- United States

- /

- Packaging

- /

- NasdaqGS:TRS

Is TriMas a Bargain After Its 11% Drop Despite Strong Year-to-Date Gains?

Reviewed by Bailey Pemberton

- Wondering if TriMas is trading for less than it's worth? You're not alone, as investors are always keen to spot undervalued opportunities before the market catches on.

- TriMas has seen some sharp moves lately, with the stock dropping 11.1% over the last week and 10.7% in the past month, even though it's still up 41.3% year-to-date.

- Market watchers are buzzing about recent industry developments and shifting economic conditions that are shining a spotlight on companies like TriMas. These changes could mean new opportunities are emerging, or they may be signaling caution depending on how you interpret the headlines.

- Currently, TriMas scores a 2 out of 6 on our valuation checks, suggesting the stock is undervalued in some areas but not across the board. Let's dig into how TriMas stacks up using multiple valuation approaches. Stick around for an even smarter way to assess value that we will get to by the end of this article.

TriMas scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TriMas Discounted Cash Flow (DCF) Analysis

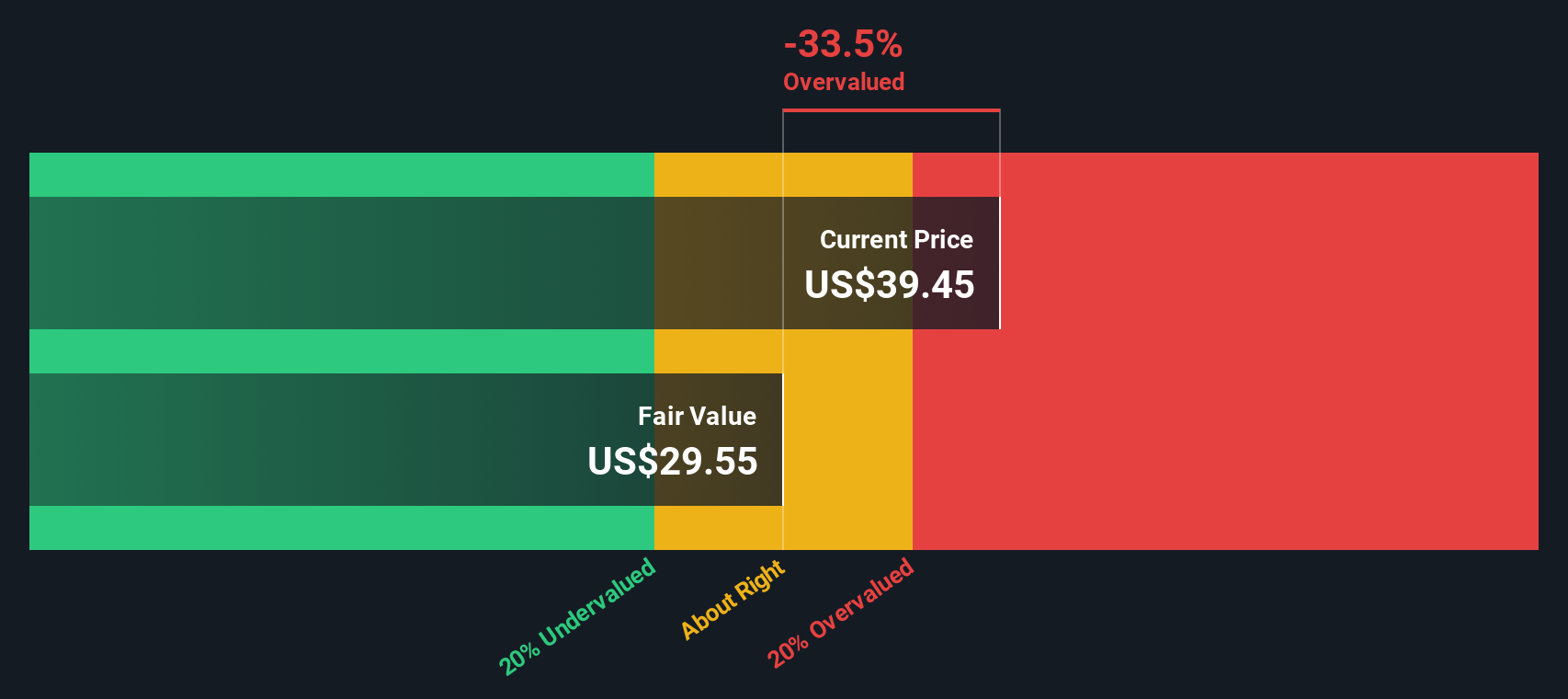

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by forecasting its future free cash flows and then discounting those amounts back to today's dollar value. This method looks at how much cash TriMas is expected to generate in the future and brings those anticipated amounts into present-day terms.

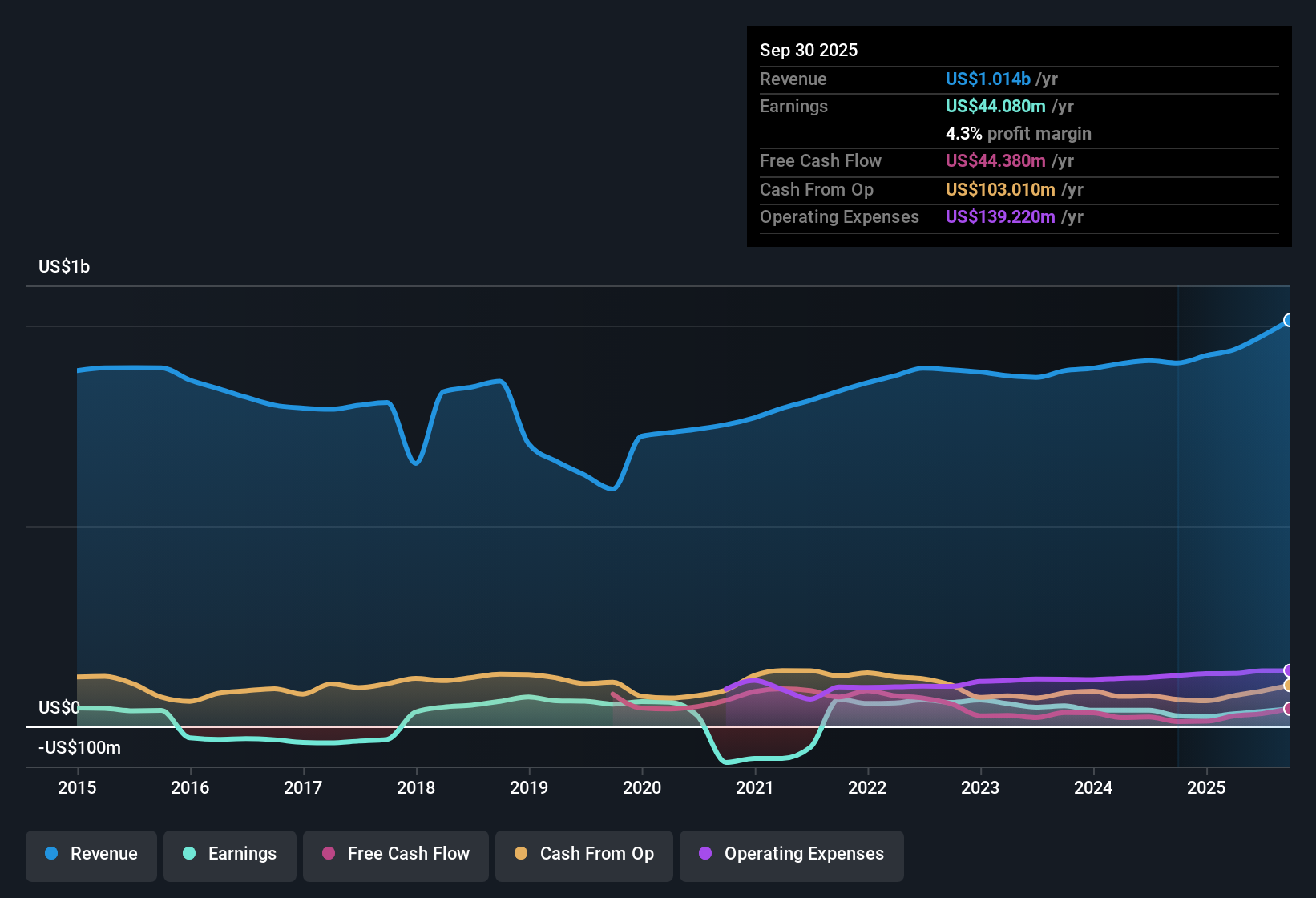

Currently, TriMas reports Free Cash Flow (FCF) of $44.2 million, with projections showing steady growth over the next decade. For example, analysts expect FCF to reach $60.9 million by the end of 2022. Looking even further ahead, estimates using a 2 Stage Free Cash Flow to Equity model suggest that FCF could rise to around $85.8 million by 2035, with annual growth rates gradually slowing over time as the business matures. The FCF projections beyond five years are extrapolated using established methodologies beyond what analysts typically publish.

Based on these calculations, the DCF model estimates TriMas' intrinsic value to be $39.80 per share. When compared to the current stock price, this valuation implies TriMas is trading at a 15.4% discount, meaning the stock appears undervalued through this lens.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TriMas is undervalued by 15.4%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: TriMas Price vs Earnings

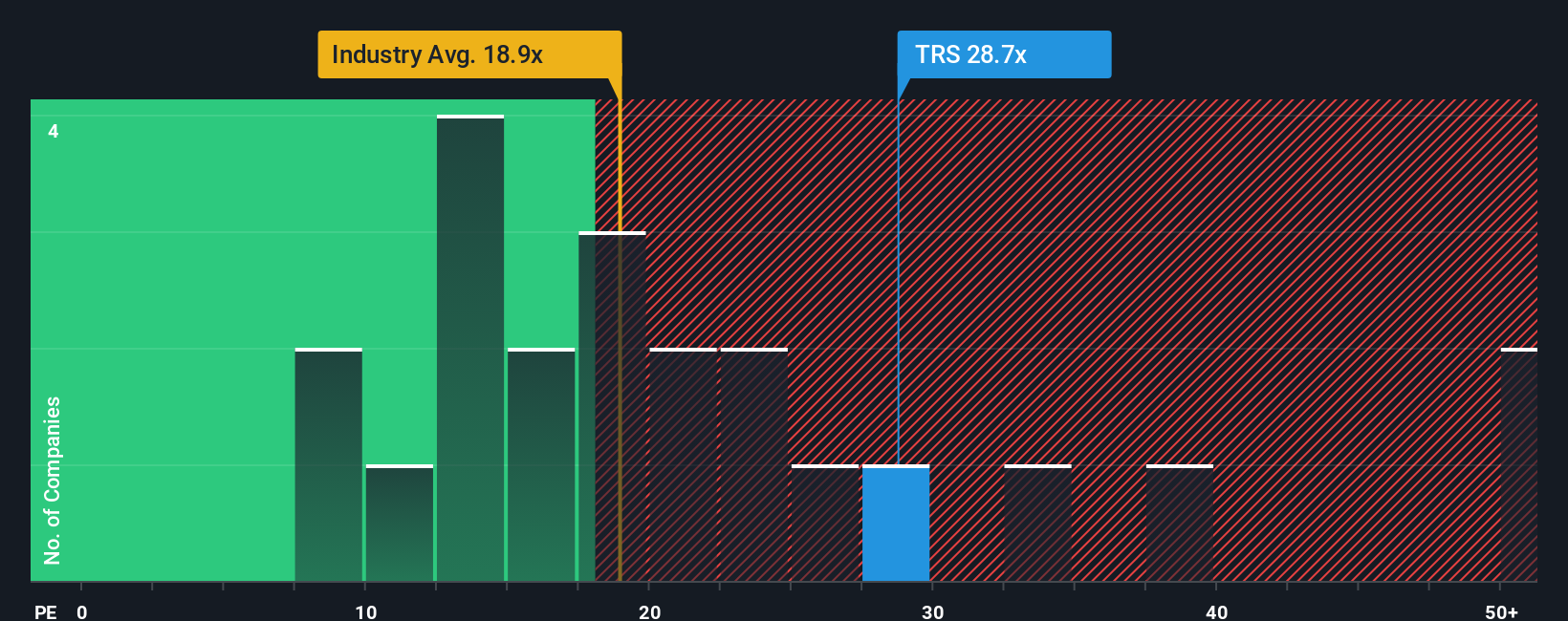

For profitable companies like TriMas, the Price-to-Earnings (PE) ratio is a popular and practical way to assess value. The PE ratio tells you how much investors are paying for each dollar of current earnings, making it an essential benchmark for comparing similar companies in the same industry.

However, what counts as a “normal” or “fair” PE ratio can vary quite a bit. This is because expectations for future growth and the company’s risk profile both play a major role. Higher growth companies typically command higher PE ratios, while riskier companies may trade at lower ratios to compensate for uncertainty.

Currently, TriMas trades at a PE ratio of 31.07x. This is significantly above the Packaging industry average of 16.42x and above the peer average of 18.42x. At first glance, this might suggest TriMas is trading at a premium. However, this is where understanding context really matters.

Simply Wall St’s “Fair Ratio” provides a deeper perspective. The Fair Ratio for TriMas is calculated at 47.66x, reflecting not just industry factors but also the company’s unique mix of earnings growth potential, profit margins, market cap, and risk. This metric gives a more tailored indication of what a reasonable multiple should be and is a stronger benchmark than simply comparing with peers or the industry, as it adjusts for the specific qualities that set TriMas apart.

Since TriMas’s current PE ratio (31.07x) is well below its Fair Ratio (47.66x), this suggests the stock is undervalued based on its earnings profile and growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TriMas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or your perspective about a company, which you can easily turn into your own fair value using your assumptions for future revenue, earnings, and profit margins. Narratives link the big picture, including the company’s unique situation and changing industry, directly to concrete numbers. This gives you a fair value based on your expectations rather than just following consensus estimates or market averages.

On Simply Wall St’s Community page, creating and exploring Narratives is easy and accessible, and millions of investors use this tool to sharpen their investment decisions. Narratives make it clear when to buy or sell by comparing your calculated Fair Value with today’s market price, and they update automatically as new earnings reports or major news hits the market. This ensures your view is always relevant.

For TriMas, these Narratives can be very different depending on your outlook. For example, some investors expect robust automation and sustainable packaging trends to drive earnings and assign a Fair Value of $45.00 per share, while more cautious investors focus on industry risks and set a much lower Fair Value. By choosing or building your Narrative, you get a decision-making framework that is as dynamic as the company itself.

Do you think there's more to the story for TriMas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriMas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives