- United States

- /

- Chemicals

- /

- NYSE:ASH

Ashland (ASH): Dividend Risk Takes Center Stage as Value Case Draws Investor Focus

Reviewed by Simply Wall St

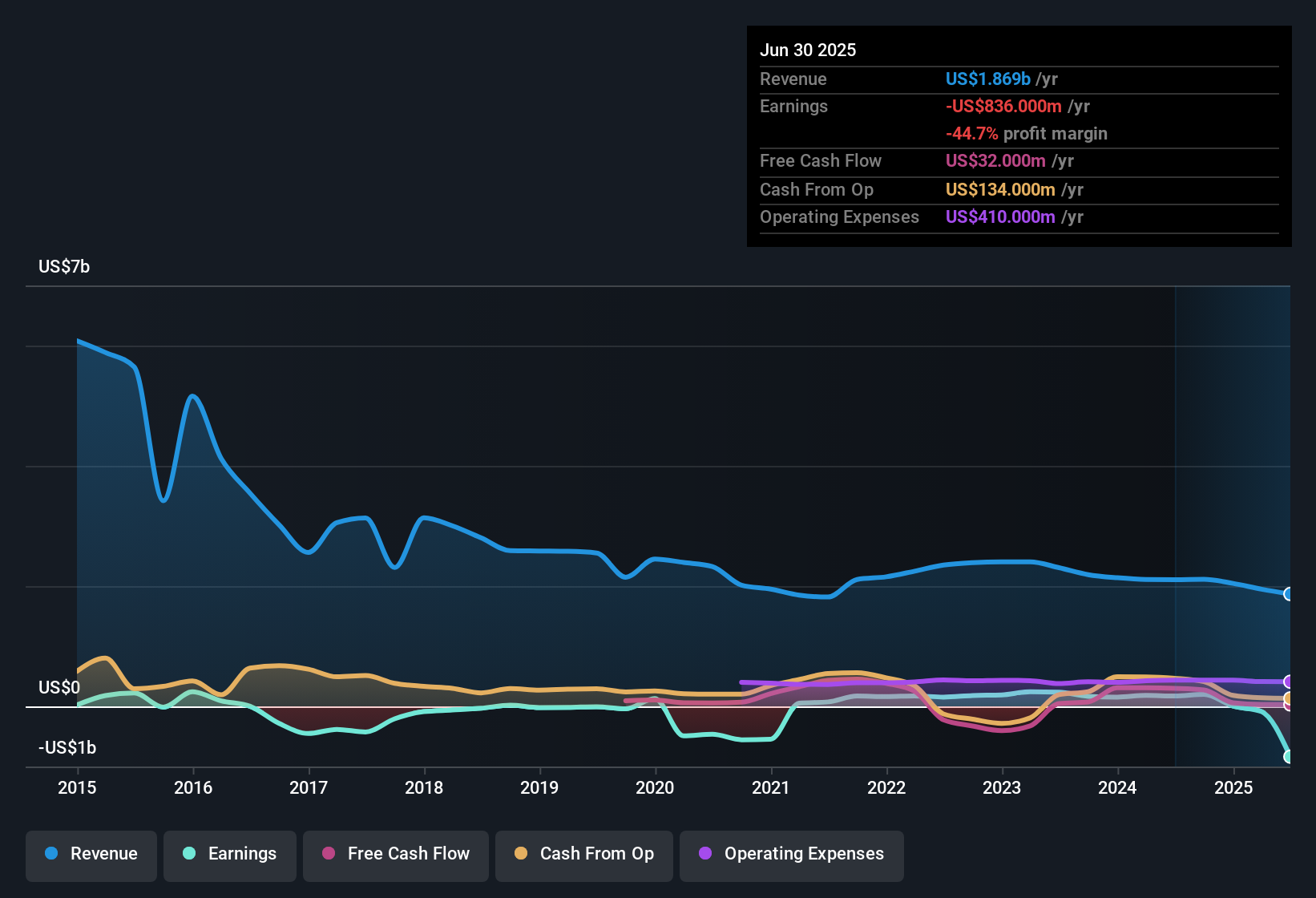

Ashland (ASH) remains unprofitable, but over the last five years it has managed to cut its losses at an annual rate of 4.8%. Revenue is forecast to grow at 3.3% per year, trailing the broader US market’s estimated 10.5% growth. With the stock trading at $50.74, below at least one fair value estimate of $93.63, investors are focusing on valuation and the company’s efforts to narrow losses amid a slower top-line outlook and potential risks to its dividend profile.

See our full analysis for Ashland.Next, we’ll see how these results compare to the narratives most widely followed by the market and within the Simply Wall St community, highlighting where expectations and reality align or diverge.

See what the community is saying about Ashland

Margins Projected to Swing From Deep Losses to Profit

- Profit margins are expected to increase dramatically, moving from a negative -44.7% today to a positive 17.5% within three years, based on analyst forecasts.

- Analysts' consensus view argues this margin turnaround heavily supports the thesis that Ashland’s shift toward high-value, specialty chemicals and ongoing cost optimization will underpin resilient earnings growth, even though

- earnings are currently at a significant loss of $-836.0 million, yet are projected to reach $347.1 million by September 2028

- ongoing network and manufacturing optimization is already delivering incremental savings ($55 to $60 million year over year expected in FY26) and is set to drive structurally higher EBITDA margins

Dividend Sustainability Emerges as a Core Risk

- The key risk identified is the sustainability of Ashland’s dividend, which stands out in the current risk-reward landscape and could impact the stock’s appeal to income-focused investors.

- Consensus narrative highlights how the company's cash flow strength is critical to maintaining its dividend, yet

- prolonged demand softness and customer concentration risk in core segments like Personal Care and Life Sciences could exacerbate revenue volatility and challenge earnings stability

- further cost-cutting measures may be harder to find once the current round of optimizations is complete, suggesting future free cash flow improvements will depend more on top-line growth rather than internal levers

Valuation Gap: Discount to Targets, but a Premium to Peers

- The current share price of $50.74 is below both the analyst consensus price target of $62.40 and the DCF fair value of $93.63, even though Ashland’s price-to-sales ratio (1.2x) is somewhat higher than the US Chemicals industry average (1.1x).

- Analysts’ consensus view underscores that despite trading at a premium to the industry on a sales basis, the market is still skeptical about Ashland’s sustainable growth trajectory, as reflected in the valuation gap and a significant $706 million goodwill impairment resulting from sector valuation compression.

- the most bullish analysts see a potential upside to $79.00, while the most bearish target just $53.00, showing wide disagreement about future value

- with earnings projected to rebound and the company expected to reduce share count by nearly 3% per year, the case for a valuation rerating relies on Ashland turning forecasts into actual profit growth

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ashland on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want a fresh angle on the data? If your view stands out, shape it into your narrative in just a few minutes. Do it your way

A great starting point for your Ashland research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ashland’s uncertain dividend outlook and reliance on improved cash flows raise concerns about consistent income for investors seeking reliable payouts.

If dependable yield matters most to you, check out these 1969 dividend stocks with yields > 3% to pinpoint companies delivering higher dividends with more secure profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASH

Ashland

Provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives