- United States

- /

- Basic Materials

- /

- NasdaqCM:SMID

Smith-Midland Corporation's (NASDAQ:SMID) Price Is Right But Growth Is Lacking

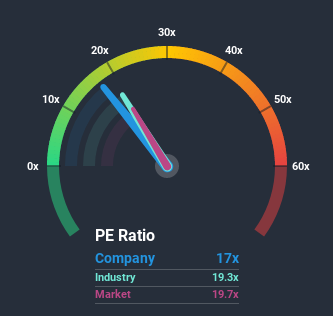

With a price-to-earnings (or "P/E") ratio of 17x Smith-Midland Corporation (NASDAQ:SMID) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 40x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Smith-Midland has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Smith-Midland

How Is Smith-Midland's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Smith-Midland's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. Still, incredibly EPS has fallen 16% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Smith-Midland's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Smith-Midland's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Smith-Midland revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Smith-Midland you should know about.

You might be able to find a better investment than Smith-Midland. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you’re looking to trade Smith-Midland, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:SMID

Smith-Midland

Smith-Midland Corporation invents, develops, manufactures, markets, leases, licenses, sells, and installs precast concrete products and systems in the United States.

Flawless balance sheet with proven track record.