- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

How Investors Are Reacting To Linde (LIN) Strong Q3 Results and $6.3B Share Buyback Completion

Reviewed by Sasha Jovanovic

- Linde plc recently reported its third quarter 2025 earnings, posting sales of US$8.62 billion and net income of US$1.93 billion, both higher than a year earlier, while also updating investors on the completion of a significant share repurchase program totaling US$6.30 billion since late 2023.

- The combination of strong earnings growth and substantial buybacks underscores Linde’s ability to generate robust cash flow and return capital to shareholders.

- With this recent display of higher earnings and continued share repurchases, we'll explore how these developments may enhance Linde's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Linde Investment Narrative Recap

To be a long-term Linde shareholder, you need faith in the company’s ability to drive steady cash flow and operating margin expansion through its project backlog, contract resilience, and share buybacks, even as industrial headwinds linger globally. The recent third-quarter results, with higher sales and net income, provide reassurance for those focused on near-term earnings momentum, though they do not materially change the primary catalyst: ongoing project pipeline delivery. However, persistent weak demand in Europe and parts of Asia-Pacific remains the biggest business risk and is unaffected by these results.

The most relevant recent announcement is Linde's completion of a US$6.30 billion share repurchase program since late 2023. This move, paired with consistent earnings growth, strengthens the investment case for ongoing shareholder returns, while reinforcing the importance of robust cash flows in times of cyclical uncertainty.

Yet, on the other hand, investors should keep in mind the structural risk posed by prolonged economic weakness in Europe, especially if...

Read the full narrative on Linde (it's free!)

Linde's outlook foresees $38.9 billion in revenue and $9.1 billion in earnings by 2028. This reflects a 5.4% annual revenue growth rate and a $2.4 billion increase in earnings from the current $6.7 billion.

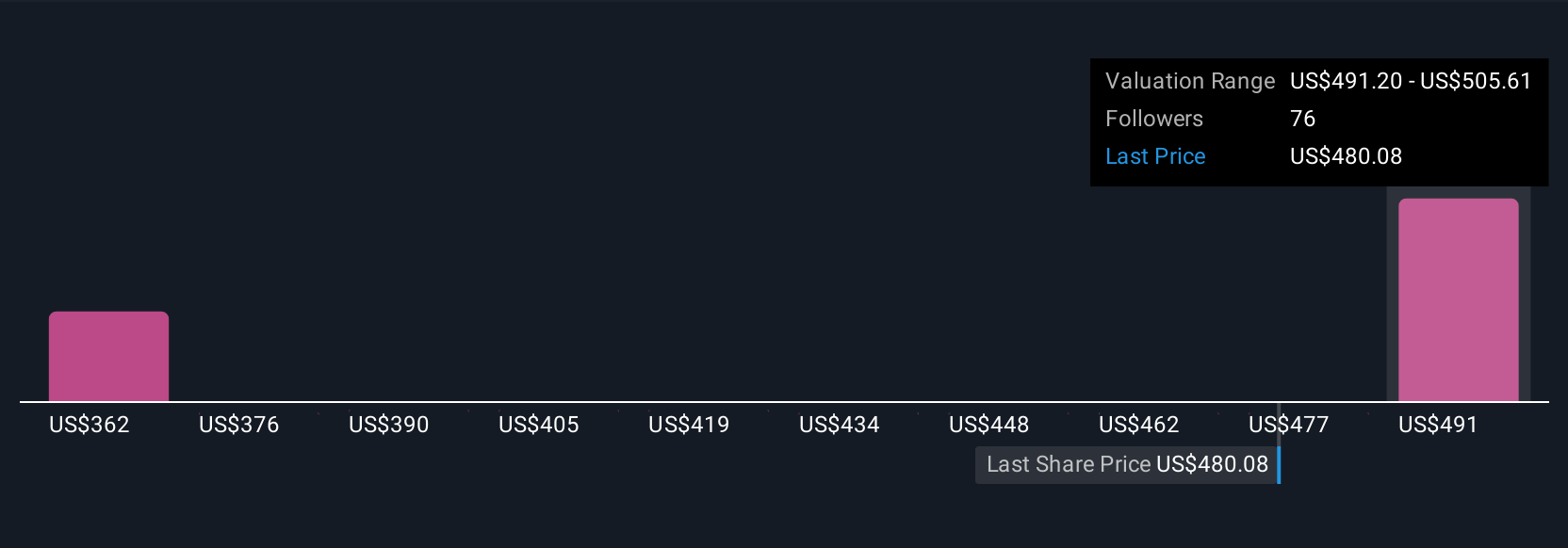

Uncover how Linde's forecasts yield a $505.61 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community placed fair value estimates on Linde ranging widely from US$301 to US$506 per share. While opinions differ on where the business is headed, concerns about weak demand in key regions remain a central theme for many investors.

Explore 6 other fair value estimates on Linde - why the stock might be worth as much as 19% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives