredictable pharma segment demand from regulatory and funding uncertainty impacting products like naloxone. One recent announcement especially relevant to this news event is Aptar’s new exclusive supply agreement for its Unit Dose Powder nasal delivery device with Nasus Pharma, tied to future sales of intranasal epinephrine pending regulatory approval. This aligns with ongoing client partnerships that reinforce AptarGroup’s position in innovative healthcare solutions and could support future milestones if broader demand for emergency medicine products remains stable. However, despite these positive signals for growth, investors should keep in mind...

Read the full narrative on AptarGroup (it's free!)

AptarGroup's narrative projects $4.3 billion in revenue and $450.9 million in earnings by 2028. This requires 6.1% yearly revenue growth and a $59.4 million earnings increase from current earnings of $391.5 million.

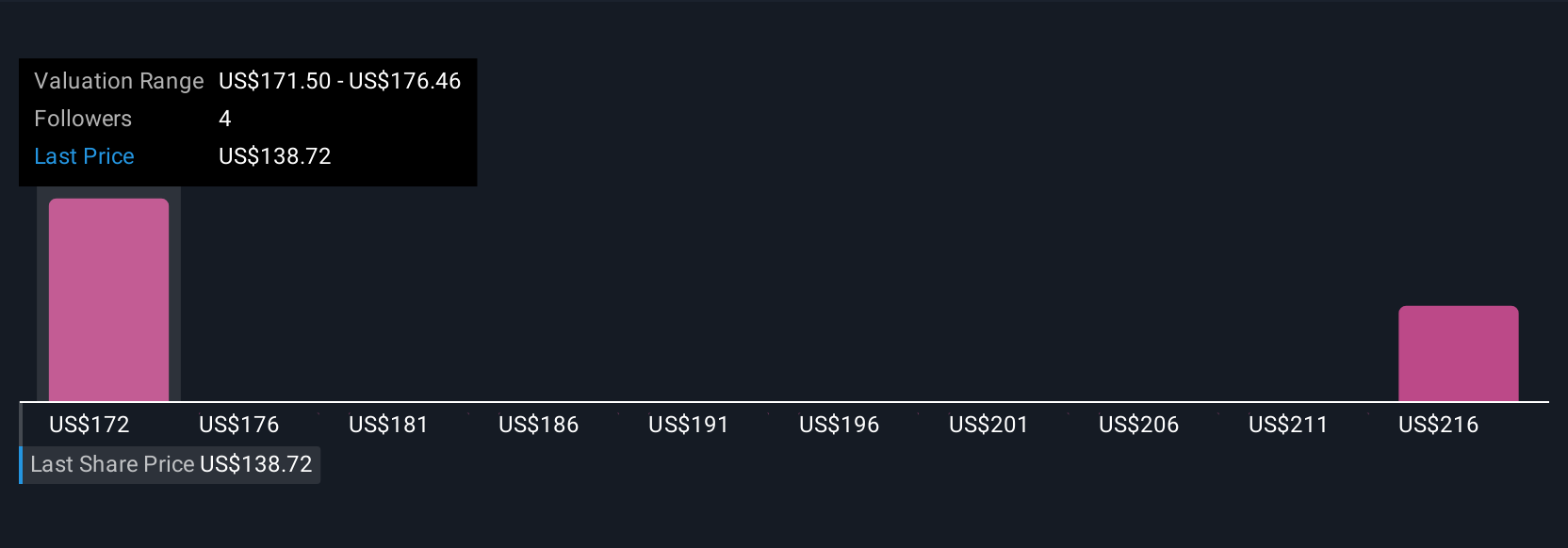

Uncover how AptarGroup's forecasts yield a $177.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

A pair of Simply Wall St Community members estimated AptarGroup's fair value between US$153 and US$177 per share. While opinions vary, uncertainty around demand for emergency medicine delivery systems could weigh on future profitability, making it crucial to consider a range of viewpoints before making decisions.

Explore 2 other fair value estimates on AptarGroup - why the stock might be worth as much as 37% more than the current price!

Build Your Own AptarGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AptarGroup research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AptarGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AptarGroup's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives