- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Kaiser Aluminum (KALU): Valuation Insights After $500 Million Debt Refinancing

Reviewed by Simply Wall St

Kaiser Aluminum (KALU) just closed a $500 million offering of 5.875% senior notes due 2034. The company will use the funds to refinance its earlier 2028 notes. This material decision affects the company’s capital structure and future interest costs.

See our latest analysis for Kaiser Aluminum.

Kaiser Aluminum has been on investors’ radar after the $500 million refinancing move, with momentum clearly building. The company’s share price has jumped 34.5% year-to-date and surged 15.2% in the past month, boosting its longer-term total shareholder return to 16.4% over the past year and nearly 48% over five years. This recent rally suggests the market is recognizing both the company’s improved financial flexibility and its growth potential.

If the recent refinancing caught your interest, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

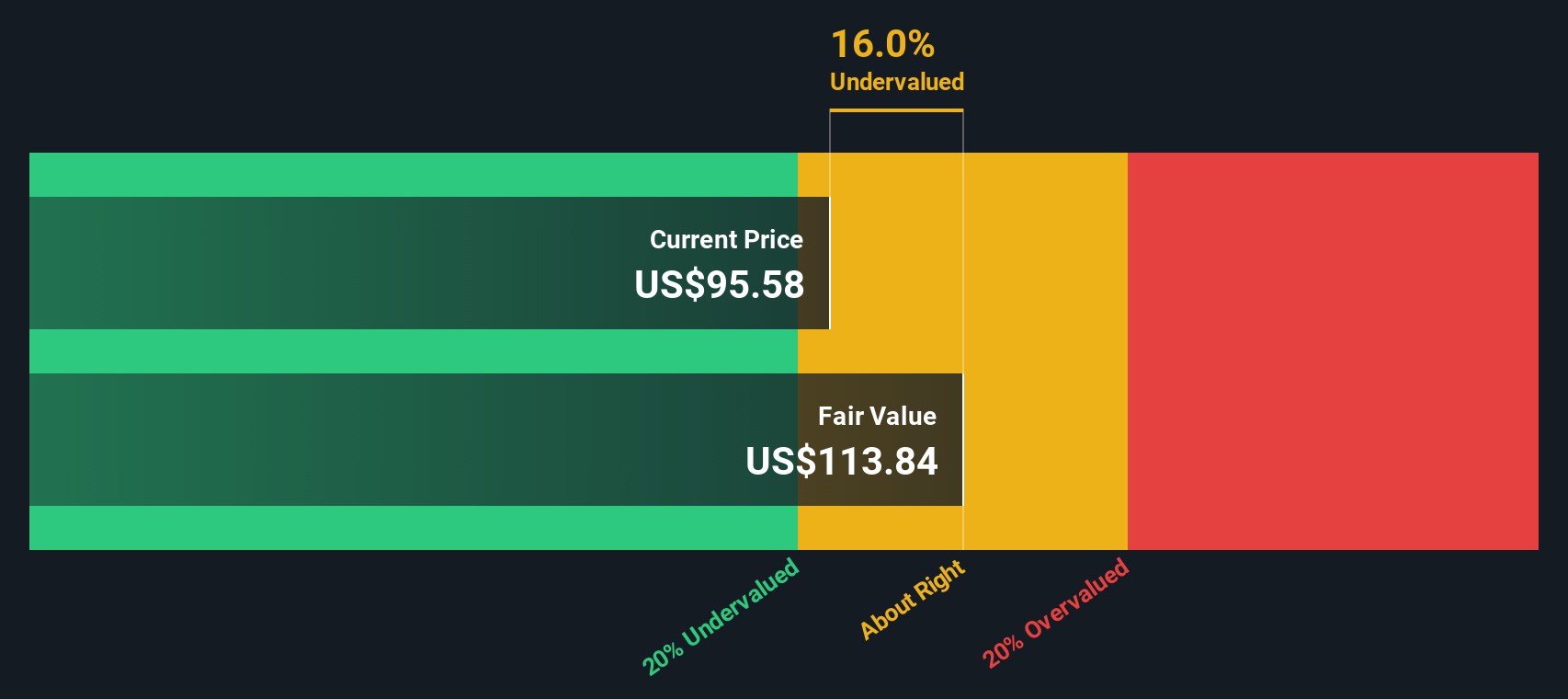

But with shares already rallying so sharply, the key question now is whether Kaiser Aluminum still has room to run or if investors are already factoring in all the potential upside from its recent improvements.

Price-to-Earnings of 17.8x: Is it justified?

Kaiser Aluminum is trading at a price-to-earnings ratio of 17.8x, which stands out as a value opportunity versus both its sector and peers, especially considering its current share price of $94.53.

The price-to-earnings (P/E) ratio compares the market price of a company’s shares to its earnings per share. For materials and metals companies, this metric is widely used to judge how profitably the market expects them to operate and grow through economic cycles. A lower P/E relative to peers may indicate undervaluation if the company’s growth is solid.

Kaiser Aluminum’s P/E of 17.8x appears compelling, given the peer average of 19.9x and the US Metals and Mining industry average of 21.4x. The company is trading below its closest competitors, while the estimated fair P/E ratio is 19.6x, a level that the market could move toward if the company continues delivering strong earnings growth. This suggests investors are getting exposure to improving profitability at a bargain compared to sector norms.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-Earnings of 17.8x (UNDERVALUED)

However, slower revenue growth or unexpected changes in metals demand could keep shares from reaching analyst price targets, even with impressive recent gains.

Find out about the key risks to this Kaiser Aluminum narrative.

Another View: Discounted Cash Flow Analysis

Looking at Kaiser Aluminum from another angle, our DCF model estimates the company's fair value to be $128.33. This is much higher than its current share price of $94.53. This approach suggests a bigger margin of undervaluation compared to what the P/E ratio shows. However, could the market be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

If you want to take a different angle or have a unique take on Kaiser Aluminum, dive in and craft your own narrative in minutes. Do it your way.

A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss out as the market shifts. Turbocharge your investing by finding strategic picks tailored to your interests with the powerful Simply Wall St Screener.

- Jump on the momentum with these 876 undervalued stocks based on cash flows to spot overlooked stocks that may be preparing for their next big move based on robust cash flow potential.

- Capture tomorrow’s breakthroughs by exploring these 27 quantum computing stocks, featuring companies at the frontier of quantum computing innovation.

- Strengthen your income strategy using these 16 dividend stocks with yields > 3% to find a curated list of stocks offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives