- United States

- /

- Basic Materials

- /

- NasdaqGS:USLM

United States Lime & Minerals (USLM): Exploring Valuation Following Strong Q3 Earnings and Dividend Confirmation

Reviewed by Simply Wall St

United States Lime & Minerals just released its third quarter earnings, showing steady growth in both sales and net income compared to last year. The company also announced its regular quarterly dividend, highlighting consistent shareholder returns.

See our latest analysis for United States Lime & Minerals.

United States Lime & Minerals has seen some bounce in its share price lately, with a 7.3% climb over the past week hinting at renewed momentum following its strong quarterly results and dividend announcement. Still, the one-year total shareholder return stands at -13.4%, showing that despite impressive financial growth, the stock has experienced its share of ups and downs. Longer-term holders, however, remain comfortably ahead, with five-year total returns topping 495%.

If these recent earnings have you looking for the next opportunity, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

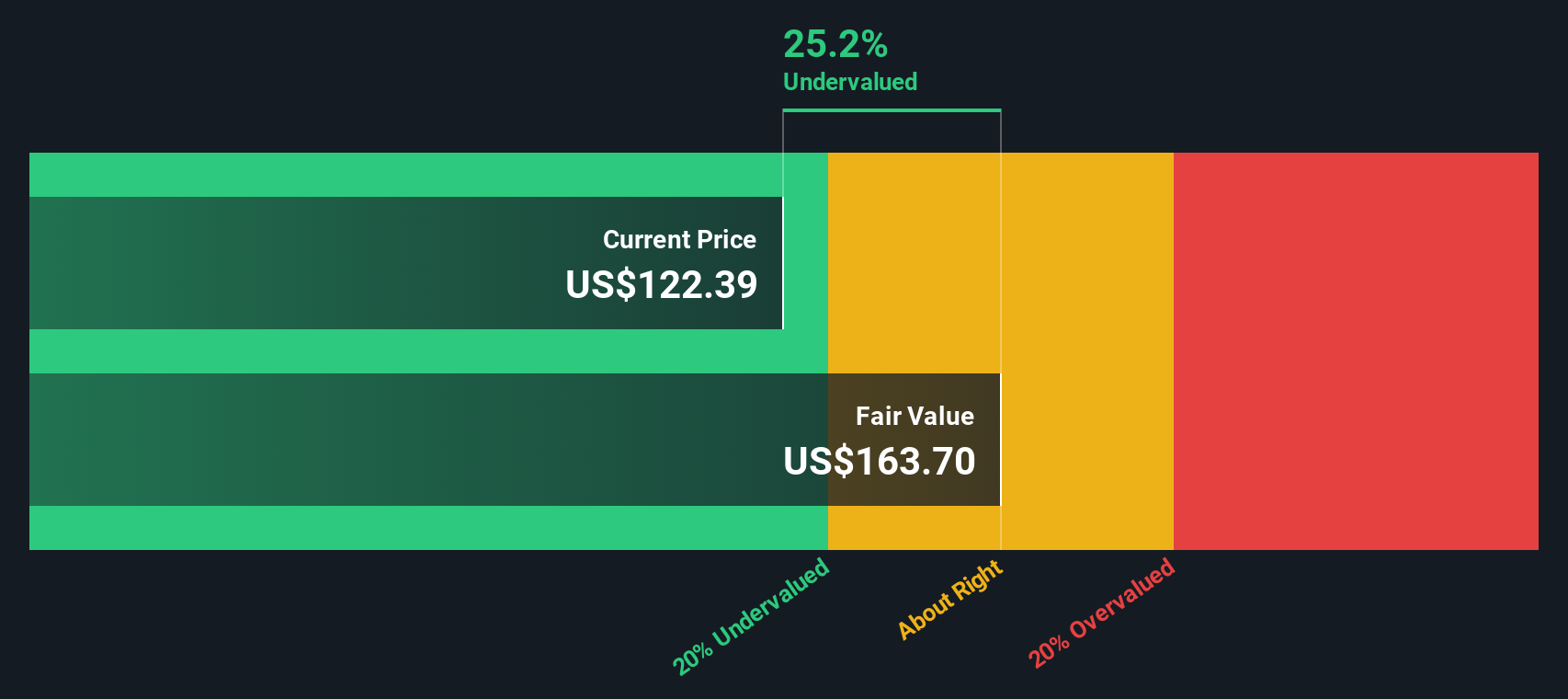

With shares making a modest comeback and fundamentals showing solid growth, the key question now is whether United States Lime & Minerals is undervalued after the dip or if the market already anticipates further gains.

Price-to-Earnings of 26x: Is it justified?

At a price-to-earnings (P/E) ratio of 26x, United States Lime & Minerals is priced notably higher than both its direct peers and the wider global industry. This signals a premium in the current market compared to other basic materials names. For context, the company's shares closed at $119.12, leaving little room for error if future results disappoint.

The P/E ratio compares a company's current share price to its per-share earnings and offers a snapshot of how much investors are willing to pay for each dollar of profit. For a mature materials business like USLM, this metric often reflects confidence in future earnings stability or superior profitability.

With peers averaging a P/E of 23.8x and global industry names at just 15.1x, the premium for USLM stands out. Unless future growth or margins are far ahead of the field, such a valuation may be tough to defend, especially in volatile cycles where multiples can contract quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 26x (OVERVALUED)

However, weaker-than-expected earnings or deteriorating industry conditions could quickly challenge this renewed optimism in United States Lime & Minerals' share price.

Find out about the key risks to this United States Lime & Minerals narrative.

Another View: Discounted Cash Flow Tells a Different Story

While United States Lime & Minerals appears expensive by traditional price-to-earnings metrics, our SWS DCF model comes to a different conclusion. It suggests that shares are actually trading at a 27% discount to their fair value, which hints at undervaluation despite the high P/E ratio. Which perspective will the market trust going forward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United States Lime & Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United States Lime & Minerals Narrative

If this analysis leaves you unconvinced, or if you want to dig deeper into the numbers yourself, why not build your own view in just minutes with Do it your way

A great starting point for your United States Lime & Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for fresh opportunities. Why settle for just one win when you can tap into a global universe of innovative companies and hidden gems using the Simply Wall Street Screener?

- Uncover value by targeting beaten-down stocks that could be set for a comeback with these 857 undervalued stocks based on cash flows.

- Capture income that compounds by reviewing these 15 dividend stocks with yields > 3% delivering yields above 3% from financially robust businesses.

- Ride the surge in artificial intelligence and spot early movers with the potential to transform entire industries using these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:USLM

United States Lime & Minerals

Manufactures and supplies lime and limestone products in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives