- United States

- /

- Packaging

- /

- NYSE:ATR

AptarGroup (ATR): Is the Recent Share Price Drop Creating a Valuation Opportunity?

Reviewed by Simply Wall St

See our latest analysis for AptarGroup.

After this sharp drop, AptarGroup’s share price is now down nearly 25% year-to-date and has lost over 30% in total shareholder return over the last twelve months. Recent price momentum is clearly fading. At the same time, underlying business fundamentals remain in focus for long-term investors.

If you’re wondering what else might offer strong growth potential, this could be a great time to widen your search and discover fast growing stocks with high insider ownership

With shares trading sharply lower, the real question now is whether AptarGroup is trading below its true value or if the market has already factored in its growth outlook. This could mean there is little room for upside.

Most Popular Narrative: 34.5% Undervalued

With AptarGroup closing at $116.01, the latest widely followed narrative suggests a fair value potentially much higher than today’s price. That creates a noticeable valuation gap and raises fresh questions about what could close it.

Proprietary drug delivery innovations and sustainable packaging recognition are driving revenue growth, margin expansion, and strengthening competitive positioning. Strategic expansion in Asia-Pacific and operational efficiency improvements are diversifying revenues, optimizing costs, and supporting long-term market leadership.

Want to know the secret behind this price target? Strong growth in cutting-edge healthcare segments, bold margin bets, and a higher future earnings multiple usually reserved for market leaders are at play. Curious which specific forecasts justify such a premium? Dive deeper to unveil what’s fueling this bullish fair value.

Result: Fair Value of $177 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal costs and unpredictable demand for certain emergency medicine delivery systems remain notable risks that could challenge this positive outlook.

Find out about the key risks to this AptarGroup narrative.

Another View: What Do the Multiples Say?

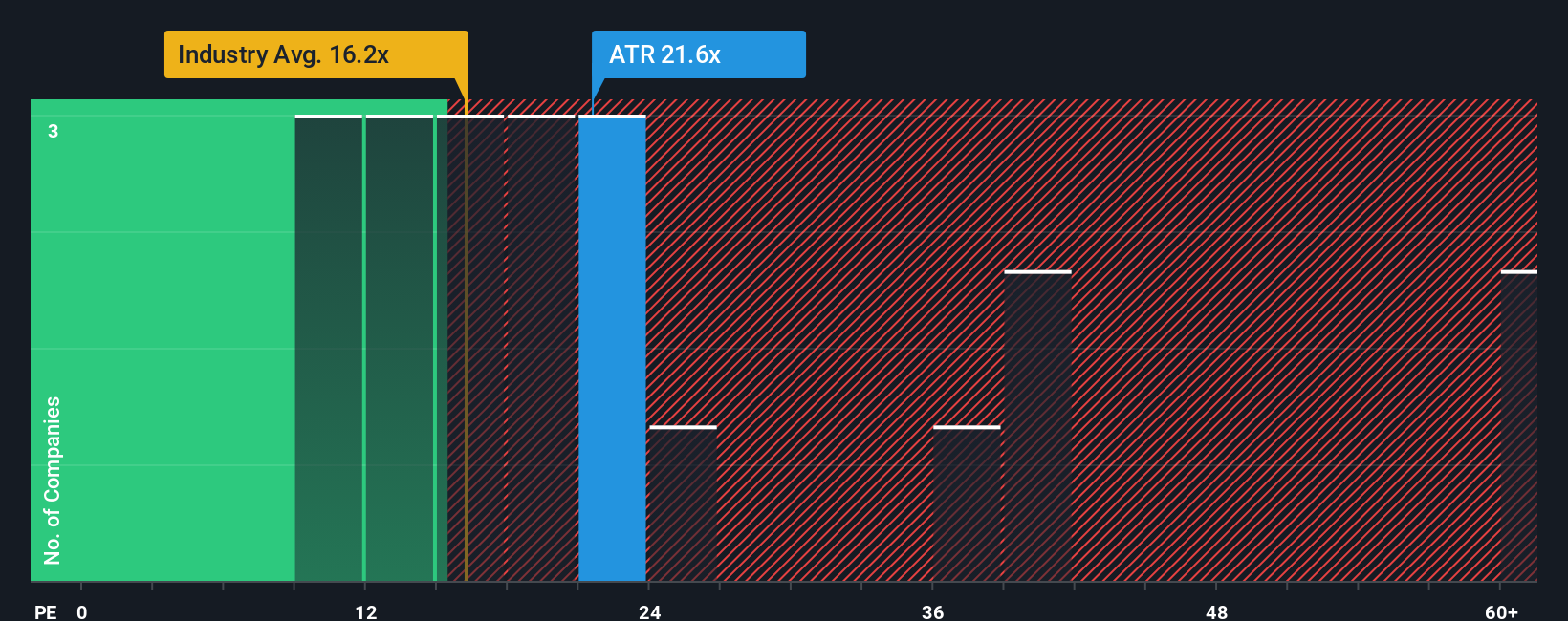

Looking from a different angle, AptarGroup is trading at a price-to-earnings ratio of 18.2x, which is notably higher than both its peer group (16.5x) and the global packaging industry average (15.7x). The fair ratio for this stock is estimated to be about 16.7x, suggesting the stock may be priced at a premium. This may raise some valuation risk for investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AptarGroup Narrative

If you see the numbers differently or want to dig into your own analysis, it’s quick and easy to craft your own perspective in under three minutes with Do it your way.

A great starting point for your AptarGroup research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock your investing edge by tackling fresh opportunities across the market. Don’t miss out on strategies others are using to get ahead today.

- Target high yields and steady payouts by exploring these 22 dividend stocks with yields > 3% offering robust dividend income above 3%.

- Capture the momentum in artificial intelligence by reviewing these 26 AI penny stocks revolutionizing industries with breakthrough AI power.

- Tap into undervalued potential by focusing on these 834 undervalued stocks based on cash flows where strong cash flows may be signaling tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives