- United States

- /

- Chemicals

- /

- NasdaqGS:IOSP

Will Innospec’s (IOSP) Recent Buybacks and Dividend Shift Focus From Weaker Earnings?

Reviewed by Sasha Jovanovic

- In the past week, Innospec Inc. reported third quarter 2025 results showing declines in both revenue and earnings, announced a semi-annual dividend of US$0.87 per share, and completed a share repurchase of 246,528 shares for US$22.2 million under its March 2025 buyback authorization.

- Despite the capital return initiatives, softer earnings and mixed analyst sentiment suggest investor focus remains on the company's operational challenges and future growth prospects.

- We'll examine how the weaker-than-expected quarterly earnings may alter expectations for Innospec’s future profitability and growth narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Innospec Investment Narrative Recap

Owning Innospec requires confidence in its ability to transition toward higher-value, sustainable specialty chemicals, while navigating raw material and margin pressures that continue to weigh on results. The recent weak third quarter earnings update is material and may reshape short-term expectations, increasing scrutiny on Innospec’s capacity to protect profitability in a period of operational headwinds. The company must demonstrate improving earnings resilience before the growth story regains momentum.

Among the latest moves, the completion of a US$22.2 million share buyback stands out, reflecting ongoing capital returns even as profitability weakens. Share repurchases and the newly declared dividend highlight strong balance sheet flexibility, but they do little to address the immediate challenge of margin compression in Performance Chemicals, a key factor shaping short-term investor sentiment.

Yet, beneath these capital return initiatives, investors should be mindful that ongoing volatility in raw material costs may continue to test earnings consistency...

Read the full narrative on Innospec (it's free!)

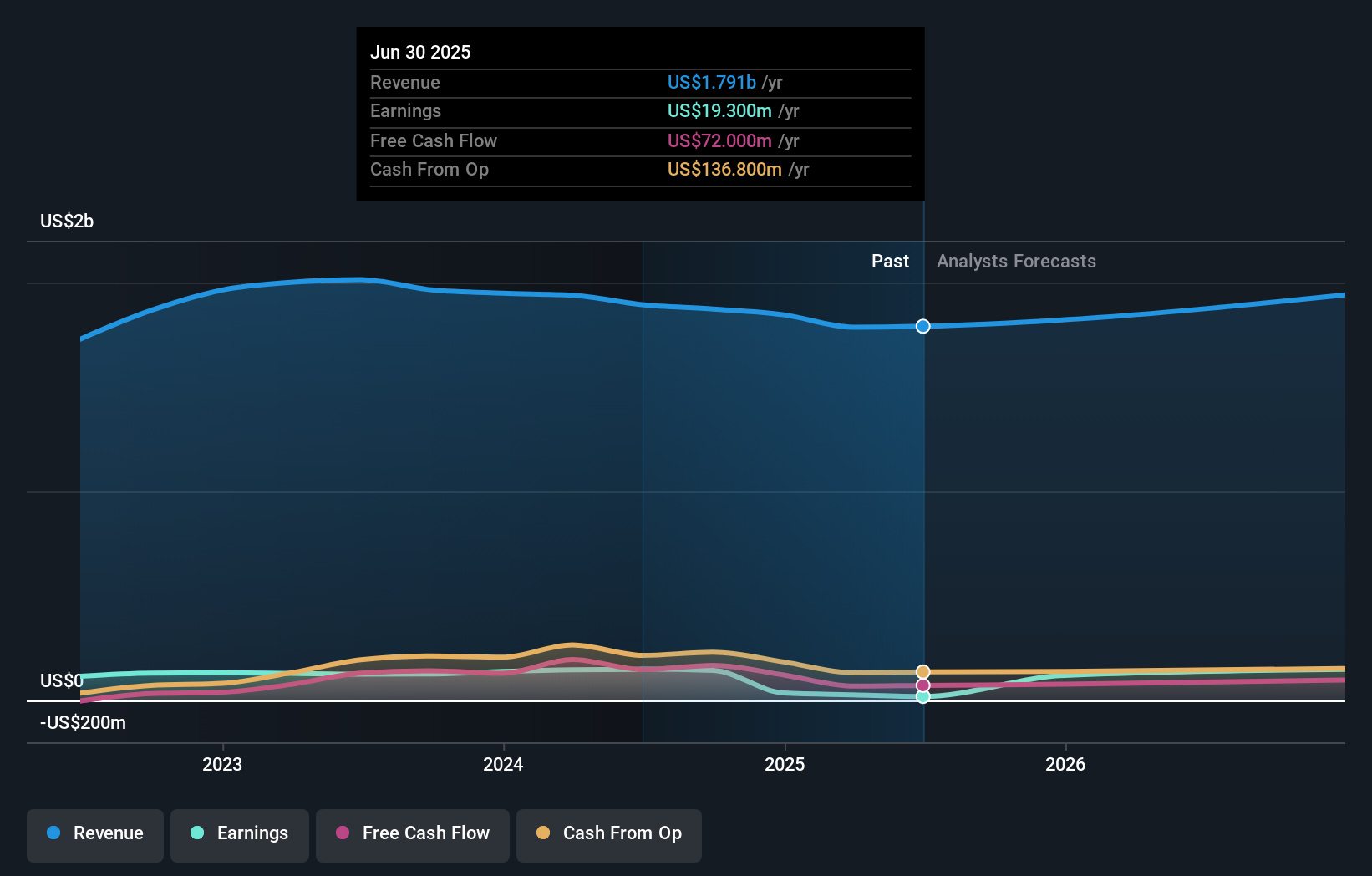

Innospec's narrative projects $2.1 billion revenue and $457.7 million earnings by 2028. This requires 5.4% yearly revenue growth and a $438.4 million increase in earnings from $19.3 million today.

Uncover how Innospec's forecasts yield a $107.50 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community provided a fair value estimate for Innospec at US$38.90 per share. Against this lone perspective, recent margin pressures and falling earnings remind you that differing opinions and new challenges can shape the future in unexpected ways.

Explore another fair value estimate on Innospec - why the stock might be worth 47% less than the current price!

Build Your Own Innospec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innospec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Innospec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innospec's overall financial health at a glance.

No Opportunity In Innospec?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IOSP

Innospec

Develops, manufactures, blends, markets, and supplies specialty chemicals in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives