- United States

- /

- Packaging

- /

- NasdaqGS:TRS

TriMas (TRS) Margin Expansion Outpaces Expectations, Testing Bullish Valuation Narratives

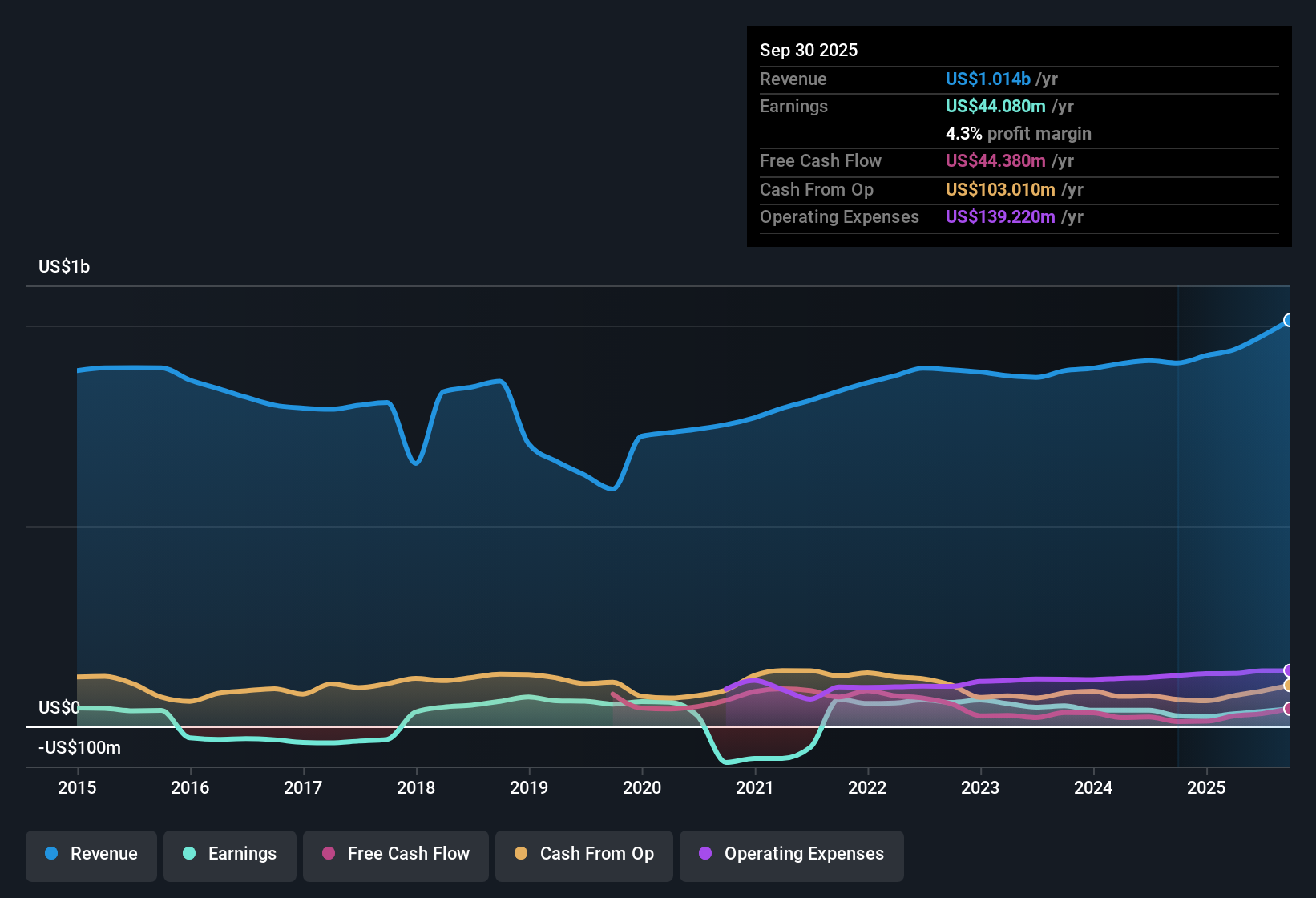

TriMas (TRS) just delivered a standout earnings performance, with net profit margins hitting 4.3%, up from last year's 2.9%. Over the past year, earnings growth surged 66%, well above its already impressive five-year average of 32.2%. Looking forward, earnings are forecast to climb 71.9% per year, far outpacing the US market and sector averages, even as revenue growth projections remain more modest. With profitability momentum building and margin improvements clear, investors now have to weigh these gains against persistent valuation and balance sheet concerns.

See our full analysis for TriMas.Next, we will see how the fresh numbers compare to the stories investors are telling. Some market narratives might get confirmed while others could face a reality check.

See what the community is saying about TriMas

Margin Expansion Well Ahead of Peers

- Net profit margins climbed to 4.3%, a significant increase from last year’s 2.9%, while analysts expect margins to further accelerate to an impressive 18.7% within three years.

- Analysts' consensus view heavily supports that operational standardization and automation initiatives will help TriMas leave industry averages in the dust for profitability.

- Consensus narrative emphasizes the integration of recent acquisitions and productivity investments as key levers powering future margin expansion. This is an uncommon trajectory in a sector facing widespread pressure on cost and input prices.

- It’s noteworthy that these profit improvements are coming even as revenue growth expectations (5.8% per year) lag the overall U.S. market. This suggests outperformance is rooted in unlocking operating leverage and not just top-line expansion.

- Analysts expect earnings to reach $223.6 million by September 2028, from $37.3 million today. This would require the company to trade at just 9.9x forward earnings rather than today’s 34.1x.

To see where Wall Street's consensus narrative sees the biggest opportunities and pressures facing TriMas, dive into the full story for balanced insight. 📊 Read the full TriMas Consensus Narrative.

Premium Valuation Faces a High Bar

- The Price-To-Earnings ratio sits at 34.1x, which is well above the sector average of 29.8x and almost double the Global Packaging industry’s 16.2x. This indicates investors are paying up for future growth.

- Analysts’ consensus view points out this premium valuation only looks reasonable if TriMas delivers significant earnings acceleration to reach the forecast $223.6 million in profits by 2028.

- The current share price ($37.02) trades near the DCF fair value ($39.10) but under the analyst target of $45.00. The market appears cautious given that profit expansion depends on substantial margin advancement and flawless execution.

- The consensus sees both upside and downside. Outperformance could justify a rerating, but execution slip-ups, especially around acquisitions or automation, could leave the stock looking expensive versus its peers and sector.

Balance Sheet Not a Green Flag Yet

- Despite strong earnings trajectories, the risk profile reveals a minor red flag. TriMas is not yet in a ‘good’ financial position, raising some questions about its flexibility if growth wobbles.

- Analysts’ consensus view acknowledges the company’s delivery of ongoing profit growth and value creation but warns that balance sheet strength remains an important watchpoint.

- Bears highlight that ongoing integration of recent acquisitions and the need for further IT standardization could produce unexpected costs, testing cash flow resilience if sector growth slows.

- At the same time, consensus narrative credits TriMas for pivoting toward high-growth segments like aerospace and sustainability-driven packaging. These moves are designed to bolster cash generation and underpin long-term financial stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TriMas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the data through your own lens? Shape your perspective and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your TriMas research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite rapid earnings growth and margin expansion, TriMas’s balance sheet still falls short. This raises concern about its financial flexibility if growth slows.

If you want stronger financial health and less risk, check out solid balance sheet and fundamentals stocks screener (1981 results) to find companies with robust balance sheets ready for any market turns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriMas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Newcrest Synergy: Gold’s Final Boss vs. The Tier-1 Purge

The Omnichannel Hegemon: AI, Advertising, and the Nasdaq Era

The Elhedery Cleansing: Dismantling the Global Generalist

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.