- United States

- /

- Chemicals

- /

- NYSE:ALB

Is Albemarle Still a Bargain After Recent Lithium Technology Investments?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Albemarle is a bargain or priced for perfection, you are not alone. We are about to break it down together.

- Albemarle’s share price has been on quite a ride lately, dropping 6.0% in the last week but nearly flat over the past month. It is still up 7.9% year-to-date despite lagging with a -2.7% return over the last year.

- Recent headlines have highlighted shifting industry dynamics and strategic moves, such as Albemarle’s investments in lithium extraction technology and partnerships to secure its place in global supply chains. These developments are giving investors plenty to digest as the company responds to ongoing demand for battery materials.

- On our 6-point valuation health check, Albemarle scores a 2 out of 6. While some metrics flash value, others suggest caution. We will dig into those traditional valuation checks next. Stay tuned, because there is a more holistic way to make sense of it all coming up at the end of this article.

Albemarle scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

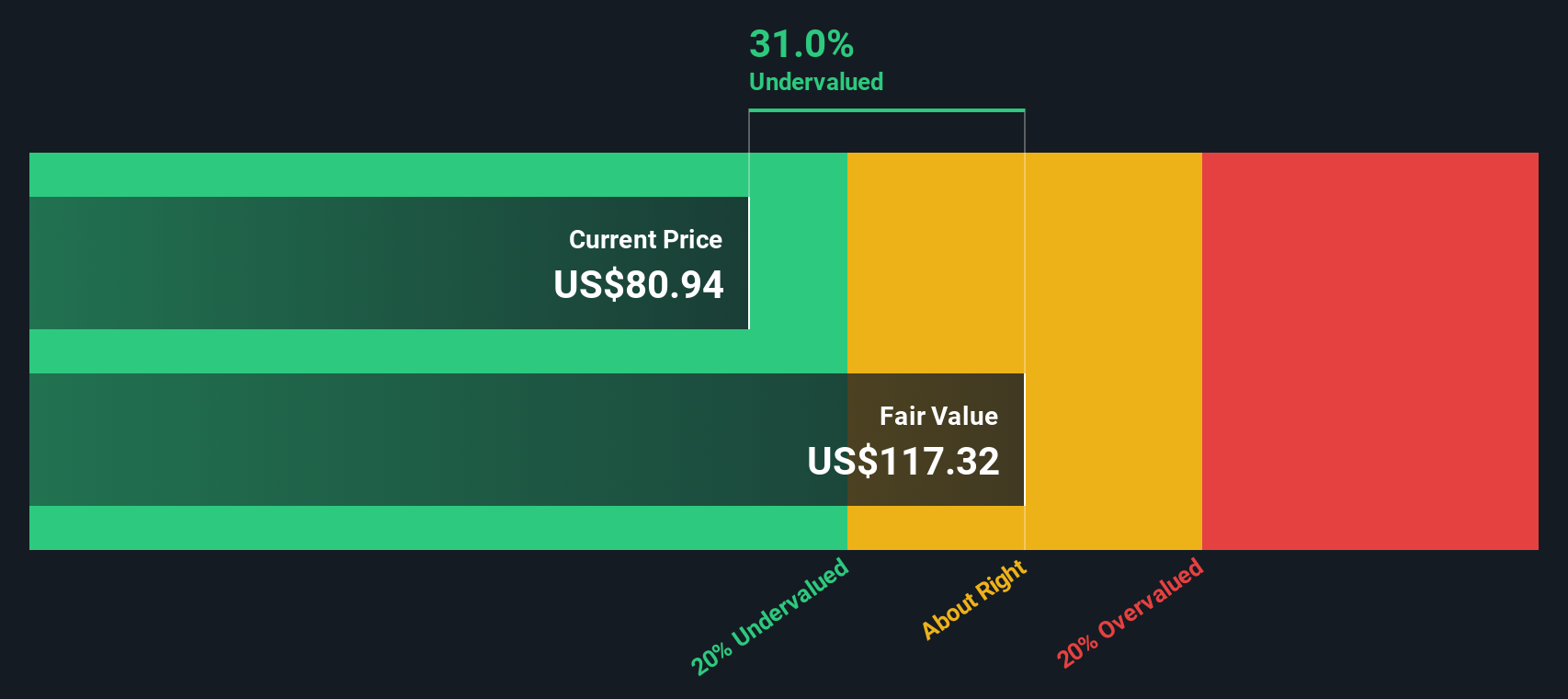

Approach 1: Albemarle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to capture the intrinsic worth of Albemarle based on what it could generate for shareholders over time.

Currently, Albemarle's latest twelve months Free Cash Flow (FCF) stands at -$330.5 million, reflecting recent headwinds. However, analysts expect strong improvement ahead, projecting FCF to reach $357.3 million by the end of 2027. Looking further out, Simply Wall St extrapolates these trends, projecting FCFs over the next decade to continue climbing, with discounted figures rising from $169.0 million in 2026 up to $634.5 million in 2035.

Using this two-stage FCF to equity model, the intrinsic value per share comes out to $159.89. Based on the DCF, Albemarle stock trades at a 42.5% discount to this estimated fair value, suggesting it is significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Albemarle is undervalued by 42.5%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

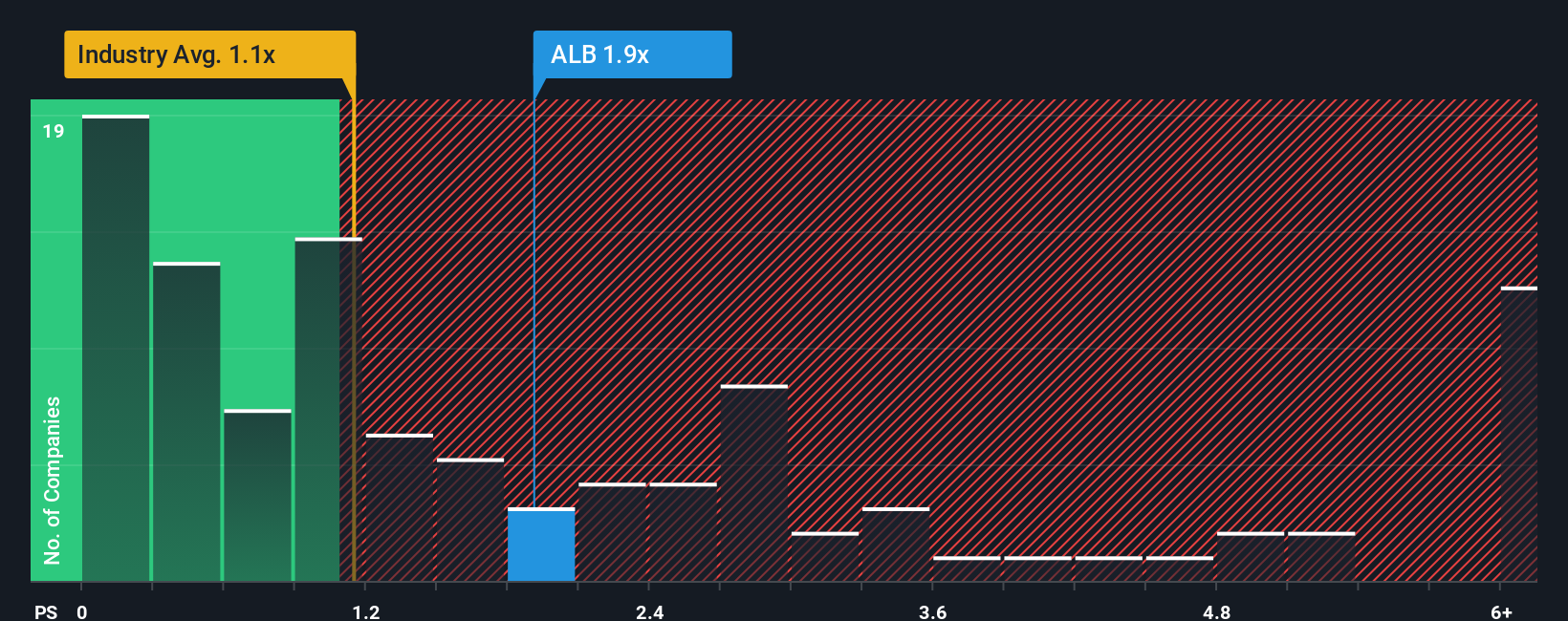

Approach 2: Albemarle Price vs Sales

For companies like Albemarle that are navigating periods of inconsistent profits or losses, the Price-to-Sales (P/S) ratio is often a more reliable yardstick than earnings multiples. The P/S metric is favored because it focuses on revenue generation, sidestepping short-term swings in earnings due to industry cycles or heavy reinvestment. This is highly relevant for a company entrenched in battery materials and clean tech supply chains.

Growth prospects, sector dynamics, and company-specific risks all shape what investors consider a “fair” P/S ratio. Rapidly expanding firms with strong sales momentum often justify a higher ratio, while those facing uncertainty or margin pressures might not. Albemarle currently trades at a P/S ratio of 2.17x. That is above both the chemical industry average of 1.14x and the average among its peers at 1.53x. At first glance, this premium might make the stock appear expensive.

This is where Simply Wall St’s "Fair Ratio" metric comes in. Unlike simple comparisons to industry or peers, the Fair Ratio blends Albemarle’s growth outlook, profitability, risk profile, market capitalization, and industry characteristics to estimate what multiple the stock should command. For Albemarle, the Fair Ratio is 0.97x, which is noticeably lower than its actual P/S. With the current multiple outpacing its Fair Ratio by a meaningful margin, this approach suggests the stock is overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Albemarle Narrative

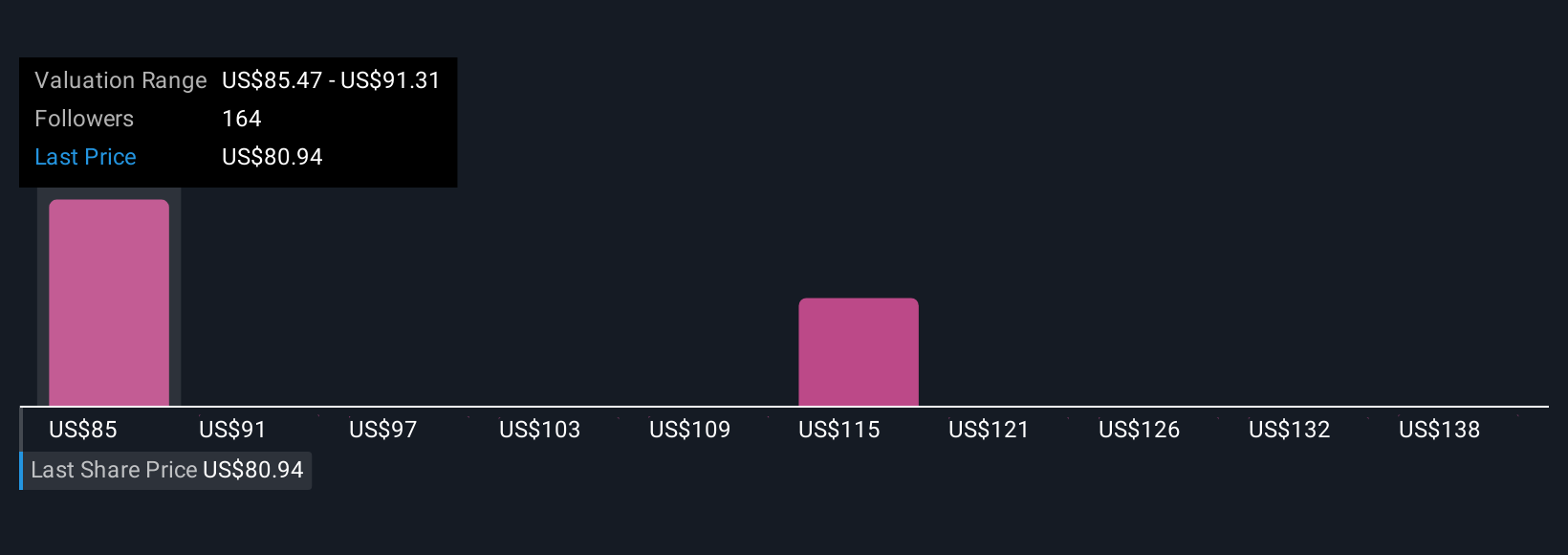

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your story behind the numbers; it is the perspective you bring to the table about a company’s future, and it connects your view of the business to your own forecast for revenue, earnings, and ultimately, fair value.

Instead of relying purely on metrics or analysts’ targets, Narratives let you outline what you believe will drive Albemarle’s success or risks and then quantify those beliefs in an easy, step-by-step way. On Simply Wall St’s Community page, millions of investors use Narratives to clarify their thesis and see the fair value that results from their specific assumptions.

Narratives make buy or sell decisions simpler by showing whether your fair value is above (buy) or below (sell) the current share price. They also update dynamically as new information, such as news or earnings, becomes available. For example, some investors might be bullish about Albemarle, seeing lithium demand rebounding to push the stock as high as $200, while others may forecast headwinds and believe fair value is closer to $58. By creating or browsing different Narratives, you can compare a wide range of scenarios and find one that matches your own view. This approach can make your investment decisions clearer and more personal.

Do you think there's more to the story for Albemarle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives