- United States

- /

- Packaging

- /

- NYSE:AMBP

Is There an Opportunity in Ardagh Metal Packaging After 14.5% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if Ardagh Metal Packaging’s stock is a hidden gem or just another name in the packaging space? Let’s dive into the numbers behind the share price to help you work out if it’s a smart buy today.

- Even though the shares are up 14.5% so far this year, they have lost 4.8% in the last week and over 6% in the past month. This suggests a mix of strong longer-term momentum and some recent investor caution.

- A recent uptick in industry demand and Ardagh Metal Packaging’s strategic push into sustainable materials have grabbed the attention of analysts and investors. Headlines highlighting new contracts and a focus on eco-friendly cans have fueled optimism for future growth.

- The company currently stands out by landing a perfect 6 out of 6 on our valuation checks. As we walk through the different ways to measure value, keep in mind that there is an approach that can reveal even deeper insights. More on that at the end of the article.

Approach 1: Ardagh Metal Packaging Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting them back to their value today. This approach is often used to capture the long-term earnings power of a business, looking beyond short-term market movements.

For Ardagh Metal Packaging, the current Free Cash Flow stands at $151.26 million. Analysts forecast that Free Cash Flow will steadily rise in the years ahead, reaching $265.4 million by 2027. Beyond this, projections are extrapolated based on historical trends and industry estimates, suggesting Free Cash Flow could climb as high as $491.8 million by 2035.

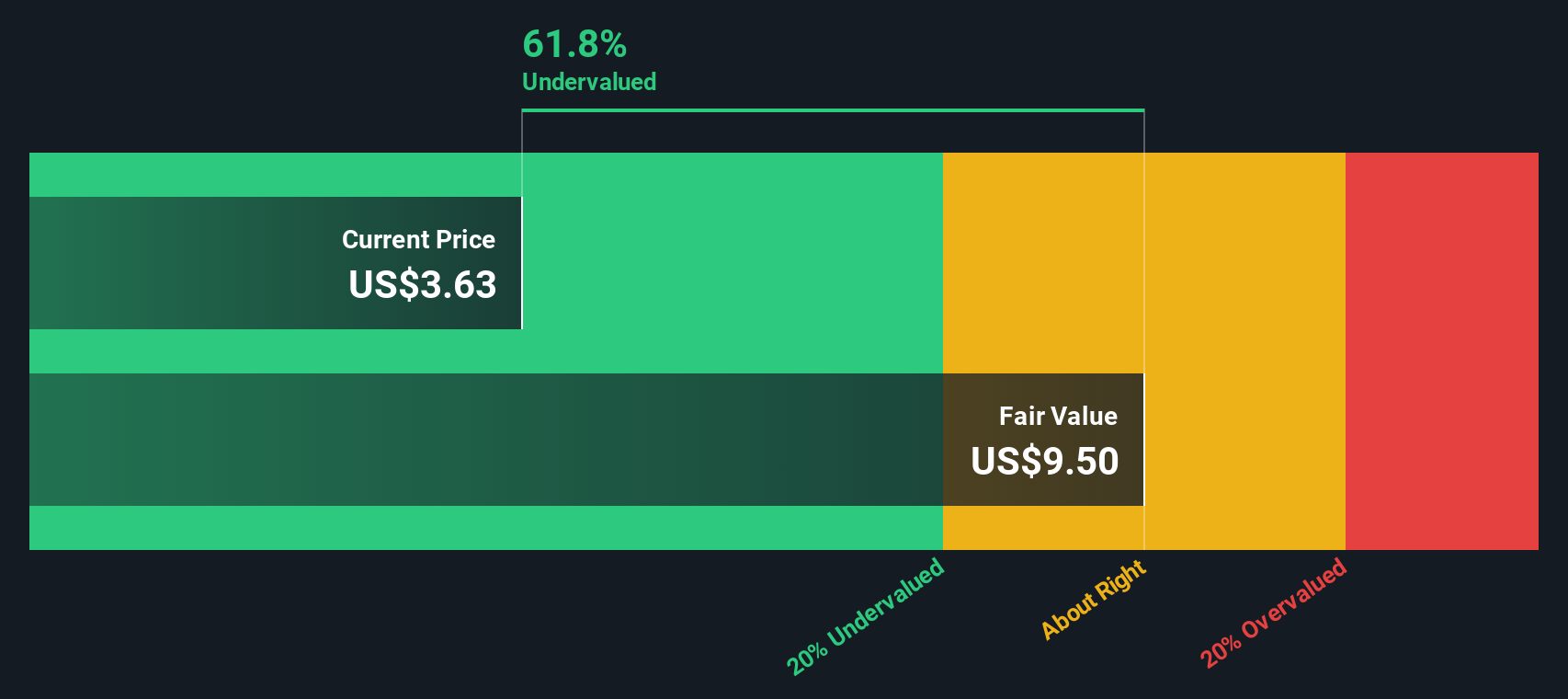

Using these forecasts, the DCF model calculates an estimated intrinsic value for the business of $9.92 per share. With the stock trading at a significant 65.7% discount to this value, the model signals that the shares are currently undervalued by a wide margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ardagh Metal Packaging is undervalued by 65.7%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Ardagh Metal Packaging Price vs Sales

For companies like Ardagh Metal Packaging, the Price-to-Sales (P/S) ratio is often the preferred valuation tool. This metric is particularly useful when profits are inconsistent or negative because it focuses on revenue, which tends to be more stable. P/S gives investors a clear sense of how much they are paying for each dollar of sales, making it more reliable for packaging businesses where margins can fluctuate.

Growth expectations and risk both play important roles in determining what counts as a “normal” or “fair” multiple. Higher-growth companies or those with more stable markets often deserve higher multiples, while slower growers or riskier businesses usually see lower ones.

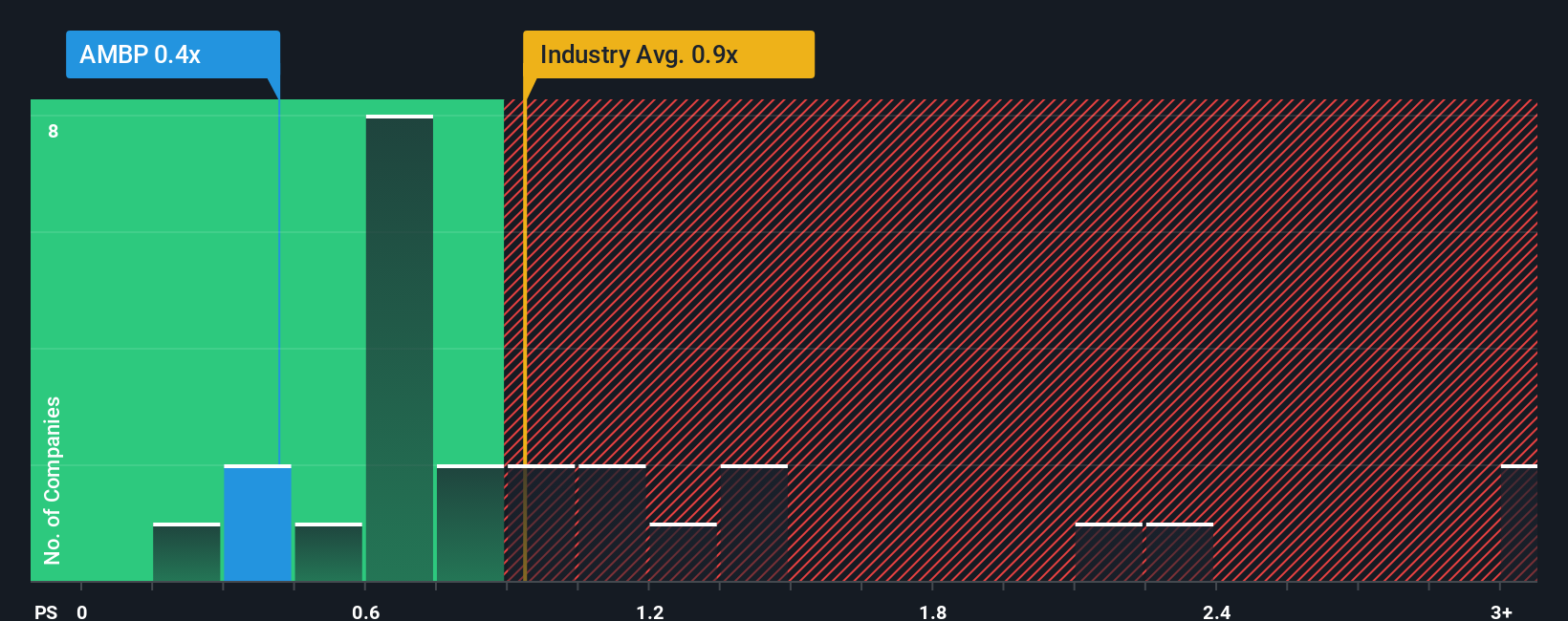

Currently, Ardagh Metal Packaging is trading at a P/S ratio of 0.38x. To provide context, the average P/S for the packaging industry sits at 0.92x while similar peers are around 0.71x. At first glance, this makes Ardagh’s stock look like a bargain relative to the industry and its competitors.

However, Simply Wall St’s proprietary Fair Ratio offers an even sharper lens. Instead of just comparing to market averages, the Fair Ratio takes into account factors like company-specific growth prospects, profit margins, market cap and potential risks. For Ardagh, the Fair Ratio is 0.67x, suggesting what a reasonable P/S should be based on the company’s unique characteristics rather than just general benchmarks.

When we compare the Fair Ratio to the current P/S, Ardagh Metal Packaging’s actual multiple is significantly lower than the fair value implied by its fundamentals. This signals the shares may be undervalued, with the numbers suggesting a good entry point for value-focused investors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ardagh Metal Packaging Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. This is a smarter, more dynamic approach that goes beyond just crunching the numbers.

A Narrative is your personal story or outlook about Ardagh Metal Packaging, tying together what you believe about its future revenue, margins, profit, and business potential in a simple, accessible way.

This concept connects your perspective, explaining why you think the company will succeed or face challenges, to actual financial forecasts and a calculated fair value. It provides a complete view that’s rooted in both the story and the statistics.

Narratives are available right inside Simply Wall St’s Community page, where millions of investors regularly share and compare their investment theses. This makes it easy for you to join the conversation and create your own Narrative with just a few clicks.

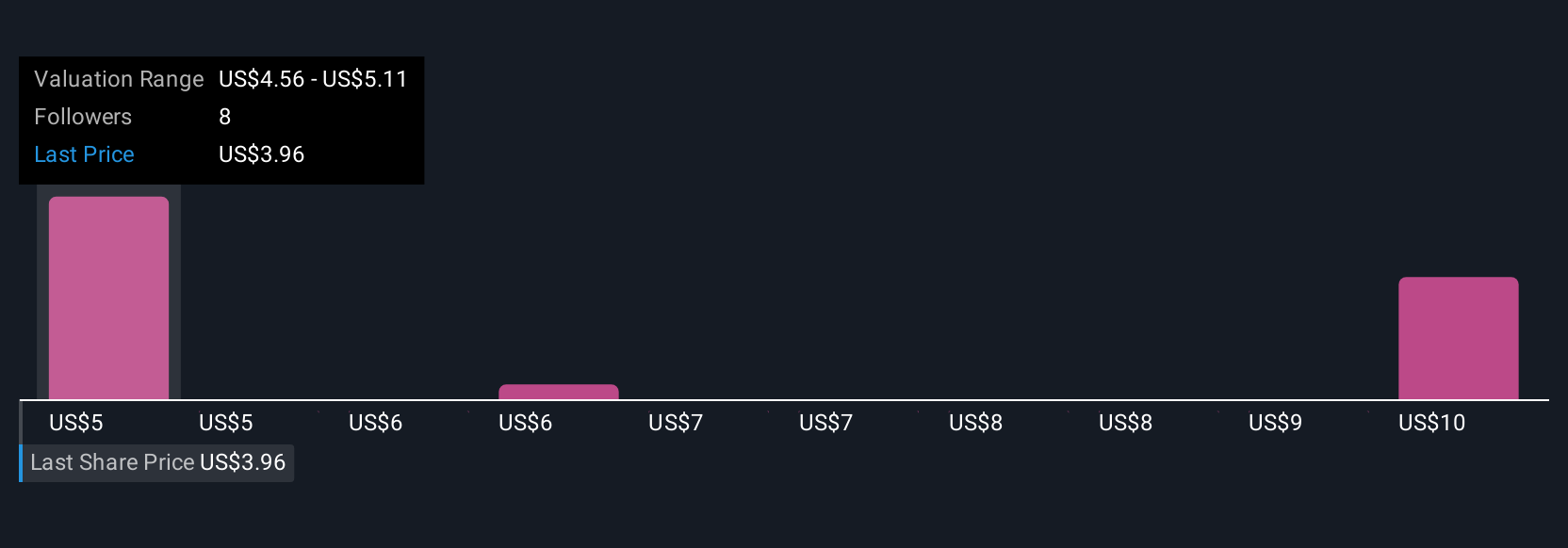

What makes Narratives powerful is how they help you decide when to buy or sell. If your Narrative's fair value is above the current share price, it might signal a buying opportunity. If it’s below, caution may be warranted.

Even better, Narratives update automatically whenever new information such as earnings or news emerges. This ensures your view and fair value reflect the latest data.

For example, some investors believe strong demand for sustainable packaging and ongoing innovation will drive Ardagh Metal Packaging’s fair value as high as $5.00 per share, while others see margin pressures and regional headwinds limiting upside to just $4.00. Both perspectives are instantly visualized, so you can see at a glance where you stand.

Do you think there's more to the story for Ardagh Metal Packaging? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMBP

Ardagh Metal Packaging

Operates as a metal beverage can company in Europe, the United States, and Brazil.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives