- United States

- /

- Chemicals

- /

- NasdaqGS:SOLS

Solstice Advanced Materials (SOLS) Is Down 9.0% After NASDAQ-100 Removal and Q3 Profit Decline – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

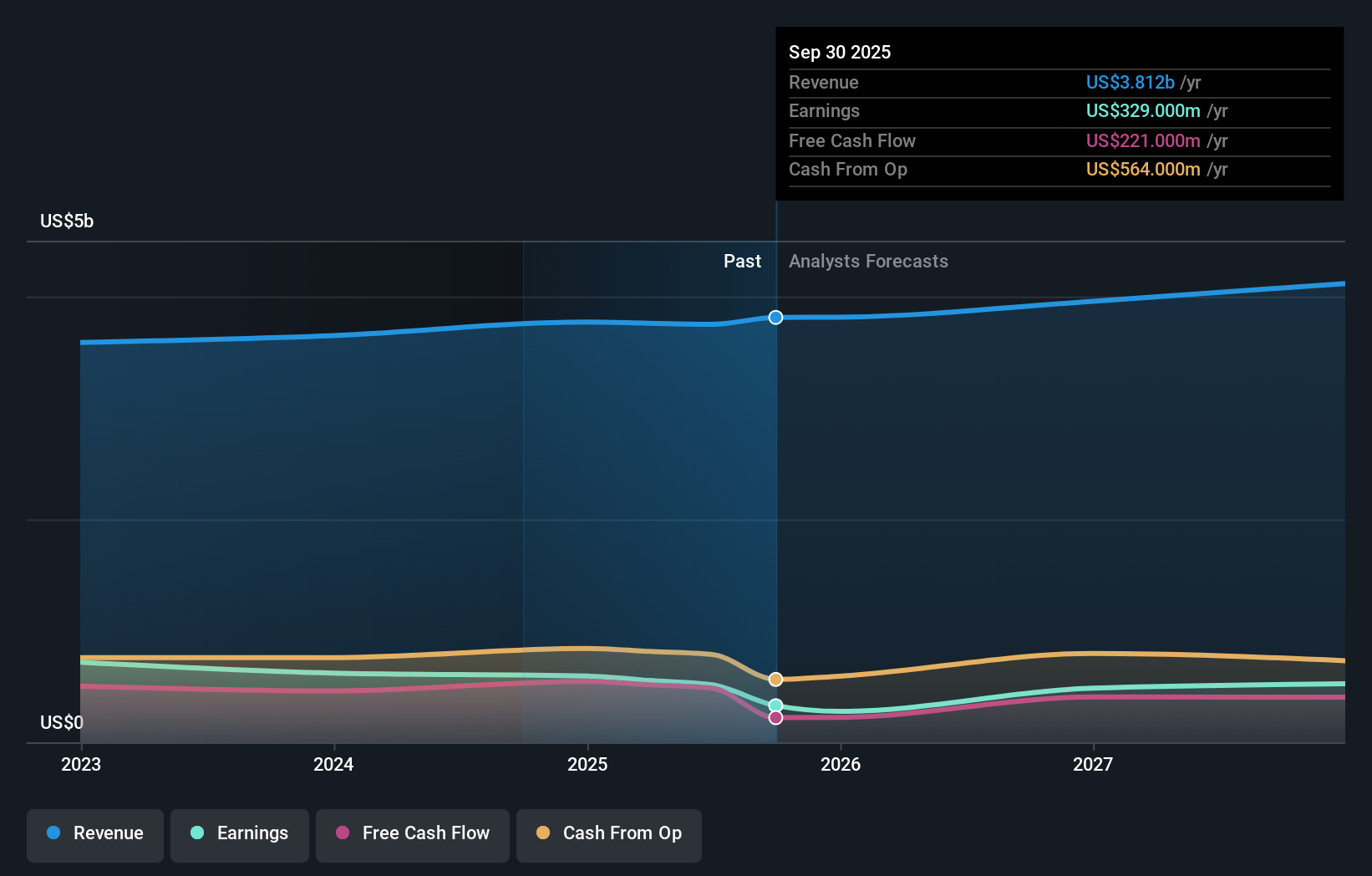

- Solstice Advanced Materials, Inc. was recently removed from the NASDAQ-100 Index following the company's release of its third quarter 2025 earnings, which showed revenue of US$969 million and a net loss of US$35 million compared to a net income the previous year.

- The company reaffirmed its full-year guidance, signaling management's expectations for continued net sales between US$3.75 billion and US$3.85 billion despite recent profitability pressures.

- We'll explore how the drop from the NASDAQ-100 and the year-over-year profit decline shape Solstice's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Solstice Advanced Materials' Investment Narrative?

To understand the big picture for Solstice Advanced Materials, shareholders need to weigh the company's transformation into an independent entity and its ability to grow profitably despite recent challenges. The news of removal from the NASDAQ-100 Index alongside a year-over-year drop from US$152 million in net income to a US$35 million net loss in Q3 has put near-term pressure on sentiment. Yet, with management reaffirming its full-year guidance for net sales between US$3.75 billion and US$3.85 billion, the most important short-term catalyst remains operational execution, hitting these targets amid margin pressures. The drop from a headline index is unlikely to change the fundamental catalysts, but it has highlighted risks tied to profitability swings and board independence, both of which were already flagged in pre-event analysis. Investors are now watching closely for progress on margins, board structure, and liquidity risks, especially as recent price moves (-11.7% year-to-date) show market sensitivity to the company's transition and performance. On the other hand, concerns about board independence are something investors should watch closely.

Despite retreating, Solstice Advanced Materials' shares might still be trading 23% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Solstice Advanced Materials - why the stock might be worth as much as 29% more than the current price!

Build Your Own Solstice Advanced Materials Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solstice Advanced Materials research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Solstice Advanced Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solstice Advanced Materials' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOLS

Solstice Advanced Materials

Operates as a specialty chemicals and advanced materials company in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives