- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Did Strong Q3 Results and Guidance Reaffirmation Just Shift Agnico Eagle Mines’ (AEM) Investment Narrative?

Reviewed by Sasha Jovanovic

- Agnico Eagle Mines Limited recently reported third-quarter 2025 results, including gold production of 866,936 ounces and net income of US$1.05 billion, and reaffirmed its 2025 full-year production guidance between 3,300,000 and 3,500,000 ounces.

- Over the same period, the company announced a quarterly dividend of US$0.40 per share and continued its share buyback program, while also delivering year-over-year gains in earnings per share and significant growth in net income.

- With robust earnings growth and reaffirmed production guidance, we'll assess how Agnico Eagle Mines’ latest results affect its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Agnico Eagle Mines Investment Narrative Recap

To be a shareholder of Agnico Eagle Mines, you need to trust in the company’s ability to translate stable gold production and disciplined capital allocation into ongoing earnings strength, especially while gold prices remain elevated. The recent third-quarter report delivered robust profits and confirmed full-year production targets, but didn’t fundamentally change the most important short-term catalyst: the trajectory of gold prices. Likewise, the biggest risk continues to be significant exposure to potential gold price reversals, this news does not materially reduce that risk.

Among the recent announcements, the reiteration of 2025 production guidance between 3.3 million and 3.5 million ounces stands out as most relevant. This affirmation suggests operational stability and gives investors clarity during a period where production execution remains closely tied to expected earnings power and supports confidence in the near-term outlook, but also underscores the dependency on market-driven gold prices as the key earnings lever.

However, it’s just as important for investors to be aware that if gold prices reverse direction, the company’s earnings…

Read the full narrative on Agnico Eagle Mines (it's free!)

Agnico Eagle Mines is projected to reach $11.0 billion in revenue and $3.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.4% and an earnings increase of $0.4 billion from the current earnings of $3.0 billion.

Uncover how Agnico Eagle Mines' forecasts yield a $188.80 fair value, a 12% upside to its current price.

Exploring Other Perspectives

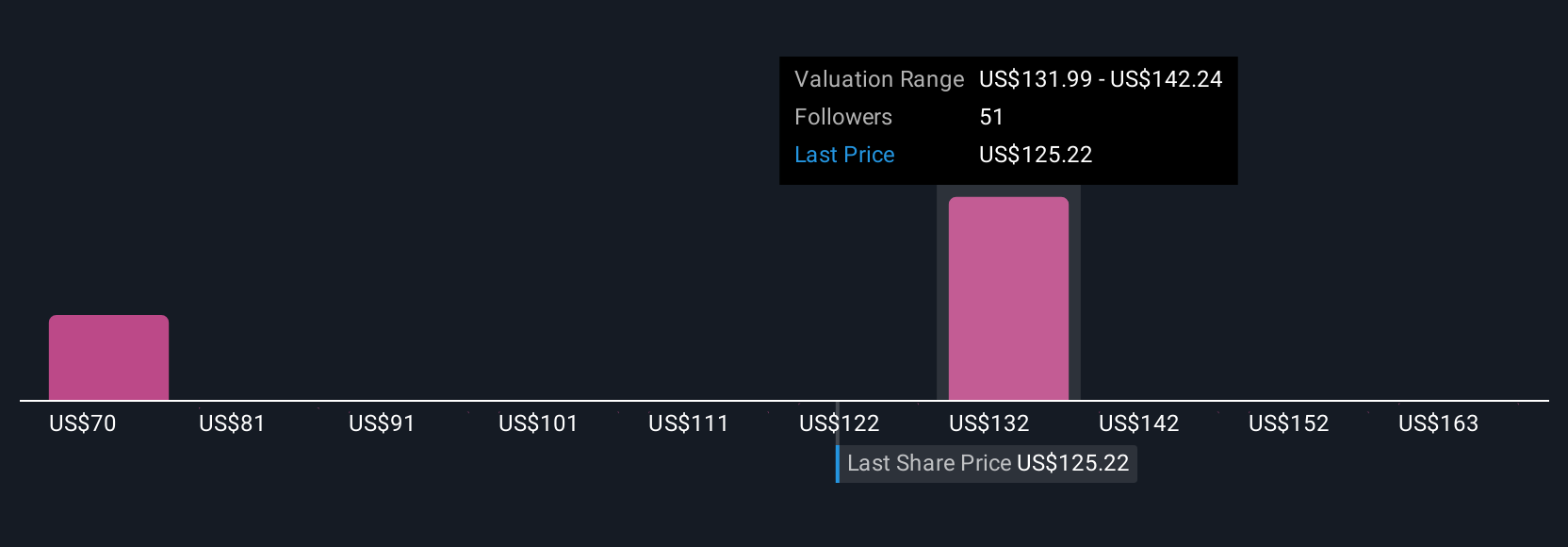

Twelve fair value estimates from the Simply Wall St Community range widely, from US$62.26 to US$207.22 per share. While opinions differ, reliance on current gold price strength remains the central catalyst affecting company performance, reviewing a range of viewpoints could provide deeper context.

Explore 12 other fair value estimates on Agnico Eagle Mines - why the stock might be worth as much as 23% more than the current price!

Build Your Own Agnico Eagle Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Agnico Eagle Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agnico Eagle Mines' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives