- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Key Things To Consider Before Buying Kaiser Aluminum Corporation (NASDAQ:KALU) For Its Dividend

Is Kaiser Aluminum Corporation (NASDAQ:KALU) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A high yield and a long history of paying dividends is an appealing combination for Kaiser Aluminum. It would not be a surprise to discover that many investors buy it for the dividends. The company also bought back stock equivalent to around 1.4% of market capitalisation this year. Remember though, due to the recent spike in its share price, Kaiser Aluminum's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on Kaiser Aluminum!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Kaiser Aluminum paid out 345% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Kaiser Aluminum paid out 25% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Kaiser Aluminum fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Consider getting our latest analysis on Kaiser Aluminum's financial position here.

Dividend Volatility

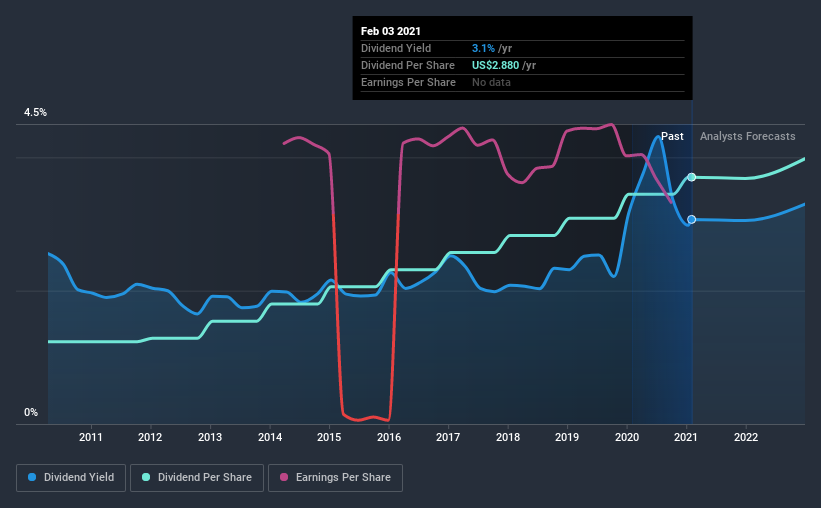

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Kaiser Aluminum's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was US$1.0 in 2011, compared to US$2.9 last year. Dividends per share have grown at approximately 12% per year over this time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Kaiser Aluminum has grown its earnings per share at 29% per annum over the past five years. The company has been growing its EPS at a very rapid rate, while paying out virtually all of its income as dividends. While EPS could grow fast enough to make the dividend sustainable, in this type of situation, we'd want to pay extra attention to any fragilities in the company's balance sheet.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments. Overall we think Kaiser Aluminum is an interesting dividend stock, although it could be better.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 6 warning signs for Kaiser Aluminum (1 is significant!) that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Kaiser Aluminum or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:KALU

Kaiser Aluminum

Engages in manufacture and sale of semi-fabricated specialty aluminum mill products in the United States and internationally.

Fair value with moderate growth potential.