- United States

- /

- Chemicals

- /

- NYSE:ALB

Evaluating Albemarle (ALB) Stock: Does Recent Momentum Signal Hidden Value or Overvaluation?

Reviewed by Simply Wall St

Albemarle (ALB) has seen some movement in its stock price over the past month, with a gain of 12%. Investors may be curious about what is driving the action, especially after a period of mixed performance this year.

See our latest analysis for Albemarle.

Momentum appears to be returning for Albemarle, as the stock has climbed more than 11% over the past month despite a challenging year. While the 1-year total shareholder return is still negative, there are signs that recent price gains may hint at shifting sentiment and renewed growth potential.

If Albemarle’s rebound has you wondering what else is building steam, now is an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

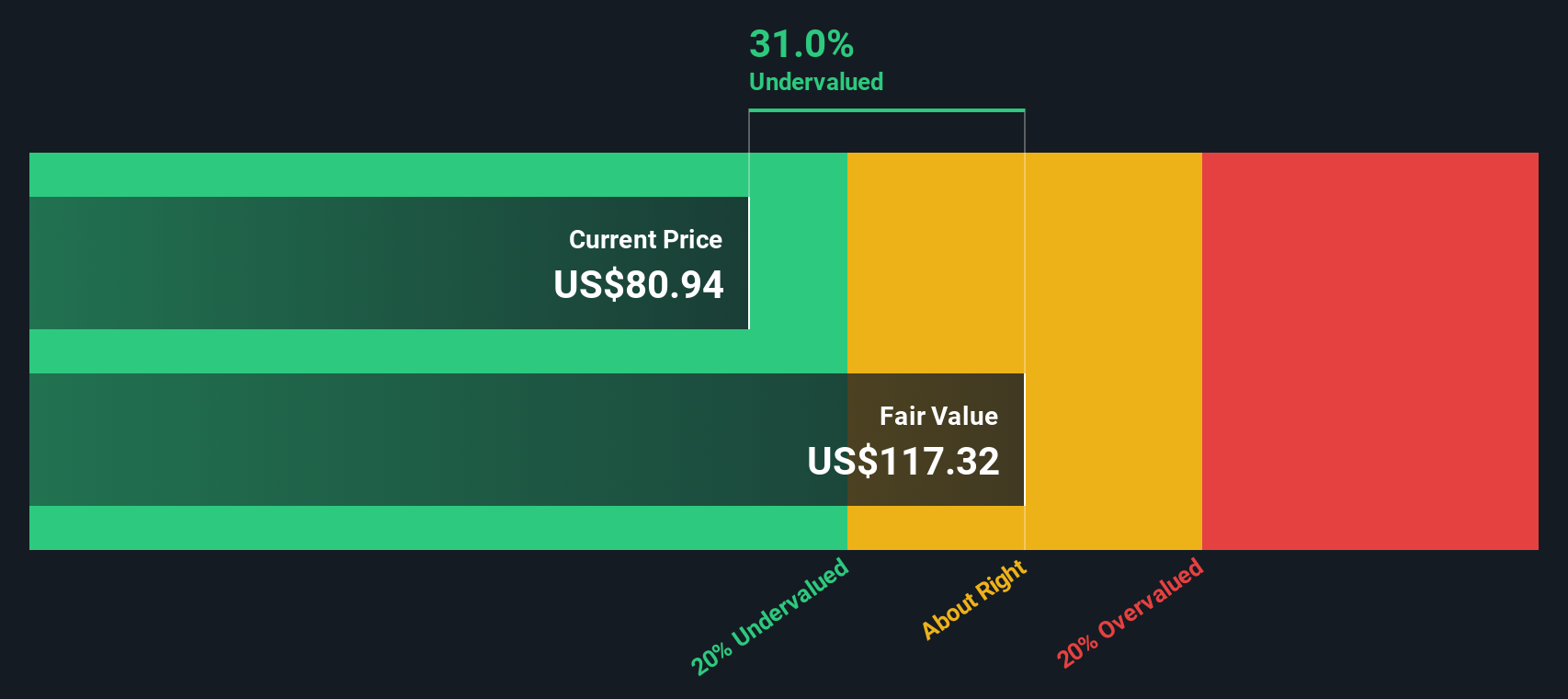

With recent gains and mixed long-term returns, the core question remains: does Albemarle’s current price reflect genuine undervaluation, or is the market already factoring in all of the company’s growth prospects, leaving limited upside for new investors?

Most Popular Narrative: 4% Overvalued

Compared to the last closing price of $91.34, the most widely followed narrative estimates Albemarle’s fair value at $87.79, putting shares slightly above that level. This perspective is shaped by updated forecasts and recent changes in market sentiment.

Bullish analysts have pointed to positive pricing momentum in lithium, supported by recent mine site closures in China. These closures are expected to reduce global supply and potentially strengthen Albemarle’s pricing power.

Want to uncover the bold earnings assumptions fueling this valuation? The narrative is built around forecasts for margin recovery and profit growth. What is the real story behind the optimistic numbers? Peek inside for the surprising drivers and logic that led to this eye-catching price target.

Result: Fair Value of $87.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low lithium prices or extended industry oversupply could suppress Albemarle’s revenue and margins. This could quickly change the company’s outlook despite recent optimism.

Find out about the key risks to this Albemarle narrative.

Another View: Discounted Cash Flow Suggests Value Opportunity

While the most popular narrative sees Albemarle as slightly overvalued, our DCF model paints a different picture. By estimating future cash flows, the SWS DCF model values Albemarle at $155.65 per share, which is 41.3% above the current price. Could market pessimism be overdone?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If these analyses don’t quite fit your take or you’d rather examine the numbers on your own, you can shape your own assessment in under three minutes using the data provided, and Do it your way.

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the next winning opportunity is just around the corner. Step ahead of the crowd and uncover stocks with unique growth and return potential using these powerful tools:

- Uncover hidden gems poised for future growth by researching these 872 undervalued stocks based on cash flows. You could spot tomorrow’s outperformers before everyone else does.

- Harness the future of medicine by targeting companies advancing healthcare AI breakthroughs with these 33 healthcare AI stocks for your portfolio.

- Get ahead of soaring yields and build income with confidence by checking out these 17 dividend stocks with yields > 3%, featuring stocks offering attractive, sustainable dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives