- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (ALB): Fresh Valuation Insights After Strong Earnings and Upbeat Market Reaction

Reviewed by Simply Wall St

Albemarle (ALB) has caught the attention of investors after its latest quarterly results came in better than anticipated, even as the industry faces pressure from softer lithium prices. Strong revenue and earnings surprises have sparked fresh discussion around its outlook.

See our latest analysis for Albemarle.

Albemarle’s share price has staged an impressive rebound, surging more than 37% year-to-date and delivering a 10.6% 1-month share price return. This momentum has drawn fresh attention after a prolonged slide. Despite ongoing pressure from weak lithium prices and recent regulatory news out of China, investors seem encouraged by Albemarle’s ability to exceed expectations and manage costs. This points to a shift in sentiment that could signal renewed growth potential.

If you’re watching the lithium story unfold and want to cast a wider net for high-growth opportunities, now’s an ideal time to discover fast growing stocks with high insider ownership

With the stock’s recent surge and mixed analyst signals, investors now face a crucial question: are Albemarle’s gains just the start of a deeper value opportunity, or is the market already pricing in a full recovery?

Most Popular Narrative: 13% Overvalued

Albemarle's most tracked narrative values the company at around $103 per share, which is below its latest closing price of $116.82. This marks a clear division between analyst consensus and the market’s recent optimism and sets up a tension for where the stock could go next.

Prolonged lithium price weakness, industry oversupply, regulatory uncertainty, and aggressive cost-cutting threaten Albemarle's growth, pricing power, and long-term competitive advantage.

Curious what projections drive this bold analyst stance? There is a powerful story here, one that hinges on ambitious profit margin gains and sharply rising revenues. Uncover the high-stakes assumptions that could make or break Albemarle’s future valuation.

Result: Fair Value of $103 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the potential for prolonged low lithium prices and the challenge of industry oversupply. Either of these factors could quickly derail the bullish outlook.

Find out about the key risks to this Albemarle narrative.

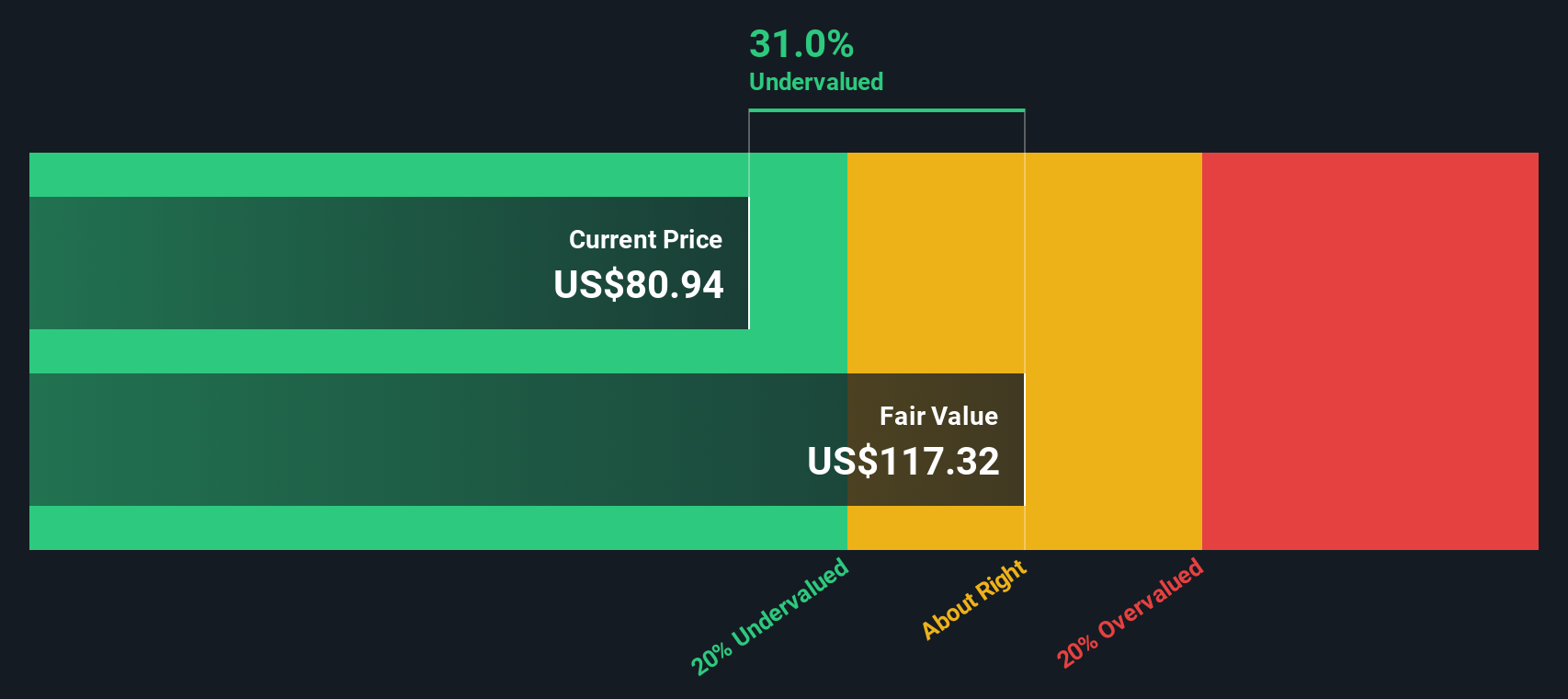

Another View: SWS DCF Model Signals Undervaluation

In contrast to analyst targets that show Albemarle as overvalued, our DCF model values shares at $141.63. This means the stock is currently trading 17.5% below this fair value estimate. This suggests the market might still be underrating Albemarle's long-term cash flow potential. Is this a sign of hidden upside, or do risks justify the discount?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If you have a different perspective or want to dig into the numbers on your own terms, it's easy to build your personal take in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Albemarle.

Looking for More Investment Ideas?

Smart investors never stick to just one play. Right now, you have the chance to spot the most promising opportunities shaping tomorrow’s market before the rest catch on.

- Uncover companies that tap into the explosive growth of AI by checking out these 26 AI penny stocks, leading the charge in artificial intelligence breakthroughs and automation.

- Maximize yield and portfolio stability with these 16 dividend stocks with yields > 3%, featuring consistent payers offering attractive yields above 3% for income-focused investors.

- Capitalize on undervalued gems by reviewing these 928 undervalued stocks based on cash flows, where strong cash flows suggest significant upside potential others may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives