- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Evaluating Valuation After $180M Stibnite Gold Project Investment and Renewed Growth Spotlight

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) is drawing fresh attention after making a $180 million investment in Perpetua Resources’ Stibnite Gold Project. This move highlights the company’s ongoing growth strategy and further strengthens its position in the U.S. gold sector.

See our latest analysis for Agnico Eagle Mines.

This latest investment comes on the heels of a remarkable rally for Agnico Eagle Mines. The company has notched a 91% year-to-date share price return and an impressive 80% total return over the past twelve months. The momentum has accelerated over the last quarter, reflecting renewed optimism around gold prices, Agnico Eagle’s low-cost production pipeline, and its strategic presence in major new projects like Stibnite. For investors, the three-year total shareholder return of nearly 300% is a strong testament to how much the company has rewarded patient capital and why it remains a top pick among gold miners.

If new gold deals and sharp gains have you thinking about what else could surprise the market, it might be the perfect time to discover fast growing stocks with high insider ownership

After such a strong run for both the company and gold itself, the key question is whether Agnico Eagle shares remain undervalued, or if the market has already baked in expectations for future growth. Is there still a buying opportunity here?

Most Popular Narrative: 17% Undervalued

Compared to Agnico Eagle Mines’ last close of $156.78, the most-followed narrative points to a fair value of $188.79. This significant gap suggests the current price has room to move higher. The fair value estimate incorporates future earnings growth, margin expansion, and sector dynamics, setting the stage for deeper debate on what is truly driving this bullish outlook.

“Sustained strength and volatility in global gold prices, underpinned by rising monetary uncertainty and increased central bank purchases, are driving robust free cash flow, record earnings, and enhanced shareholder returns at Agnico Eagle; continued monetary instability and de-dollarization trends are likely to support elevated future gold prices, which should flow directly to higher revenue and profitability.”

Curious how this story transforms gold price spikes and central bank secrecy into a double-digit upside? One major assumption about Agnico Eagle’s future power is shockingly ambitious. Find out what it is by reading the entire breakdown that underpins this premium valuation.

Result: Fair Value of $188.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is still important to note that any sustained pullback in gold prices or operational setbacks at key mines could quickly weaken this bullish outlook.

Find out about the key risks to this Agnico Eagle Mines narrative.

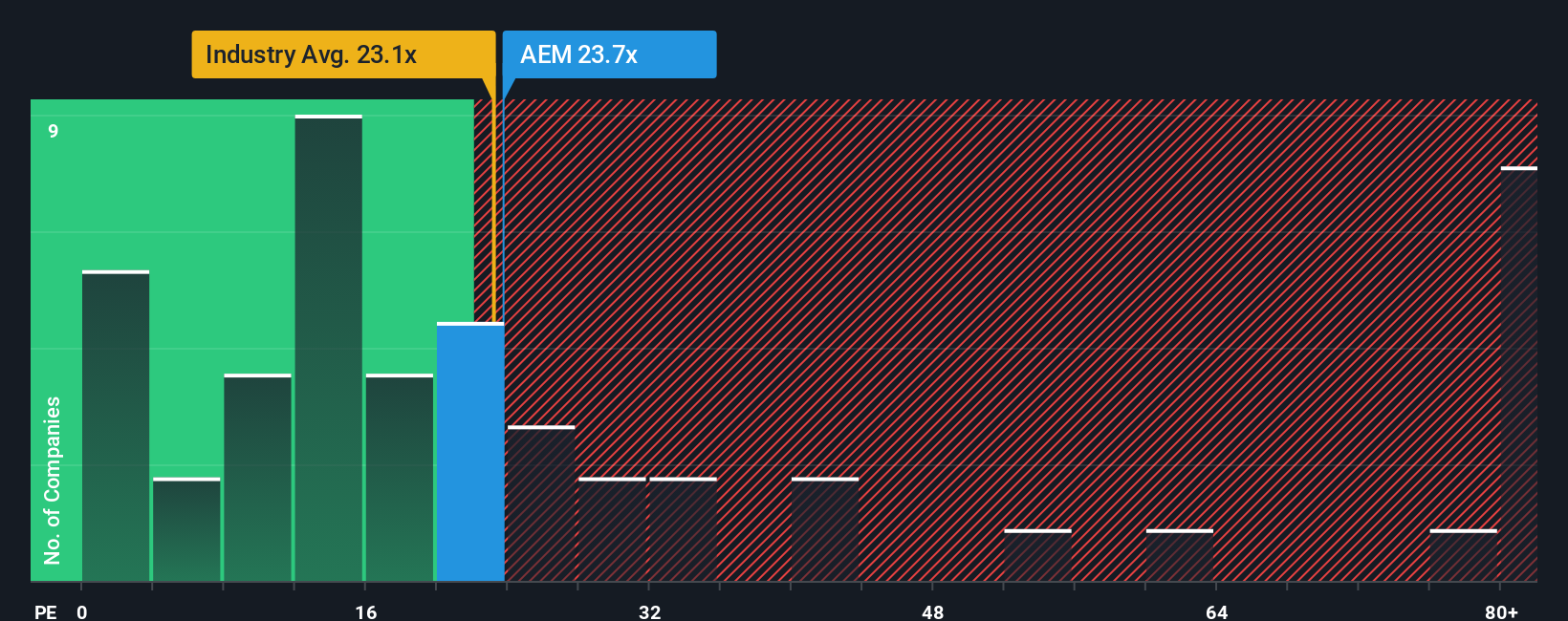

Another View: A Closer Look at Market Multiples

While bullish narratives suggest upside, market multiples tell a more cautious story. Agnico Eagle's price-to-earnings ratio sits at 26.6x, higher than both the US Metals and Mining industry average (23.9x) and the fair ratio of 23.2x. This could signal less margin for error if sentiment shifts or growth slows. Has recent momentum pushed expectations too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agnico Eagle Mines Narrative

If you see things differently or want to dig into the numbers yourself, you can build your personal view in just a couple of minutes with Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let unique opportunities slip by. Uncover potential winners for your portfolio using these exclusive hand-picked screens on Simply Wall Street.

- Unlock the potential of next-generation technology with these 26 AI penny stocks to see which companies are driving real innovation in artificial intelligence.

- Capture reliable income streams by checking out these 21 dividend stocks with yields > 3%, featuring stocks paying strong yields above 3%.

- Position yourself early in the rapidly growing digital finance space by accessing these 81 cryptocurrency and blockchain stocks and investing in blockchain and cryptocurrency breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives